Japan Telecommunication Services Market Size, Share, and COVID-19 Impact Analysis, By Product (Hardware, Services), By Service Type (Data Services, Fixed Internet Access Services, Voice Services, Fixed Voice Services, Messaging Services), By Transmission (Wireless, Wireline), By Application (Commercial, Residential), and Japan Telecommunication Services Market Insights Forecasts to 2032

Industry: Information & TechnologyJapan Telecommunication Services Market Insights Forecasts to 2032

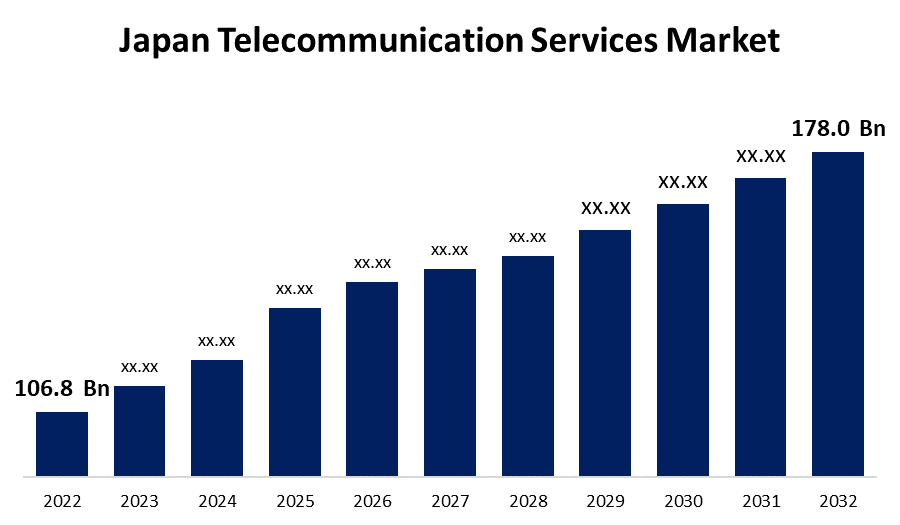

- The Japan Telecommunication Services Market Size was valued at USD 106.8 Billion in 2022.

- The Market Size is Growing at a CAGR of 5.2% from 2022 to 2032.

- The Japan Telecommunication Services Market Size is expected to reach USD 178.0 Billion by 2032.

Get more details on this report -

The Japan Telecommunication Services Market Size is expected to reach USD 178.0 Billion by 2032, at a CAGR of 5.2% during the forecast period 2022 to 2032.

Market Overview

The telecommunications industry is an essential sector in Japan, considerably impacting the Japanese economy. Japan is at the leading edge of telecommunications development, with 264.76 million connections in 2021, including 203.33 million mobile phones, or an average of 1.6 per person. Furthermore, mobile phone penetration in Japan is nearly universal, with a considerable movement toward smartphones. The country is also in the vanguard of 5G adoption, with plans to deliver nationwide coverage in the near future. Japan seeks to incorporate IoT devices into urban development, transportation, healthcare, and other disciplines through programs such as Society 5.0. This opens up a plethora of opportunities for telecommunications service providers.

Japan is well-known for its technological breakthroughs and has long been a trailblazer in the development of telecommunications. Japan ranks 57th in mobile internet, i.e., on tablets and smartphones, with a download speed of 40.80 Mbit/second. In a worldwide comparison, Japan ranks 19th with a common download speed of 147.70 Mbit/second for fixed-network broadband internet. Moreover, Rakuten Mobile, a Japanese telecommunications carrier, accomplished a major benchmark in its network development operations on May 3023. With the construction of nearly 57,000 base stations and 98.4 percent of 4G population coverage, the firm continues to improve its market position.

Report Coverage

This research report categorizes the market for Japan Telecommunication Services Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Telecommunication Services Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Telecommunication Services Market.

Japan Telecommunication Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 106.8 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.2% |

| 2032 Value Projection: | USD 178.0 Billion |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | COVID-19 Impact Analysis, By Product, By Service Type, By Transmission, By Application |

| Companies covered:: | NTT DOCOMO, KDDI Corporation, SoftBank Group Corp., Rakuten Mobile, Inc, Internet Initiative Japan (IIJ), Optage, SKYPerfecTV, WOWOW, Nippon Telegraph and Telephone Corporation, and Other key venders |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's telecommunications market ranks among the most technologically advanced in the world, with modern facilities and an abundance of consumer technology penetration. While traditional fixed-line voice services have declined due to mobile use, demand for high-speed internet, particularly fiber-optic connections, remains strong. To give more affordable propositions, telecom providers are increasingly offering bundled packages that may include internet, mobile, TV, and occasionally additional services. Furthermore, the incorporation of modern technologies, together with Japan's proclivity for innovation, is likely to result in stimulating advances over the forecast period. With breakthroughs such as 5G, IoT, and AI, Japan's telecoms sector is likely to experience transformational changes, consolidating the nation's standing as a global innovation leader. The main obstacle, however, will be in adapting and catering to the changing demands of the consumer base, especially given demographic concerns such as the aging population.

Market Segment

- In 2022, the services segment is witnessing a higher growth rate over the forecast period.

Based on the product, the Japan Telecommunication Services Market is segmented into hardware and services. Among these, the services segment is witnessing a higher growth rate over the forecast period. The services subsection pertains to the wide range of services offered by telecommunications firms to consumers and enterprises. Mobile telephone service, internet access over broadband, and satellite TV play critical roles in the daily lives of individuals and commercial operations, resulting in high demand. These services rely on hardware infrastructure to provide connectivity and communication. Furthermore, whereas hardware purchases may be infrequent (e.g., when switching to a new phone or infrastructure), service subscriptions give telecom operators with constant monthly revenue.

- In 2022, the fixed internet access services segment accounted for the largest revenue share of more than 41.8% over the forecast period.

On the basis of service type, the Japan Telecommunication Services Market is segmented into data services, fixed internet access services, voice services, fixed voice services, and messaging services. Among these, the fixed internet access services segment is dominating the market with the largest revenue share of 41.8% over the forecast period, fiber-optic internet, in particular, was a prominent factor in Japan's Telecommunication Services Market. The country's pursuit of high-speed internet access, as well as its emphasis on building a strong technology infrastructure, has boosted this market significantly. Given Japan's technological growth and infrastructural development, widespread adoption of fiber-optic connections is predicted to surge the Japanese telecommunications services market, especially the fixed internet access services segment.

- In 2022, the wireless segment is witnessing highest CAGR growth over the forecast period.

On the basis of transmission, the Japan Telecommunication Services Market is segmented into wireless and wireline. Among these, the wireless segment is witnessing highest CAGR growth over the forecasted period. The widespread availability of mobile devices, alongside the increasing demand for high-speed mobile data (particularly with the arrival of 5G) and the variety of wireless services, significantly contribute to this predominance. Japan continues to be at the center of 5G adoption, with telecom companies launching 5G services and the government encouraging broad adoption. With the growth of smartphones and mobile devices, consumers have become increasingly reliant on mobile data and voice services. The growth of the Internet of Things (IoT) has increased the demand for wireless connectivity in electronics and systems.

- In 2022, The residential segment accounted for the largest revenue share of more than 57.2% over the forecast period.

On the basis of application, the Japan Telecommunication Services Market is segmented into commercial and residential. Among these, the residential segment is dominating the market with the largest revenue share of 57.2% over the forecast period. This domination is aided by a large number of households, as well as high internet and smartphone adoption levels. Individual consumers and households are the emphasis of the residential segment. The services are often standardized, with only minor changes based on speed, capacity, or bundled services. With smartphones becoming more prevalent, there is a rising demand for mobile internet and voice services for residential customers. Furthermore, because of the country's substantial fiber infrastructure, many Japanese residents have switched to fiber-optic connections. Moreover, when individual subscriptions are aggregated, they represent a significant revenue stream for telecom companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Telecommunication Services Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- NTT DOCOMO

- KDDI Corporation

- SoftBank Group Corp.

- Rakuten Mobile, Inc

- Internet Initiative Japan (IIJ)

- Optage

- SKYPerfecTV

- WOWOW

- Nippon Telegraph and Telephone Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On July 2023, Pocketalk Corporation and SoftBank Corporation announced a comprehensive strategic alliance to expand translation business in Japan and globally. Pocketalk and SoftBank have agreed to develop a comprehensive strategic alliance to collaborate on the expansion of "Pocketalk" solution sales and deployments in both Japanese and global markets, with the goal of selling one million "Pocketalk" series devices in three years.

- On May 2023, KDDI Corporation, Okinawa Cellular Telephone Company, and Rakuten Mobile, Inc. announced the signing of a new roaming agreement. KDDI will continue to provide roaming services to Rakuten Mobile in areas not covered by the previous roaming agreement, including select high-traffic shopping districts in Tokyo's 23 wards and the cities of Osaka and Nagoya, as well as select indoor locations (subways, underground shopping centers, tunnels, and other indoor facilities) and rural areas. Furthermore, by encouraging shared infrastructure use, KDDI will push both the effective use of its 4G infrastructure and the launch of its 5G network.

- On February 2023, Nokia, NTT DOCOMO, INC., and NTT have announced the achievement of two significant technology milestones on the way to 6G. The first is the incorporation of artificial intelligence (AI) and machine learning (ML) into the radio air interface, allowing 6G radios to learn. The second is the use of new sub-terahertz (sub-THz) frequencies to significantly increase network capacity.

- On January 2023, KDDI CORPORATION stated that it has begun commercial deployment of O-RAN (1) compatible 5G Open vRAN sites in Osaka City, Osaka Prefecture, Japan, in collaboration with Samsung Electronics Co., Ltd. and Fujitsu Limited. Sites are made up of general-purpose server equipment and are compatible with all 5G handsets. Full-scale construction is scheduled to begin in 2024.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Telecommunication Services Market based on the below-mentioned segments:

Japan Telecommunication Services Market, By Product Type

- Hardware

- Services

Japan Telecommunication Services Market, By Service Type

- Data Services

- Fixed Internet Access Services

- Voice Services

- Fixed Voice Services

- Messaging Services

- Others

Japan Telecommunication Services Market, By Transmission

- Wireless

- Wireline

Japan Telecommunication Services Market, By Application

- Commercial

- Residential

Need help to buy this report?