Japan Syringe Market Size, Share, and COVID-19 Impact Analysis, By Type (Insulin Syringe, Conventional Syringe), By Material (Glass, Plastic, Stainless Steel), By Syringe Size (Smaller Volume Syringe, Larger Volume Syringe), and Japan Syringe Market Insights, Industry Trend, Forecasts to 2032

Industry: HealthcareJapan Syringe Market Insights Forecasts to 2032

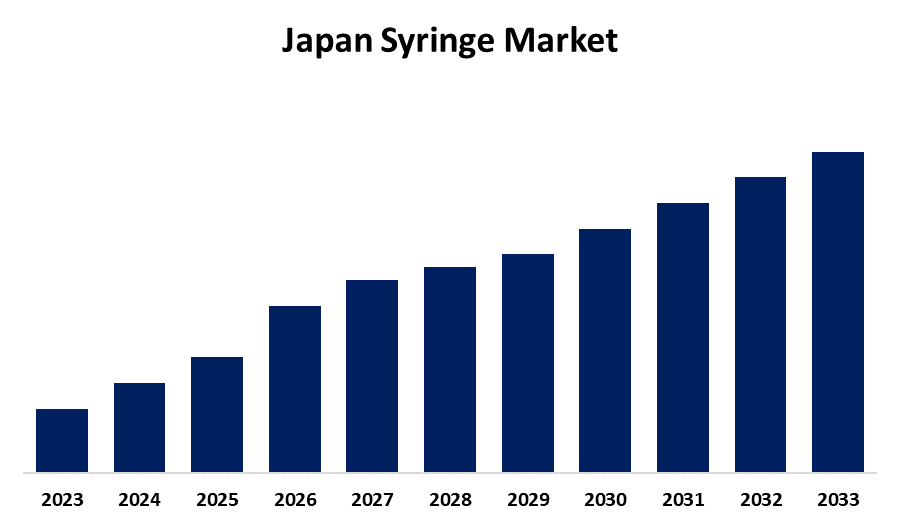

- The Japan Syringe Market Size was valued at USD XX Billion in 2022.

- The Market Size is Growing at a CAGR of 5.1% from 2022 to 2032

- The Japan Syringe Market Size is expected to reach USD XX Billion by 2032

Get more details on this report -

The Japan Syringe Market size was valued at USD XX Billion in 2022. The Japan Syringe Market Size is expected to reach USD XX Billion by 2032, at a CAGR of 5.1% during the forecast period 2022 to 2032. The Japan syringe market is important for the country's healthcare system, catering to the needs of various medical institutions and contributing to the population's overall well-being.

Market Overview

Conventional syringes, safety syringes, insulin syringes, prefilled syringes, and specialty syringes are available in the Japan syringe market. Manufacturers in the market focus on producing high-quality, precise, and safe syringes in order to meet the government's stringent regulatory standards. The Japan Syringe market signifies the industry in Japan that manufactures, distributes, and sells syringes. Syringes are critical tools in healthcare settings because they are used to inject or withdraw fluids from the body. The Japanese syringe market serves a variety of applications, including hospitals, clinics, laboratories, and home healthcare. Japan holds a significant position in the global syringe market, due to a strong emphasis on technological advancements and healthcare infrastructure. The country's aging population, combined with its well-established healthcare system, contributes to the country's consistent demand for syringes. Furthermore, Japan's thriving pharmaceutical and biotechnology industries drive the demand for syringes, which are essential in drug delivery and research.

Report Coverage

This research report categorizes the market for the Japan syringe market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the syringe market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the syringe market.

Japan Syringe Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 5.1% |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 133 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Material, By Syringe Size |

| Companies covered:: | BD, Nipro, TERUMO, B. Braun SE, Teleflex, ICU Medical, Inc., Advin Health Care, Healthcare Technologies, Eisai Co., Ltd., Others |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan is well-known for its technological advancements and healthcare innovation. The introduction of advanced syringe technologies, such as safety syringes and prefilled syringes, benefits the market by improving patient safety, increasing accuracy, and streamlining medical procedures. Japan has a modern healthcare infrastructure, including hospitals, clinics, and research facilities. Syringes are in high demand due to the availability of comprehensive healthcare facilities and services, as they are necessary tools for a variety of medical procedures, treatments, and laboratory testing. Japan has a high level of healthcare spending, which is fueled by both public and private investments in healthcare services and infrastructure. Rising healthcare spending correlates directly with increased demand for medical devices such as syringes, propelling the syringe market forward.

Restraining Factors

Raw materials for syringes include plastics, metals, and rubber components. Price fluctuations in these raw materials can have an impact on syringe manufacturing costs. Volatile raw material costs make it difficult for syringe manufacturers to maintain profitability and market pricing stability.

Market Segmentation

The Japan Syringe Market share is classified into type, material, and syringe size.

- The conventional syringe segment is expected to hold the largest share of the Japan syringe market during the forecast period.

The Japan syringe market is segmented by type into insulin syringe and conventional syringe. Among these, the conventional syringe segment is expected to hold the largest share of the Japan syringe market during the forecast period. The conventional syringe segment includes standard syringes used in a variety of medical applications. These syringes usually have a barrel, plunger, and needle. They come in a variety of sizes and capacities, ranging from 1 mL to 60 mL or more. Traditional syringes are commonly used to administer medications, administer vaccinations, draw blood, and perform various medical procedures.

- The plastic segment is expected to hold the largest share of the Japan syringe market during the forecast period.

Based on the material, the Japan syringe market is divided into glass, plastic, and stainless steel. Among these, the plastic segment is expected to hold the largest share of the Japan syringe market during the forecast period. Because of their versatility, low cost, and ease of use, plastic syringes are widely used. They are preferred by both healthcare providers and patients for a wide range of medical applications. Plastic syringes' widespread use in a variety of healthcare settings, including hospitals, clinics, and home healthcare, contributes to their market dominance. Furthermore, advancements in plastic syringe technology, such as safety features and prefilled options, contribute to the segment's growth in Japan.

- The larger volume syringe segment is expected to hold the largest share of the Japan syringe market during the forecast period.

The Japan syringe market is divided by syringe size into smaller volume syringe and larger volume syringe. Among these, the larger volume syringe segment is expected to hold the largest share of the Japan syringe market during the forecast period. This is primarily because larger volume syringes are widely used in medical procedures, hospital settings, and critical care units. The demand for larger volume syringes is driven by the need for efficient and precise fluid administration, such as IV medications or fluid aspiration.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan syringe market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BD

- Nipro

- TERUMO

- B. Braun SE

- Teleflex

- ICU Medical, Inc.

- Advin Health Care

- Healthcare Technologies

- Eisai Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development:

In August 2021, Otsuka Pharmaceuticals, a Japanese company, announced the launch of Ajovy, a new syringe injection for migraine treatment, as a result of a licence agreement with Teva Pharmaceutical Industries Ltd.

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2032. Spherical Insights has segmented the Japan Syringe Market based on the below-mentioned segments:

Japan Syringe Market, By Type

- Insulin Syringe

- Conventional Syringe

Japan Syringe Market, By Material

- Glass

- Plastic

- Stainless Steel

Japan Syringe Market, By Syringe Size

- Smaller Volume Syringe,

- Larger Volume Syringe

Need help to buy this report?