Japan Synthetic Rubber Market Size, Share, and COVID-19 Impact Analysis, By Type (Styrene Butadiene Rubber, Nitrile Rubber, Polybutadiene Rubber, Butyl Rubber, and Others), By Application (Tire, Non-tire Automotive, Industrial Rubber Goods, Footwear, and Others), and Japan Synthetic Rubber Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Synthetic Rubber Market Insights Forecasts to 2035

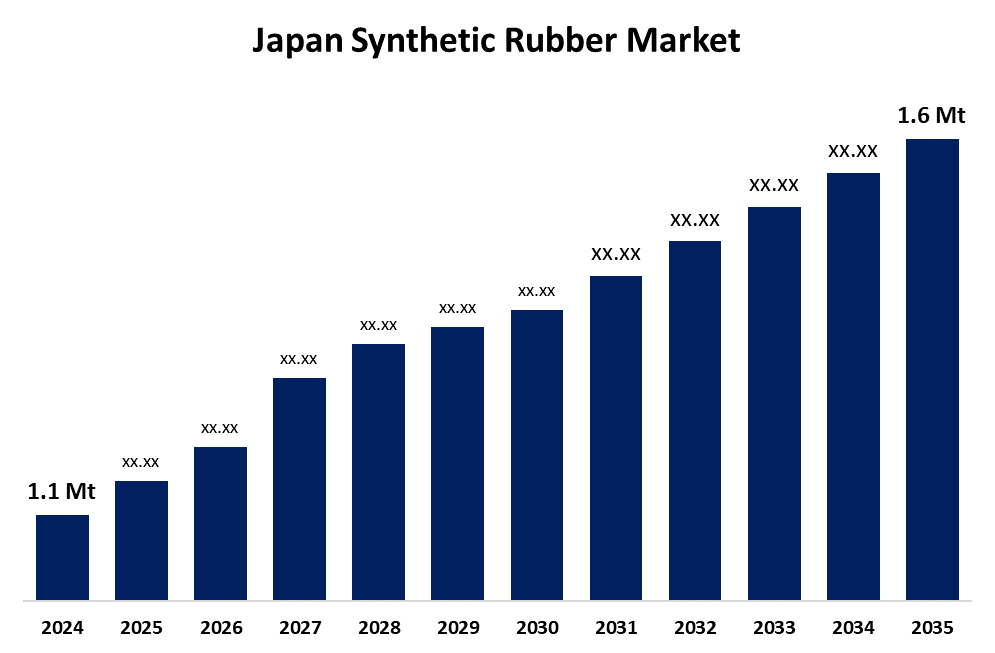

- The Japan Synthetic Rubber Market Size Was Estimated at 1.1 Million Tons in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.46% from 2025 to 2035

- The Japan Synthetic Rubber Market Size is Expected to Reach 1.6 Million Tons by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Synthetic Rubber Market Size is anticipated to reach 1.6 Million tons by 2035, Growing at a CAGR of 3.46% from 2025 to 2035. The Japanese synthetic rubber industry expands because many industries, including automotive manufacturing and infrastructure construction, and electric vehicle production, show rising interest in synthetic materials. The market receives its momentum from synthetic rubber's rising preference among consumers because it offers improved properties and better endurance in severe environments.

Market Overview

The manufacturing and distribution, along with trading of synthetic rubber, constitute the synthetic rubber market, which consists of man-made elastomers typically produced from polyene monomer-based polymers. This marketplace features different synthetic rubber types, including SBR and EPR, that serve various purposes in tires, automotive components, shoes, and industrial applications. The automotive sector's rising tire manufacturing needs, together with the expanding synthetic rubber applications in footwear and industrial products, represent the main market growth drivers. The synthetic rubber market in Japan primarily serves the automotive and electronics industries, which use the material to manufacture tires and seals, and insulation. Market expansion receives backing from new synthetic rubber formula developments, which aim to enhance heat resistance and durability properties. Market growth continues to expand because of manufacturing capabilities in Japan and its technical expertise.

The major organizations operating in the Japanese synthetic rubber market can increase their market share through expanded operations within the tire and automotive sectors while leveraging sustainable rubber manufacturing technology and growing medical and industrial needs. The Japanese government implements synthetic rubber market policies that focus on technical development and innovation support, and sustainable development advancement. Japan implements these strategic guidelines to enhance its standing within worldwide synthetic rubber markets as well as to reach its economic and environmental targets. The government supports collaborations between synthetic rubber producers, together with academic institutions and research organizations, to produce innovative solutions and develop state-of-the-art products.

Report Coverage

This research report categorizes the market for the Japan synthetic rubber market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan synthetic rubber market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan synthetic rubber market.

Japan Synthetic Rubber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | 1.1 Million Tons |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.46% |

| 2035 Value Projection: | 1.6 Million Tons |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 176 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | Chevron Phillips Chemical Company LLC, Dupont, JSR Corporation, SABIC, Exxon Mobil Corporation, Trinseo, Mitsubishi Chemical Corporation (MCC), Sinopec, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The expanding automotive industry in Japan creates a substantial rise in synthetic rubber requirements for producing tires and automotive components. The Japan Automobile Manufacturers Association reported domestic vehicle production reached 7.84 million units in 2021, which demonstrates strong automotive parts demand. The automotive industry's expansion, together with escalating component durability requirements, drives higher synthetic rubber consumption for automotive parts such as seals and gaskets and hoses, and belts. Healthcare makes use of synthetic rubber through its applications in catheters and gloves, and tubing. The focus on infrastructure development in Japan through road construction, together with building projects and public works, creates additional demand for synthetic rubber products. The development of advanced synthetic rubber materials, which enhance durability alongside heat resistance and chemical resistance features, is transforming industry demand patterns. The development of specialty applications demonstrates a purposeful shift toward high-value niche markets, which creates new business prospects and shapes Japan's synthetic rubber market trajectory. Synthetic rubber finds its applications in consumer products, which include footwear, sports equipment, and home items, because consumers seek durable and comfortable products.

Restraining Factors

Synthetic rubber production within Japanese operations faces significant operational difficulties because crude oil price changes directly affect production costs. Oil prices function as a fundamental element that determines production expenses, together with business profitability and pricing frameworks. The availability of raw materials decreases, and costs increase when geopolitical events, along with natural disasters, interrupt supply chains. The demanding industrial conditions push manufacturers to implement adaptable management systems that help them lower supply chain instability and raw material procurement risks. The strict environmental regulations in Japan create additional complexities that increase production expenses and prevent specific manufacturing methods. Companies need to invest heavily in pollution control technologies and implement compliance measures to meet these regulations, which creates additional financial strain on their operations.

Market Segmentation

The Japan synthetic rubber market share is classified into type and application.

- The styrene butadiene rubber segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan synthetic rubber market is segmented by type into styrene butadiene rubber, nitrile rubber, polybutadiene rubber, butyl rubber, and others. Among these, the styrene butadiene rubber segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Segment growth occurs as a result of its economic advantages and consumer preference when compared to natural rubber. Styrene-Butadiene Rubber (SBR) finds its primary application in automotive tire manufacturing because of its superior durability and abrasion resistance. The product finds major application in wire and cable insulation as well as belting and roll coverings and cutting boards, and haul-off pads. The material serves as the base for manufacturing footwear and conveyor belts, together with hoses and floor tiles and adhesives, and gaskets.

- The tire segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan synthetic rubber market is segmented by application into tire, non-tire automotive, industrial rubber goods, footwear, and others. Among these, the tire segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. One factor that would contribute to segmental growth is the rapid expansion of the automotive industry, along with improvements in tires. Moreover, the growing market share of electric vehicles is driving up the demand for synthetic rubber. Because of its outstanding resistance to abrasion and superb aging stability, styrene-butadiene rubber is the favored material in tire production, hence driving the tire and its components in the forecasted period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan synthetic rubber market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Chevron Phillips Chemical Company LLC

- Dupont

- JSR Corporation

- SABIC

- Exxon Mobil Corporation

- Trinseo

- Mitsubishi Chemical Corporation (MCC)

- Sinopec

- Others

Recent Developments:

- In July 2023, Exxon Mobil Corporation announced it completed a purchase agreement for Denbury Inc., which specializes in carbon capture, utilization, and storage (CCS) as well as enhanced oil recovery. The $4.9 billion acquisition will strengthen ExxonMobil’s CCS capabilities while advancing its low-carbon solutions business development.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Synthetic Rubber Market based on the below-mentioned segments:

Japan Synthetic Rubber Market, By Type

- Styrene Butadiene Rubber

- Nitrile Rubber

- Polybutadiene Rubber

- Butyl Rubber

- Others

Japan Synthetic Rubber Market, By Application

- Tire

- Non-tire Automotive

- Industrial Rubber Goods

- Footwear

- Others

Need help to buy this report?