Japan Synthetic Paper Market Size, Share, and COVID-19 Impact Analysis, By Type (Biaxially Oriented Polypropylene (BOPP), High Density Polyethylene (HDPE), Polyethylene Terephthalate (PET), and Others), By End Use (Industrial, Institutional, and Commercial/Retail), By Application (Label and Non-Label), and Japan Synthetic Paper Market Insights, Industry Trend, Forecasts to 2035

Industry: Advanced MaterialsJapan Synthetic Paper Market Insights Forecasts to 2035

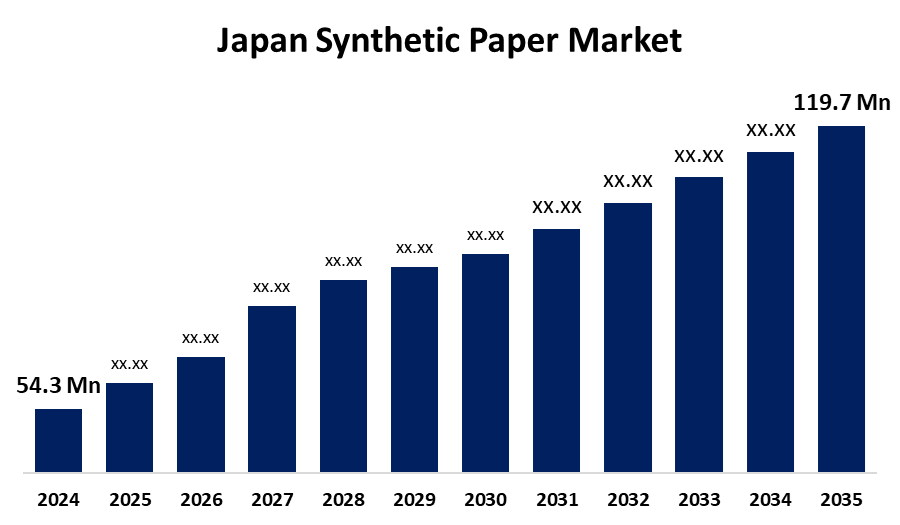

- The Japan Synthetic Paper Market Size Was Estimated at USD 54.3 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.45% from 2025 to 2035

- The Japan Synthetic Paper Market Size is Expected to Reach USD 119.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Synthetic Paper Market Size is anticipated to reach USD 119.7 Million by 2035, Growing at a CAGR of 7.45% from 2025 to 2035. The Japan synthetic paper market size is growing with heightened demand from the food and beverage sector, increasing awareness of consumers regarding the advantages of synthetic paper, and the implementation of eco-friendly manufacturing practices.

Market Overview

Japan Synthetic Paper Market Size refers to the business that manufactures long-lasting, water-resistant paper substitutes from synthetic resins for labeling, packaging, printing, and other environmentally friendly uses. Synthetic paper, which is created using materials such as biaxially oriented polypropylene (BOPP) and high-density polyethylene (HDPE), is chemically resistant, tear-resistant, and water-resistant. It is applied extensively in labels, packaging, maps, outdoor signs, and other commercial print uses due to its long-lasting and good print quality. Major strengths are superior printability, water resistance, and digital printing technology compatibility. The growth of opportunities is fueled by the boom in new e-commerce and the demand for eco-friendly packaging materials. Growth in the market is being fueled by development in the process of manufacturing synthetic resin, more adoption of digital printing, higher consumption, and a movement among consumers toward green products. The Japanese government aids the industry with funding programs and environmental policies favoring sustainable material development, as part of national environmental objectives. Market leaders like Yupo Corporation keep on innovating, keeping Japan at the forefront globally in the business of synthetic paper while strengthening its leadership position in material sustainability.

Report Coverage

This research report categorizes the market size for the Japan synthetic paper market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan synthetic paper market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan synthetic paper market.

Japan Synthetic Paper Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 54.3 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.45% |

| 2035 Value Projection: | USD 119.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Type, By End Use, By Application |

| Companies covered:: | Yupo Corporation, Toppan Holdings Inc., Cosmo Films Japan LLC, Dynic Corporation, Toyobo Co. Ltd., Dai Nippon Printing Co., Ltd., Seiko Epson Corporation, Daicel Corporation, Hokuetsu Corporation, Kuraray Co., Ltd., Mitsubishi Chemical Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese market for synthetic paper is propelled by growing demand for tough, water-resistant, and tear-resistant products in industries like packaging, labeling, and printing. The trend toward green and recyclable substitutes for conventional paper is fueling market expansion. Advances in the technology for synthetic resin manufacturing and print compatibility also improve the attractiveness of products. Furthermore, government endorsement of sustainable materials, such as finance for programs, and the growth of e-commerce and logistics industries further drive demand for high-performance synthetic paper solutions.

Restraining Factors

The Japan synthetic paper industry is hampered by restraints like high manufacturing cost, dependency on petroleum raw material, poor biodegradability, and compatibility with conventional printing devices, which hamper wider adoption and environmental attractiveness.

Market Segmentation

The Japan synthetic paper market share is classified into type, end use, and application.

- The biaxially oriented polypropylene (BOPP) segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan synthetic paper market is segmented by type into biaxially oriented polypropylene (BOPP), high density polyethylene (HDPE), polyethylene terephthalate (PET), and others. Among these, the biaxially oriented polypropylene (BOPP) segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its superior printability, clarity, and chemical and moisture resistance. BOPP synthetic paper has extensive applications wherever aesthetic value and longevity are required, e.g., labels, packaging, and advertising. BOPP synthetic paper is the preferred choice of the labeling sector due to its sharp graphics and rich colors, making it a preferred product for use on packaging and product labels.

- The industrial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan synthetic paper market is segmented by end use into industrial, institutional, and commercial/retail. Among these, the industrial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Synthetic paper provides greater durability and resistance to severe environmental factors, thus being more suitable for industrial purposes like tags, labels, and safety signs that are subjected to high temperatures, moisture, and chemicals.

- The non-label segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan synthetic paper market is segmented by application into label and non-label. Among these, the non-label segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The synesthetic qualities and durability capabilities of synthetic paper qualify it for use beyond labeling. In printing and publishing, synthetic paper is utilized for producing high-grade brochures, catalogs, and marketing collateral, due to it can retain rich graphics and endure handling, making it a great material for visually oriented printed materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan synthetic paper market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yupo Corporation

- Toppan Holdings Inc.

- Cosmo Films Japan LLC

- Dynic Corporation

- Toyobo Co. Ltd.

- Dai Nippon Printing Co., Ltd.

- Seiko Epson Corporation

- Daicel Corporation

- Hokuetsu Corporation

- Kuraray Co., Ltd.

- Mitsubishi Chemical Corporation

- Others

Recent Developments:

- In April 2024, Cosmo Films' subsidiary, Cosmo Synthetic Paper (CSP), is creating a buzz. They launched 8 new brands emphasizing strength, printability, and sustainability. This makes CSP a trendsetter, providing cutting-edge solutions for the ever-evolving scenario of printing.

- In December 2021, Yupo Corporation launched a new product with reduced plastic that is used in synthetic paper for labelling.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan synthetic paper market based on the below-mentioned segments:

Japan Synthetic Paper Market, By Type

- Biaxially Oriented Polypropylene (BOPP)

- High Density Polyethylene (HDPE)

- Polyethylene Terephthalate (PET)

- Others

Japan Synthetic Paper Market, By End Use

- Industrial

- Institutional

- Commercial/Retail

Japan Synthetic Paper Market, By Application

- Label

- Non-Label

Need help to buy this report?