Japan Surfactants Market Size, Share, and COVID-19 Impact Analysis, By Source (Synthetic and Bio-based), By Product (Non-Ionic, Amphoteric, and Others), and Japan Surfactants Market Insights, Industry Trend, Forecasts to 2035.

Industry: Chemicals & MaterialsJapan Surfactants Market Insights Forecasts to 2035

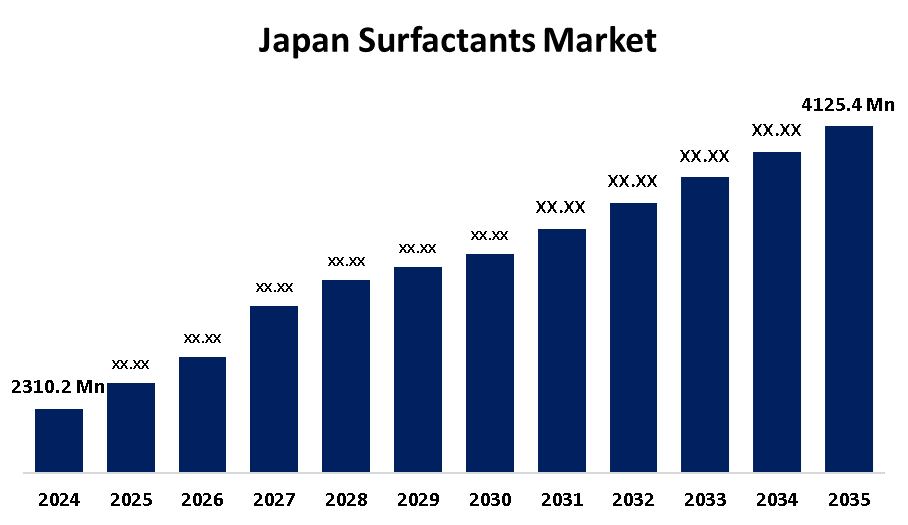

- The Japan Surfactants Market Size Was Estimated at USD 2310.2 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 5.41 % from 2025 to 2035

- The Japan Surfactants Market Size is Expected to Reach USD 4125.4 million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Surfactants market is anticipated to reach USD 4125.4 million by 2035, growing at a CAGR of 5.41 % from 2025 to 2035. The surfactants market in Japan is driven by various factors, including rising consumer awareness of sustainable practices, rising demand for bio-based surfactants, increased utilization in personal care, pharmaceutical, and chemical sectors, and regulatory support for sustainable surfactants.

Market Overview

Surfactants are surface-active substances that lower the surface tension between two different compounds, such as a liquid and a gas, two liquids, or a liquid and a solid. They have both a water-soluble (hydrophilic) and a water-insoluble (hydrophobic) component, which is known as amphiphilic. They act as emulsifiers, detergents, dispersants, foaming agents, and wetting agents in a range of industries, including the textile, industrial, pharmaceutical, food processing, personal care, and domestic cleaning sectors. The Japan surfactants market is changing owing to increased environmental concerns and sustainability goals. Demand for biodegradable, eco-friendly surfactants is rising as regulations tighten and consumers demand green products. Companies are focusing on plant-based and renewable surfactant development. This is consistent with Japan's carbon-reduction and sustainable industrial efforts. The Japan surfactants market is expanding due to rising demand for personal care and cosmetics. The personal care industry is expected to develop at a 6% annual rate due to an aging population, creating a demand for effective surfactants in high-quality formulations. The rising demand for sustainable and biodegradable surfactants is a key trend in this market.

Report Coverage

This research report categorizes the market for the Japan surfactants market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan surfactants market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan surfactants market.

Japan Surfactants Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2310.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.41 % |

| 2035 Value Projection: | USD 4125.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 165 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Source, By Product, and COVID-19 Impact Analysis |

| Companies covered:: | Toho Tenax Co., Ltd., Mitsubishi Chemical Corporation, Tosoh Corporation, Asahi Kasei Corporation, Mitsui Chemicals, Inc., Daia Chemical Corporation, Nippon Shokubai Co., Ltd., Kao Corporation, Olin Corporation, Sodium Persulfates Corp, Others, and others key players |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan surfactants market is being driven by rising demand for eco-friendly, biodegradable surfactants due to rising environmental awareness and strict regulations. The demand for surfactants in Japan's home cleaning industry is being driven by increased hygiene awareness after COVID-19. The Japan Cleaning Products Association estimates that the country's household cleaning products market is expanding at a rate of around 4% per year. As a result of government initiatives to reduce plastic waste and encourage environmentally friendly actions, Japan's sustainability regulations are increasing the demand for biodegradable surfactants. Additionally, increased use in utilization in the personal care industry plays an important role in market expansion.

Restraining Factors

One of the notable challenges is the high cost of advanced or bio-based surfactants, which limits their accessibility to price-sensitive buyers. Additionally, Japan has the toughest chemical regulations, which further limit the market expansion.

Market Segmentation

The Japan surfactants market share is classified into source and product.

- The synthetic segment held the dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan surfactants market is segmented by source into synthetic and bio-based. Among these, the synthetic segment held the dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period. This segmental growth is attributed to its low production costs and easy availability. Additionally, they are widely used in household detergents, shampoos, and cleaning products.

- The non-ionic segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan surfactants market is segmented by product into non-ionic, amphoteric, and others. Among these, the non-ionic segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segmental growth is attributed to its excellent emulsifying, wetting, and dispersing properties. Additionally, they are chemically stable and are compatible with a wide range of formulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan surfactants market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toho Tenax Co., Ltd.

- Mitsubishi Chemical Corporation

- Tosoh Corporation

- Asahi Kasei Corporation

- Mitsui Chemicals, Inc.

- Daia Chemical Corporation

- Nippon Shokubai Co., Ltd.

- Kao Corporation

- Olin Corporation

- Sodium Persulfates Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan surfactants market based on the below-mentioned segments:

Japan Surfactants Market, By Source

- Synthetic

- Bio-based

Japan Surfactants Market, By Product

- Non-Ionic

- Amphoteric

- Others

Need help to buy this report?