Japan Steel Drums and IBCs Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Steel Drums and Intermediate Bulk Containers (IBCs)), By Material (Carbon Steel and Stainless Steel), By End-User (Chemicals, Food and Beverages, Pharmaceuticals, Petroleum and Lubricants, Paints and Dyes, and Others), and Japan Steel Drums & IBCs Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Steel Drums & IBCs Market Insights Forecasts to 2035

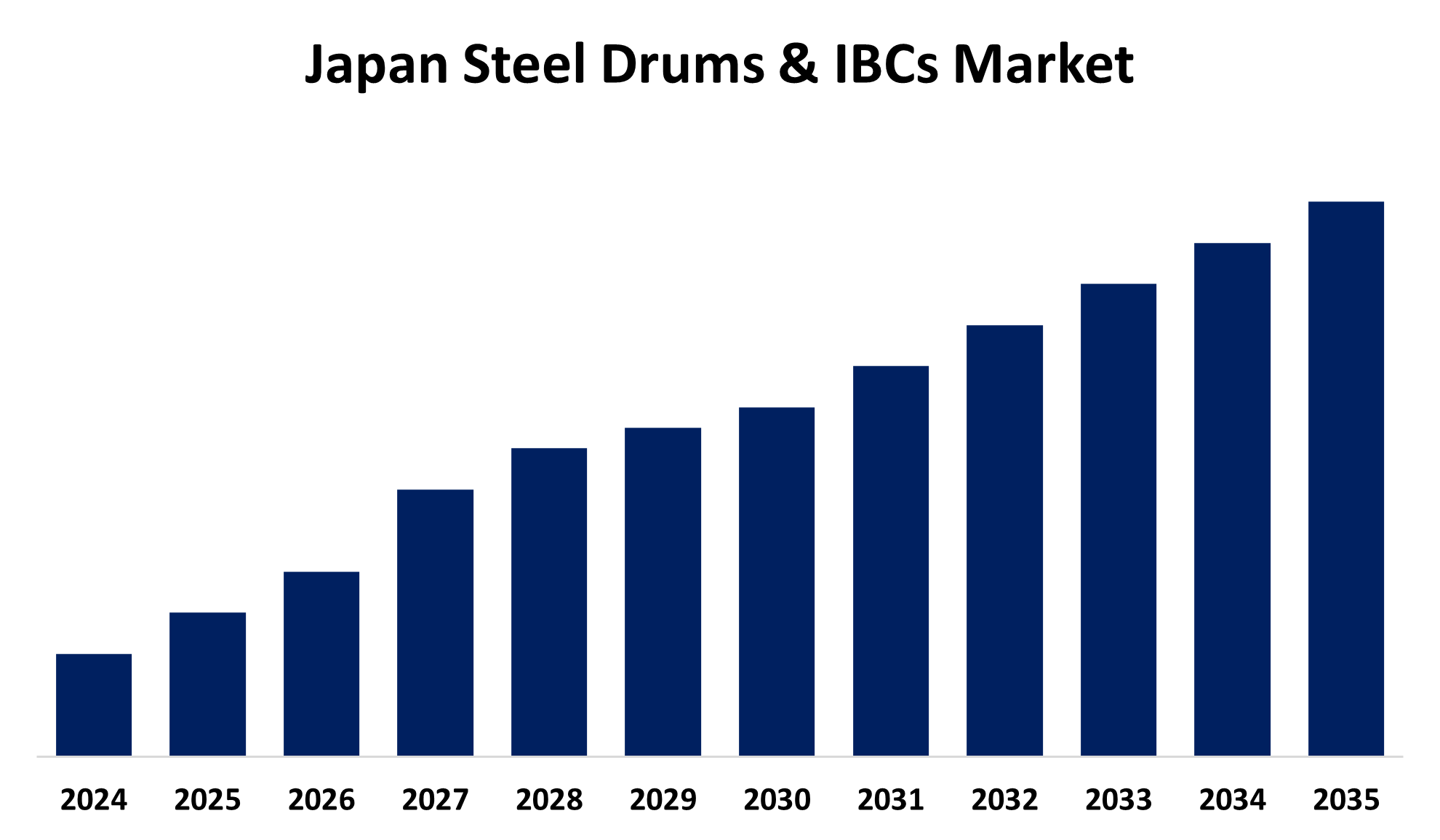

- The Japan Steel Drums and IBCs Market Size is Expected to Grow at a CAGR of 4.1% from 2025 to 2035

- The Japan Steel Drums and IBCs Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Steel Drums & IBCs Market Size is Expected to Hold a Significant Share by 2035, at a CAGR of 4.1% during the Forecast Period 2025-2035. The steel drum and intermediate bulk container (IBCs) market in Japan is growing due to the increasing demand for packaging that is durable and can be used multiple times, rising application in sectors such as electronics and chemicals, and government policies supporting bulk packaging that is environmentally friendly.

Market Overview

The Japan Intermediate Bulk Container (IBCs) and Steel Drums Market Size refers to the industry in the rigid packaging for safe storage and transportation of bulk liquids and solids, typically used in the chemical, pharmaceutical, food and beverage, and petrochemical industries. Their advantages are superior durability, corrosion resistance, international safety standards compliance, and long-term cost savings through reusability. Advancements in tracking tools such as RFID and automated handling systems benefit the industry by enhancing supply chain efficiency. Moreover, the growth of the market is driven by rising industrial production, a robust export-driven economy, and growing demand for long-lasting, recyclable packaging material. The sector is supported by the Japanese government via strict regulatory systems that ensure safety and sustainability, such as guidelines on hazardous material handling and recycling.

Report Coverage

This research report categorizes the market for the Japan steel drums & IBCs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan steel drums & IBCs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan steel drums & IBCs market.

Japan Steel Drums and IBCs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.1% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product Type, By Material, By End-User |

| Companies covered:: | Mitsui E&S Holdings Co., Ltd., Nakano Industries Co., Ltd., Kawata Co., Ltd., Time Technoplast Ltd., Yamamoto Industries, Ltd., Nisshin Yoki Co., Ltd., SCHUTZ Japan, Hoshino Gakki Co., Ltd., Nippon Steel Corporation, Greif Japan, Sumitomo Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan steel drums and IBCs market is prompted by increasing demand for safe and long-lasting bulk packaging in the chemical, pharmaceutical, and food industries. Increased industrialization, export operations, and demand for cost-effective logistics drive adoption. Stepped-up environmental protection regulations that encourage reusable and recyclable packaging also drive market expansion. Further, manufacturing technology and intelligent tracking technologies such as RFID improve operational efficiency, and steel drums and IBCs emerge as solutions for secure storage and transportation in Japan's changing supply chain environment.

Restraining Factors

The Japan steel drums and IBCs market is hindered by prohibitively high production and maintenance costs, stringent environmental conformity regulations, and rising competition from light, flexible packaging options, which have lower logistics expenses and more convenient handling for certain industries.

Market Segmentation

The Japan steel drums & IBCs market share is classified into product type, material, and end-user.

- The steel drums segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan steel drums & IBCs market is segmented by product type into steel drums and intermediate bulk containers (IBCs). Among these, the steel drums segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their resilience, toughness, and resistance to harsh conditions. Steel drums are therefore most suitable for carrying dangerous and non-dangerous substances. The ongoing increase in the chemical and petroleum sectors is one of the key drivers of the demand for steel drums.

- The carbon steel segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan steel drums & IBCs market is segmented by material into carbon steel and stainless steel. Among these, the carbon steel segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its cost-effectiveness, strength, and durability. Carbon steel drums have especially been popular with the chemical and petroleum industries since they can transport hazardous material safely and efficiently.

- The chemicals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan steel drums & IBCs market is segmented by end-user into chemicals, food and beverages, pharmaceuticals, petroleum and lubricants, paints and dyes, and others. Among these, the chemicals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their strength and durability, which render them a choice in this market. The use of safe and secure packaging systems for hazardous chemicals is essential, and steel drums and IBCs provide the protection required.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan steel drums & IBCs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsui E&S Holdings Co., Ltd.

- Nakano Industries Co., Ltd.

- Kawata Co., Ltd.

- Time Technoplast Ltd.

- Yamamoto Industries, Ltd.

- Nisshin Yoki Co., Ltd.

- SCHUTZ Japan

- Hoshino Gakki Co., Ltd.

- Nippon Steel Corporation

- Greif Japan

- Sumitomo Corporation

- Others

Recent Developments:

- In May 2025, on order to lower carbon emissions, Nippon Steel intended to invest close to 870 billion yen ($6.05 billion) on electric furnaces at its three domestic factories. By the fiscal year 2029, the Japanese government planned to support up to 251 billion yen of the steelmaker's decarbonisation initiatives, with a particular emphasis on the three factories.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan steel drums & IBCs market based on the below-mentioned segments:

Japan Steel Drums & IBCs Market, By Product Type

- Steel Drums

- Intermediate Bulk Containers (IBCs)

Japan Steel Drums & IBCs Market, By Material

- Carbon Steel

- Stainless Steel

Japan Steel Drums & IBCs Market, By End-User

- Chemicals

- Food and Beverages

- Pharmaceuticals

- Petroleum and Lubricants

- Paints and Dyes

- Others

Need help to buy this report?