Japan Soy Protein Market Size, Share, and COVID-19 Impact Analysis, By Type (Soy Protein Isolates, Soy Protein Concentrates, Soy Protein Flours, Others), By Form (Powder, Bars, Ready to Drink, Capsules & Tablets, Others), By Application (Functional Foods, Sports Nutrition, Meat Additives, Confectionary & Other Food Products, Pharmaceuticals, Others), By Distribution Channel (Supermarkets/Hypermarkets, Convenience Store, E-commerce, Others), and Japan Soy Protein Market Insights Forecasts to 2032

Industry: HealthcareJapan Soy Protein Market Insights Forecasts to 2032

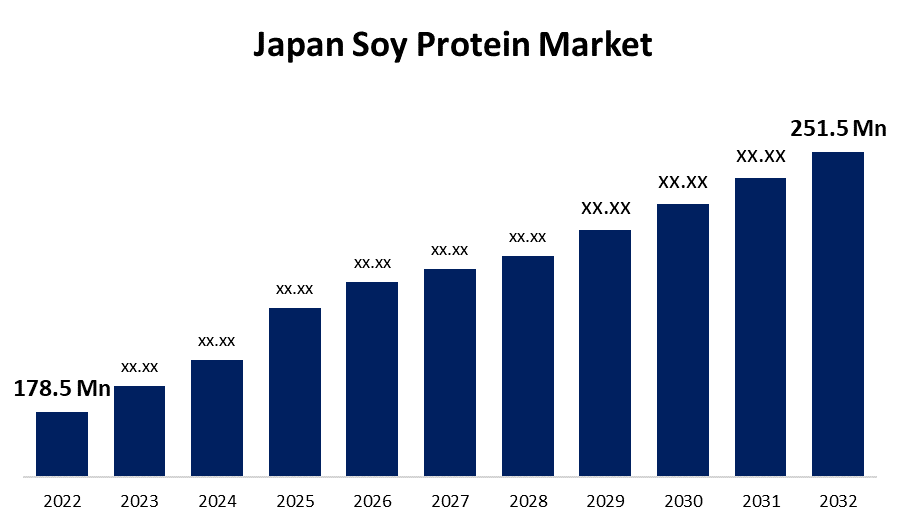

- The Japan Soy Protein Market Size was valued at USD 178.5 Million in 2022.

- The Market Size is Growing at a CAGR of 3.5% from 2022 to 2032.

- The Japan Soy Protein Market Size is Expected to Reach USD 251.5 Million by 2032.

Get more details on this report -

The Japan Soy Protein Market Size is Expected to Reach USD 251.5 Million by 2032, at a CAGR of 3.5% during the forecast period 2022 to 2032.

Market Overview

Soy protein, derived from soybeans, is known as a premium plant-based protein because it contains all the essential amino acids required for human health and development. In addition, it has a powerful profile that includes 33 calories, 49.2 grams of protein, and 36 grams of carbohydrates. Along with this, it provides numerous health benefits, such as cholesterol reduction, increased cardiac health, and osteoporosis prevention. Because it is a cost-effective alternative to meat and dairy proteins, soy protein is frequently used in vegan and vegetarian meal plans. The product distinguishes itself through its lean protein and low-fat composition, long-lasting freshness, and adaptability across various food processing methods. Furthermore, textured vegetable protein (TVP) like soy protein is widely consumed across end-user industries because it improves the texture and nutritional content of dishes, thereby supporting overall heart health. Furthermore, soybean has been discovered to be high in phytic acid, which is both good and bad. The phytic acids have been shown to lower the risk of colon cancer by acting as an antioxidant. However, phytic acid inhibits iron, zinc, and calcium absorption and may promote mineral deficiencies. The high functionality of soy protein, combined with the growing desire to incorporate vegan-based proteins, has been the primary driving force in the soy protein market.

Report Coverage

This research report categorizes the market for Japan soy protein market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan soy protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan soy protein market.

Japan Soy Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 178.5 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 3.5% |

| 2032 Value Projection: | USD 251.5 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Form, By Application, By Distribution Channel. |

| Companies covered:: | Archer Daniels Midland Company, CHS Inc., DuPont de Nemours Inc., Fuji Oil Group, Kerry Group, Kobayashi Noodle Co., Ltd., Daiei Sangyo Kaisha Ltd., Ait Corp., Ajitech Co., Ltd., Japan Trust Co., Ltd., Nichimo Co., Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japanese soy protein market is growing rapidly as consumers increasingly prefer plant-based proteins to animal-derived proteins. This shift is accelerated by the growing trend of veganism, increased health concerns, and a better understanding of the health benefits of soy protein. Furthermore, athletes and fitness enthusiasts prefer soy protein due to its low sugar content and high nutrient content. Its adaptability is evident as it finds its way into baked goods and confectioneries, where it improves the taste, structure, and longevity. Notably, its inclusion in infant nutrition and acceptance in animal nutrition indicate its wide appeal. Cutting-edge culinary developments that enable the introduction of superior plant-based meat substitutes, as well as significant R&D commitments from industry leaders, are further catalyzing the Japan market. Furthermore, the expanding food and beverage sector, rising consumer spending power, and the ease of obtaining products from a diverse range of physical and online stores will drive the Japan soy protein market in the coming years.

Restraining Factors

Plant-based meat proteins have gained traction, but soy protein has been seen to lose its edge over its counterparts in the long term as various ingredients rich in protein and low in carbs have surfaced and displaced, once the segment leader. Furthermore, soy protein has been identified as a major allergen, whereas pea protein is classified as hypoallergenic. Other plant-based ingredient items, such as almonds, oats, and other legumes, have grown rapidly, potentially displacing soy proteins.

Market Segment

- In 2022, the soy protein isolates segment accounted for the largest revenue share over the forecast period.

Based on the type, Japan’s soy protein market is segmented into soy protein isolates, soy protein concentrates, soy protein flours, and others. Among these, the soy protein isolates segment has the largest revenue share over the forecast period. The growth can be attributed to their rising adoption of gluten-free and plant-based bakery products, as well as their rising use as an economical protein fortification ingredient in various food applications, driving Japan soy protein market growth. Furthermore, the ability of soy protein flours to improve nutritional profiles and serve as a functional binding agent has fueled their popularity and growth in the food industry.

- In 2022, the powder industry segment accounted for the largest revenue share over the forecast period.

Based on form, the Japan soy protein market is segmented into powder, bars, ready-to-drink, capsules & tablets, and others. Among these, the powder segment has the largest revenue share over the forecast period, owing to its convenience and versatility, it can be easily incorporated into a variety of food and beverage applications. Furthermore, powdered soy protein has a longer shelf life, is easier to transport, and stores efficiently, all of which contribute to its market growth.

- In 2022, the functional foods industry segment accounted for the largest revenue share over the forecast period.

Based on application, the Japan soy protein market is segmented into functional foods, sports nutrition, meat additives, confectionary & other food products, pharmaceuticals, and others. Among these, the functional foods segment has the largest revenue share over the forecast period, owing to the increasing consumer awareness of the health benefits of soy protein consumption. Because of its essential amino acids, low saturated fat content, and cholesterol-lowering properties, soy protein is widely used in functional food products such as fortified beverages, protein bars, and plant-based meat alternatives.

- In 2022, the supermarkets/hypermarkets industry segment accounted for the largest revenue share over the forecast period.

Based on distribution channels, the Japan soy protein market is segmented into supermarkets/hypermarkets, convenience stores, e-commerce, and others. Among these, the supermarkets/hypermarkets segment has the largest revenue share over the forecast period. Soy protein products are readily available to a large and diverse customer base due to their broad geographical coverage, convenient shopping experience, and ability to cater to the diverse needs of consumers. As an increasing incorporation of soy protein isolates in dietary supplements and functional health products, pharmaceuticals are the fastest-growing distribution channel in the soy protein market owing to increased consumer awareness of the health benefits of soy protein and its potential to promote well-being.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within Japan’s soy protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Archer Daniels Midland Company

- CHS Inc.

- DuPont de Nemours Inc.

- Fuji Oil Group

- Kerry Group

- Kobayashi Noodle Co., Ltd.

- Daiei Sangyo Kaisha Ltd.

- Ait Corp.

- Ajitech Co., Ltd.

- Japan Trust Co., Ltd.

- Nichimo Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2023, Roquette Freres, a manufacturer of plant-based ingredients, made a strategic investment in the Japanese startup Daiz Inc. Daiz Inc. specializes in extrusion technology, which aids in the development of novel plant-based ingredients.

- In February 2021, DuPont completed a merger that combined its Nutrition Business with International Flavors & Fragrances (IFF), resulting in a formidable entity poised to become a prominent supplier of ingredients to the food industry in the United States. The resulting company generated an impressive USD 11 billion in revenue and is well-positioned to provide a diverse range of ingredients, including soy proteins, for a variety of consumer products.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented Japan’s soy protein market based on the below-mentioned segments:

Japan Soy Protein Market, By Type

- Soy Protein Isolates

- Soy Protein Concentrates

- Soy Protein Flours

- Others

Japan Soy Protein Market, By Form

- Powder

- Bars

- Ready to Drink

- Capsules & Tablets

- Others

Japan Soy Protein Market, By Application

- Functional Foods

- Sports Nutrition

- Meat Additives

- Confectionary & Other Food Products

- Pharmaceuticals

- Others

Japan Soy Protein Market, By Distribution

- Supermarket/Hypermarket

- Convenience Store

- E-commerce

- Others

Need help to buy this report?