Japan Sodium Silicate Market Size, Share, and COVID-19 Impact Analysis, By Type (Liquid and Solid), By Form (Crystalline and Anhydrous), and Japan Sodium Silicate Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Sodium Silicate Market Insights Forecasts to 2035

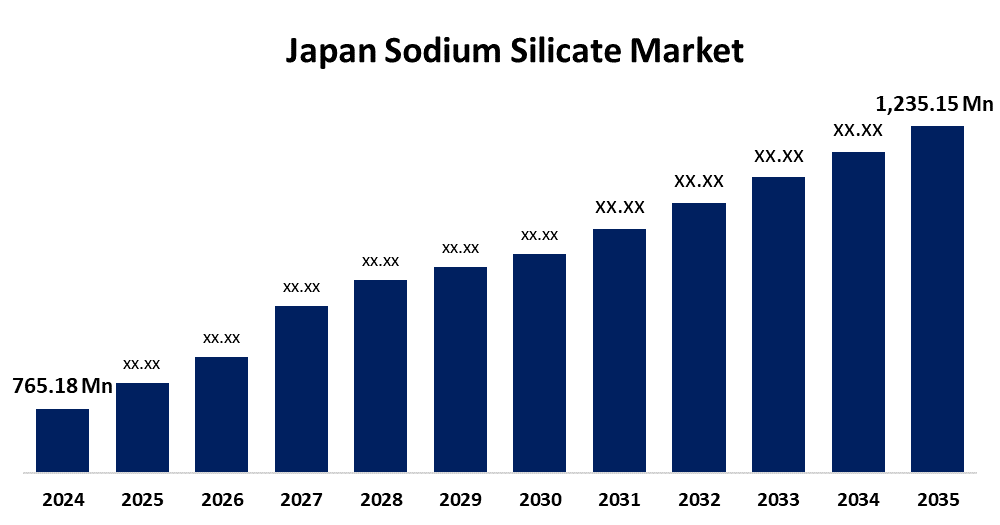

- The Japan Sodium Silicate Market Size was estimated at USD 765.18 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.45% from 2025 to 2035

- The Japan Sodium Silicate Market Size is Expected to Reach USD 1,235.15 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Sodium Silicate Market Size is anticipated to reach USD 1,235.15 Million by 2035, growing at a CAGR of 4.45% from 2025 to 2035. Japan's sodium silicate market is driven by smart city initiatives, AI integration, and increasing demand for location-based services. The country's focus on disaster preparedness and environmental monitoring further accelerates investments in real-time spatial data systems and digital twin technologies.

Market Overview

The Japan sodium silicate market refers to the industry focused on sodium silicate production and applications, including detergents, adhesives, water treatment, and construction materials. The Japanese construction sector is another significant factor driving the demand for sodium silicate. Sodium silicate finds extensive use in a variety of building applications as a water-repellent agent, cement binder, and setting accelerator. Because Japan's aging infrastructure bridges, tunnels, and buildings need to be renovated and reinforced on a regular basis, there is a growing need for silicate-based solutions that boost structural durability. Fire-resistant boards that provide increased safety in construction and geotechnical grouting for soil stabilization both heavily use sodium silicate. Particularly prized are materials that offer improved resistance and long-term performance, given Japan's earthquake susceptibility.

Report Coverage

This research report categorizes the market for the Japan sodium silicate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan sodium silicate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan sodium silicate market.

Japan Sodium Silicate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 765.18 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.45% |

| 2035 Value Projection: | USD 1,235.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type and By Form |

| Companies covered:: | Fuji Chemical Co., Ltd., Tokuyama Corporation, AGC Si-Tech Co., Ltd., Nippon Chemical Industrial Co., Ltd., CIECH, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for sodium silicate in Japan is being driven mostly by the growing emphasis on water resource management and environmental sustainability. The amount of wastewater generated has increased significantly due to growing industrial activity and urbanization, necessitating the urgent need for efficient treatment methods. In water and wastewater treatment facilities, sodium silicate is a crucial part of the coagulants and flocculants. It is a popular choice for the environment because of its capacity to improve sedimentation and eliminate contaminants including phosphates, lubricants, and heavy metals. Municipalities and industrial operators in Japan are using sodium silicate-based systems to guarantee adherence to environmental requirements because of the country's strict and frequently updated water quality rules.

Restraining Factors

The fluctuating cost of energy and raw materials is one of the main issues the Japanese sodium silicate market is facing. Sodium silicate production is mostly dependent on raw materials like silica sand and soda ash (sodium carbonate), both of which are prone to price swings worldwide as a result of trade restrictions, supply-demand imbalances, and changes in the energy market.

Market Segmentation

The Japan sodium silicate market share is classified into type and form.

- The liquid segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan sodium silicate market is segmented by type into liquid and solid. Among these, the liquid segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Water-repellent, adhesive, and binder applications are the main uses for liquid sodium silicate. Because of its superior adhesive qualities, it is particularly prized in the production of detergents, paints, and coatings.

- The crystalline segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan sodium silicate market is segmented by form into crystalline and anhydrous. Among these, the crystalline segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Crystalline sodium silicate is commonly utilized in processes including the production of paper, soaps, and detergents that require a precise chemical composition and high purity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan sodium silicate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fuji Chemical Co., Ltd.

- Tokuyama Corporation

- AGC Si-Tech Co., Ltd.

- Nippon Chemical Industrial Co., Ltd.

- CIECH

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan sodium silicate market based on the below-mentioned segments:

Japan Sodium Silicate Market, By Type

- Liquid

- Solid

Japan Sodium Silicate Market, By Form

- Crystalline

- Anhydrous

Need help to buy this report?