Japan Smart Warehousing Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Warehouse Size (Small, Medium, and Large), By Vertical (Retail & E-commerce, Manufacturing, Transportation & Logistics, Food & Beverages, Healthcare, Energy and Utilities, Agriculture, and Others), and Japan Smart Warehousing Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyJapan Smart Warehousing Market Insights Forecasts to 2035

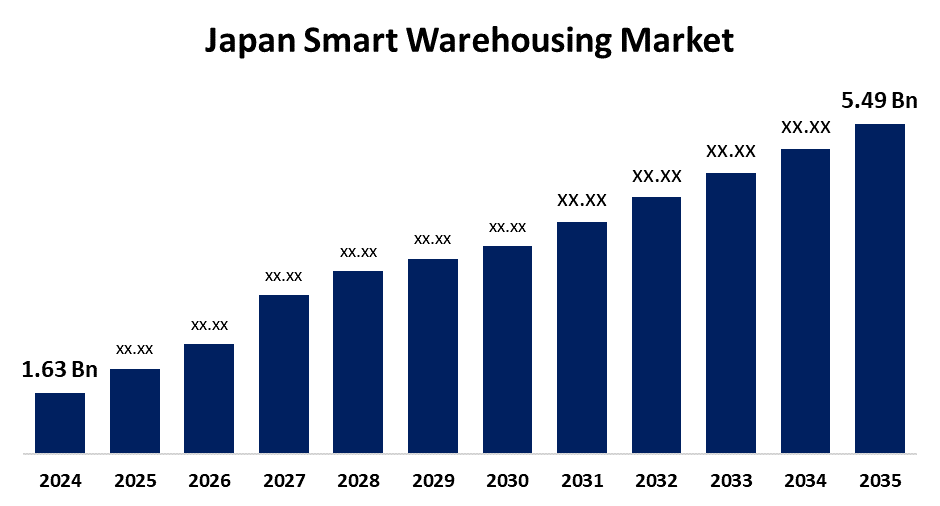

- The Japan Smart Warehousing Market Size Was Estimated at USD 1.63 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.67% from 2025 to 2035

- The Japan Smart Warehousing Market Size is Expected to Reach USD 5.49 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Smart Warehousing Market Size is anticipated to reach USD 5.49 Billion by 2035, growing at a CAGR of 11.67% from 2025 to 2035. The Japan smart warehousing market is growing as a result of various drivers, such as rising e-commerce activity, uptake of cutting-edge technologies such as IoT and AI, and government incentives.

Market Overview

The Japan smart warehousing market defines technologically smart warehouse compounds that use robotics, IoT, AI, cloud-based WMS, and AGVs to ensure maximum storage, stock, and order picking. These solutions address e-commerce, manufacturing, automotive, pharmaceutical, food & beverage, and logistics operations with real-time tracking, vertically-oriented space-efficient storage (AS/RS), forecasted inventory, and autonomous material handling. Japan's competitive edge is in precision engineering expertise, space-efficient city-optimized systems, and cloud- and AI-enabled WMS interfacing for scalability and operating acumen enhancement. New areas of opportunity are unfolding in the software and services areas, namely cloud, real-time asset tracking, predictive analytics, autonomous last-mile integration (robots/drones), and green warehouse solutions. Drivers in the market are Japan's digital revolution and e-commerce explosion, an aging population compelling automation adoption, labor resource shortage, increasing logistics costs and limitations in overtime, and restricted land for horizontal development. Government programs like the MLIT's Smart Logistics Initiative, Connected Industries program, establishment of digital agencies, and huge investment support IoT/AI convergence, green logistics, and modernization of infrastructure.

Report Coverage

This research report categorizes the market for the Japan smart warehousing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan smart warehousing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan smart warehousing market.

Japan Smart Warehousing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.63 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.67% |

| 2035 Value Projection: | USD 5.49 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 223 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Component, By Warehouse Size, By Vertical |

| Companies covered:: | Fujitsu Limited, Zebra Technologies Corp., Tecsys Inc, International Business Machines Corporation, Manhattan Associates Inc., Oracle Corporation, YE DIGITAL CORPORATION, Cognex Corporation, Manhattan Associates., PSI Logistics, ABB Ltd, SAP SE, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers for the Japanese smart warehousing market are e-commerce expansion at a fast growth rate, higher demands for real-time inventory management, and a declining labor force that compels the adoption of automation. Rising cost of logistics, space constraints in warehouses, and regulations on overtime also encourage the adoption of cost-effective, tech-based alternatives. Furthermore, further improvements in AI, IoT, and robots also make warehouses more efficient and scalable. Further, government support for digitalization and intelligent logistics programs also accelerates the development and deployment of intelligent warehousing systems across industries.

Restraining Factors

The Japan smart warehousing market is hampered by the high initial investment, complexity of merging the solution with heritage systems, and lack of qualified IT and robotics personnel. Small- and medium-sized businesses are also constrained by inadequate financial and technical resources.

Market Segmentation

The Japan smart warehousing market share is classified into component, warehouse size, and vertical.

- The hardware segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart warehousing market is segmented by component into hardware, software, and services. Among these, the hardware segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the crucial role that hardware components such as sensors, robots, and automatic systems play in smart warehouse infrastructure. These hardware components are the building blocks of transforming warehouses into smart warehouses through automation provision, enhanced data collection, and real-time monitoring and control of operations.

- The large segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart warehousing market is segmented by warehouse size into small, medium, and large. Among these, the large segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the immense advantages of colossal operations in adopting intelligent warehousing solutions. Vast warehouses, usually occupied by big retailers, manufacturers, and logistics companies, are very massive and possess intricate operations with enormous inventories, which greatly benefit from automation and advanced data analysis.

- The transportation & logistics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart warehousing market is segmented by vertical into retail & e-commerce, manufacturing, transportation & logistics, food & beverages, healthcare, energy and utilities, agriculture, and others. Among these, the transportation & logistics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the central role that efficient warehousing plays in the effectiveness of overall transportation and logistics operations. As the backbone of supply chain management, transportation and logistics companies heavily rely on smart warehousing solutions to enhance the efficacy of operations, reduce costs, and improve delivery speed.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan smart warehousing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujitsu Limited

- Zebra Technologies Corp.

- Tecsys Inc

- International Business Machines Corporation

- Manhattan Associates Inc.

- Oracle Corporation

- YE DIGITAL CORPORATION

- Cognex Corporation

- Manhattan Associates.

- PSI Logistics

- ABB Ltd

- SAP SE

- Others

Recent Developments:

- In January 2024, Fujitsu Limited and YE DIGITAL CORPORATION collaborated to boost distribution center functionality in Japan to address labor shortages and sustainable supply chains. They will integrate Fujitsu's warehouse management system (WMS) with YE DIGITAL's automated MMLogiStation to efficiently streamline logistics operations.

- In April 2023, Kyoto University and IBM Japan built a medical data and AI platform on Google Cloud to promote data utilization at Kyoto University's Graduate School of Medicine and affiliated hospitals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan smart warehousing market based on the below-mentioned segments:

Japan Smart Warehousing Market, By Component

- Hardware

- Software

- Services

Japan Smart Warehousing Market, By Warehouse Size

- Small

- Medium

- Large

Japan Smart Warehousing Market, By Vertical

- Retail & E-commerce

- Manufacturing

- Transportation & Logistics

- Food & Beverages

- Healthcare

- Energy and Utilities

- Agriculture

- Others

Need help to buy this report?