Japan Smart Pills Market Size, Share, and COVID-19 Impact Analysis, By Application (Capsule Endoscopy, Drug Delivery, Vital Sign Monitoring), By Disease Indication (Occult GI Bleeding, Crohn’s Disease, Small Bowel Tumors, and Celiac Disease, Inherited Polyposis Syndromes, Neurological Disorders, and Other Disease Indications), and Japan Smart Pills Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Smart Pills Market Insights Forecasts to 2035

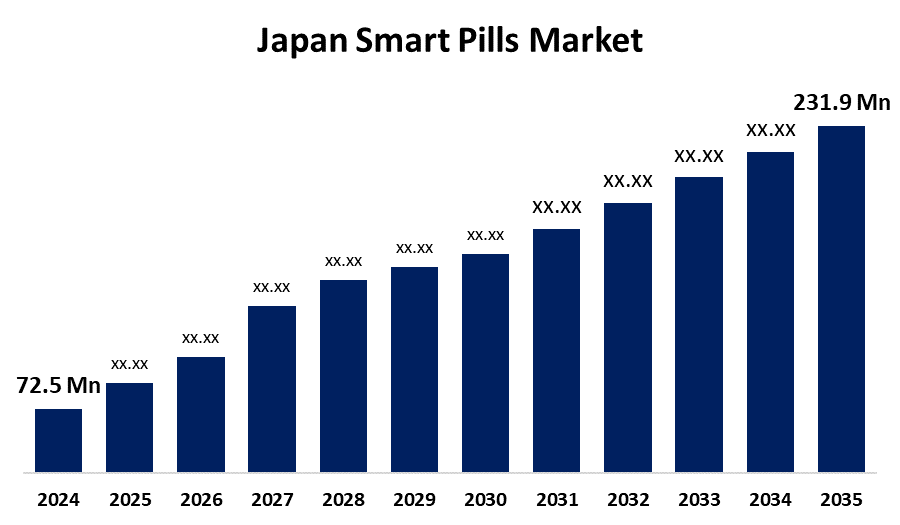

- The Japan Smart Pills Market Size Was Estimated at USD 72.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 11.15% from 2025 to 2035

- The Japan Smart Pills Market Size is Expected to Reach USD 231.9 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Smart Pills Market Size is anticipated to reach USD 231.9 Million by 2035, growing at a CAGR of 11.15% from 2025 to 2035. The Japan smart pills market is driven by various factors, including a rising aging population, rising GIT and stomach cancer rates, technological advancements and innovative healthcare developments.

Market Overview

Smart pills are also recognized as digital pills or ingestible sensors. This market focuses on ingestible medical devices that contain electronic components and sensors to monitor, diagnose, or treat medical conditions. Smart pills refer to technology involving electronic devices, sensors, cameras or transmitters being placed with traditional pharmaceutical medicines. They provide real-time information to external devices like smartphones, tablets, or clinical systems through wireless technology, which helps with patient health and effective treatment. The growing incidence of chronic diseases, including diabetes and cardiovascular diseases which raises the demand for new health solutions. Japan possesses one of the world's most aged populations, and this aged population is more susceptible to chronic illnesses such as GIT, which creates the need for non-invasive diagnostic equipment like smart pills. The combination of smart pill technology and artificial intelligence presents a great opportunity for predictive analytics and enabling proactive health management.

Report Coverage

This research report categorizes the market for the Japan smart pills market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan smart pills market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan smart pills market.

Japan Smart Pills Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 72.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.15% |

| 2035 Value Projection: | USD 231.9 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Application and By Disease Indication |

| Companies covered:: | Otsuka Holdings Co., Ltd., Olympus Corporation, Pentax Medical, FUJIFILM Holdings Corporation, Medtronic, and Other |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rise in the prevalence of chronic diseases such as GI disorders, diabetes, cardiovascular diseases, obesity, and metabolic syndrome is one of the main driving factors for Japan smart pill market. Japan has the largest geriatric population, which is more prone to chronic diseases, which drive the demand for non-invasive diagnostic solutions. The smart pills are wireless with cameras and sensors, which help in detection and tracking; hence, this process is painless and causes minimal discomfort with speedy recovery. Additionally, advancements in microelectronics and sensor technology are making smart pills progressively more effective, which further expands the market.

Restraining Factors

One of the main limitations is the high cost of production linked with smart pill technology, making it unaffordable for price-sensitive individuals. The use of smart pills to monitor health data raises privacy concerns due to the risk of data being stolen, hacked, or misused.

Market Segmentation

The Japan smart pills market share is classified into application and disease indication.

- The capsule endoscopy segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart pills market is segmented by application into capsule endoscopy, drug delivery, and vital sign monitoring. Among these, the capsule endoscopy segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because they provide a painless procedure for diagnosing GIT disorders. Additionally, they cause minimal discomfort, which drives the expansion of this segment.

- The celiac disease segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The Japan smart pills market is segmented by disease indication into occult GI bleeding, Crohn’s disease, small bowel tumors, celiac disease, inherited polyposis syndromes, neurological disorders, and other disease indications. Among these, the celiac disease segment held the highest share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is due rising incidence of GI disorders and chronic diseases like cancer and diabetes. Technological advancements in the drug delivery systems, along with the integration of sensors, are propelling the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan smart pills market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Otsuka Holdings Co., Ltd.

- Olympus Corporation

- Pentax Medical

- FUJIFILM Holdings Corporation

- Medtronic

- Other

Recent Developments

- In August 2020, Ostuka Pharmaceuticals acquired Proteus Digital Health for USD 15 million to improve Japan's footprint in digital medicine.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan smart pills market based on the below-mentioned segments:

Japan Dried Smart Pills Market, By Application

- Capsule Endoscopy

- Drug Delivery

- Vital Sign Monitoring

Japan Dried Smart Pills Market, By Disease Indication

- Occult GI Bleeding

- Crohn’s Disease

- Small Bowel Tumors

- Celiac Disease

- Inherited Polyposis Syndromes

- Neurological Disorders

- Other Disease Indications

Need help to buy this report?