Japan Smart Parcel Locker Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware and Software), By Type (Modular Parcel Lockers, Postal Lockers, Cooling Lockers for Fresh Food, and Laundry Lockers), By Application (Commercial/Corporate Offices, Residential, Retail BOPIS, Government & Municipal Buildings, Universities & Colleges, and Others), and Japan Smart Parcel Locker Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Smart Parcel Locker Market Insights Forecasts to 2035

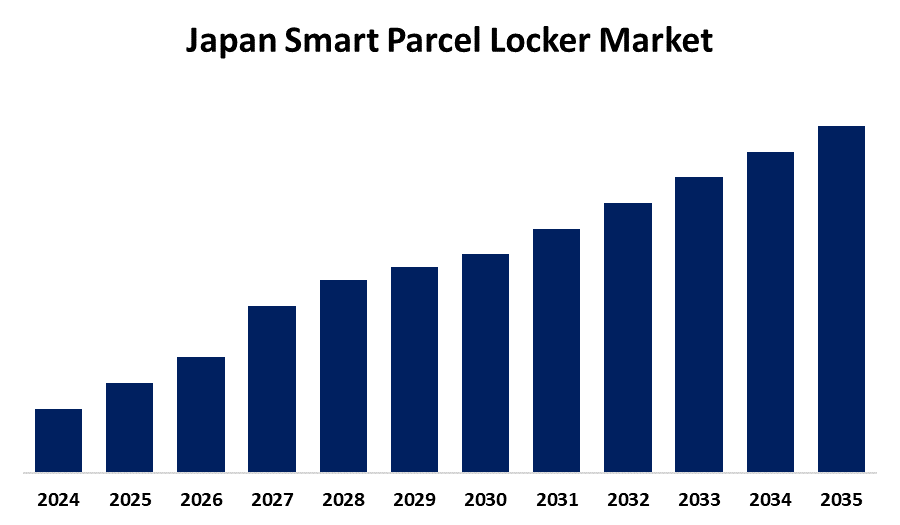

- The Japan Smart Parcel Locker Market Size is Expected to Grow at a CAGR of 11.4% from 2025 to 2035

- The Japan Smart Parcel Locker Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Smart Parcel Locker Market Size is Expected to Hold a Significant Share by 2035, at a CAGR of 11.4% during the forecast period 2025-2035. The Japan market for smart parcel lockers is growing due to increasing e-commerce, urbanization, and contactless delivery demand. Advances in IoT and AI further extend the functionality of lockers, increasing adoption in different urban and commercial environments.

Market Overview

The Japan Smart Parcel Locker Market Size refers to automated, manual delivery and pickup systems installed within public, residential, commercial, and transit areas to facilitate final delivery logistics. These lockers provide secure storage compartments with access through digital authentication, and enable 24/7 access through SMS, email, or app notification. The strengths of the Japanese market are technological innovation, with IoT, AI, biometric authentication, and concurrent tracking, and strong deployment service expectations. Opportunities are to develop locker networks in residential complexes, educational campuses, government buildings, and grocery delivery with thermoregulated modules. The major growth drivers are the skyrocketing volumes of the digital marketplace, increased demand for contactless delivery and ease, increasing urbanization, and the requirement for efficient, secure logistics solutions. Government programs such as Japan Society 5.0, digitalization through the Digital Agency, and investments in smart city infrastructure create conducive policy and funding conditions for parcel locker uptake.

Report Coverage

This research report categorizes the market for the Japan smart parcel locker market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan smart parcel locker market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan smart parcel locker market.

Japan Smart Parcel Locker Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 11.4% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 195 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Component, By Application |

| Companies covered:: | TZ Limited, InPost, Quadient, Hollman, Inc., KEBA, MobiiKey, Parcel Port, Kern Ltd., Zhilai Tech, Cleveron, My Parcel Locker, Yamato Holdings, Florence Corporation, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan smart parcel locker market is stimulated by the accelerating online retailing expansion, rising demand for touchless delivery solutions, and the necessity of effective last-mile delivery logistics. Increased urbanization and declining household sizes also drive the demand for safe and convenient storage of parcels. Advances in IoT, cloud connectivity, and concurrent tracking improve user experience and operational efficiency. Increased consumer demands for 24/7 access and quicker delivery, as well as labor shortages in logistics, further drive the adoption of smart parcel lockers.

Restraining Factors

The Japan smart parcel locker market is hindered by restraints like high cost of installation, scarcity of urban space, logistical system integration issues, and privacy of data, which in total hamper mass deployment and decelerate market growth.

Market Segmentation

The Japan smart parcel locker market share is classified into component, type, and application.

- The hardware segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart parcel locker market is segmented by component into hardware and software. Among these, the hardware segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to high demand for locker cabinets, control panels, and assembled hardware, spurring investment in physical parcel locker systems. Secure and scalable systems are required in dense traffic locations such as malls, offices, and campuses, accelerating deployment and manufacturing expansion.

- The modular parcel lockers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart parcel locker market is segmented by type into modular parcel lockers, postal lockers, cooling lockers for fresh food, and laundry lockers. Among these, the modular parcel lockers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to their expandable design, simplicity of expansion, and flexibility to different industries and locations. Logistics service providers, retailers, and universities favor modular systems because they are scalable, have standardized installation procedures, and can accommodate differing parcel volume and size variations effectively.

- The retail BOPIS segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart parcel locker market is segmented by application into commercial/corporate offices, residential, retail BOPIS, government & municipal buildings, universities & colleges, and others. Among these, the retail BOPIS segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to utilizing lockers to automate Buy Online, Pick Up In-Store (BOPIS) processes, alleviate in-store traffic, and accommodate consumers demand for quick, contactless pickup, particularly during peak season and promotional events in large retail chains and department stores.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan smart parcel locker market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- TZ Limited

- InPost

- Quadient

- Hollman, Inc.

- KEBA

- MobiiKey

- Parcel Port

- Kern Ltd.

- Zhilai Tech

- Cleveron

- My Parcel Locker

- Yamato Holdings

- Florence Corporation

- Others

Recent Developments:

- In July 2023, Quadient S.A. announced the renewal of its parcel locker joint venture, Packcity Japan, with Yamato Transport. Established in 2016, the partnership continues under the same ownership structure, with Quadient holding 51% and Yamato Transport 49%, reinforcing their commitment to expanding smart locker solutions in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan smart parcel locker market based on the below-mentioned segments:

Japan Smart Parcel Locker Market, By Component

- Hardware

- Software

Japan Smart Parcel Locker Market, By Type

- Modular Parcel Lockers

- Postal Lockers

- Cooling Lockers for Fresh Food

- Laundry Lockers

Japan Smart Parcel Locker Market, By Application

- Commercial/Corporate Offices

- Residential

- Retail BOPIS

- Government & Municipal Buildings

- Universities & Colleges

- Others

Need help to buy this report?