Japan Smart Labels Market Size, Share, and COVID-19 Impact Analysis, By Technology (Electronic Article Surveillance (EAS) Security, RFID Labels, Sensing Labels, Near Field Communication Tag, and Others), By Component (Transceivers, Memories, Sensors, Batteries, Microprocessors, and Others), By Application (Inventory management, Asset Tracking, Condition Monitoring, Industrial & Logistics Automation, and Others), and Japan Smart Labels Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyJapan Smart Labels Market Insights Forecasts to 2035

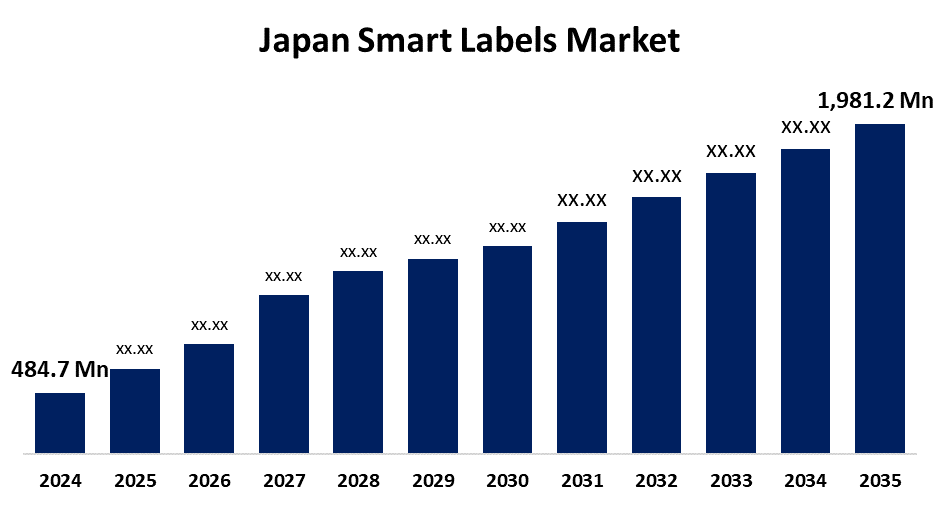

- The Japan Smart Labels Market Size Was Estimated at USD 484.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 13.65% from 2025 to 2035

- The Japan Smart Labels Market Size is Expected to Reach USD 1,981.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Smart Labels Market Size is anticipated to reach USD 1,981.2 Million by 2035, growing at a CAGR of 13.65% from 2025 to 2035. The smart labels market in Japan is growing as a result of demands for greater supply chain visibility, inventory management, and improved customer interactions. The main drivers are technological improvements in RFID and NFC, growing use of smartphones for QR code scanning, and use of smart labels in IoT ecosystems.

Market Overview

The Japan smart labels market refers to the application of smart label technologies in the form of RFID, NFC, electronic shelf labels (ESL), and sensor-equipped tags to improve product tracking, data storage, and real-time communication. Smart labels are applied extensively across retail, logistics, healthcare, and manufacturing to increase inventory management, confirm product authenticity, facilitate dynamic pricing, and aid supply chain transparency. The top strengths are Japan's developed digital infrastructure, high IoT integration, and a consumer base that is accepting of technology. Opportunities exist in developing uses across pharmaceuticals, cold chain logistics, and intelligent retail environments. Market expansion is spurred by Japan's growing need for automation caused by labor shortages, high e-commerce activity, and requirements for secure and efficient supply chains. Moreover, Japan's national digitalization strategy under the Society 5.0 initiative and government incentives for smart retail and logistics transformation complement market growth.

Report Coverage

This research report categorizes the market for the Japan smart labels market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan smart labels market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan smart labels market.

Japan Smart Labels Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 484.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 13.65% |

| 2035 Value Projection: | USD 1,981.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 224 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Component, By Application |

| Companies covered:: | Murata Manufacturing Co., Ltd., Toppan Holdings Inc., Avery Dennison Corporation, DHL, Checkpoint Systems, Inc., Zebra Technologies Corporation, SATO Holdings Corporation, Invengo Technology, CCL Industries Inc., Displaydata Ltd., Alien Technology, LLC, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for supply chain transparency, cost-effective inventory management, and anti-counterfeit measures in retail, health care, and logistics is driving Japan's smart labels market. Labor shortages in the country further encourage automation uptake, while mature digital infrastructure and extensive adoption of IoT technologies enable smart label adoption. Also, Japan's digital transformation drive under the Society 5.0 initiative and government incentives for smart retail systems push companies towards investing in smart labeling solutions for operational efficiency and improved customer interaction.

Restraining Factors

The smart labels market in Japan is hindered by high costs of implementation, complexity in compatibility with legacy systems, and issues of data security and privacy. Furthermore, a lack of awareness among small organizations hinders widespread adoption despite the long-term advantages of reduced operation costs.

Market Segmentation

The Japan smart labels market share is classified into technology, component, and application.

- The RFID labels segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart labels market is segmented by technology into electronic article surveillance (EAS) security, RFID labels, sensing labels, near field communication tag, and others. Among these, the RFID labels segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to need for accurate inventory control, real-time tracking, and supply chain visibility. Since the requirement for manual data entry systems for scanning/requesting processes that need to have a line of sight is avoided, productivity is greatly increased, manual errors are reduced, and labor expense is saved.

- The batteries segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart labels market is segmented by component into transceivers, memories, sensors, batteries, microprocessors, and others. Among these, the batteries segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the requirement of active smart labels that need to have power sources embedded in them to enable functionalities like sensing, data logging, and wireless communication. Battery-powered RFID, NFC, and sensor solutions for cold chain monitoring, pharmaceutical packaging, and high-value goods tracking need long periods of powered use.

- The inventory management segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan smart labels market is segmented by application into inventory management, asset tracking, condition monitoring, industrial & logistics automation, and others. Among these, the inventory management segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the sophisticated supply chains that require real-time visibility, precision, and operational efficiency. Service providers are embracing these technologies more to increase inventory control, assist in the reduction of shrinkage, as well as increase responsiveness towards demand shifts, retailers, manufacturers, and logistics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan smart labels market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Murata Manufacturing Co., Ltd.

- Toppan Holdings Inc.

- Avery Dennison Corporation

- DHL

- Checkpoint Systems, Inc.

- Zebra Technologies Corporation

- SATO Holdings Corporation

- Invengo Technology

- CCL Industries Inc.

- Displaydata Ltd.

- Alien Technology, LLC

- Others

Recent Developments:

- In January 2023, Toppan (a printing and packaging company) released paper-based NFC tag labels to curb counterfeit activity. The new NFC tag employs paper material rather than the usual PET film.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan smart labels market based on the below-mentioned segments:

Japan Smart Labels Market, By Technology

- Electronic Article Surveillance (EAS) Security

- RFID Labels

- Sensing Labels

- Near Field Communication Tag

- Others

Japan Smart Labels Market, By Component

- Transceivers

- Memories

- Sensors

- Batteries

- Microprocessors

- Others

Japan Smart Labels Market, By Application

- Inventory Management

- Asset Tracking

- Condition Monitoring

- Industrial & Logistics Automation

- Others

Need help to buy this report?