Japan Scaffolding Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Supported Scaffolding, Suspended Scaffolding, Rolling Scaffolding, and Other), By Material (Steel Scaffolding, Aluminum Scaffolding, and Wooden Scaffolding), and Japan Scaffolding Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingJapan Scaffolding Market Insights Forecasts to 2035

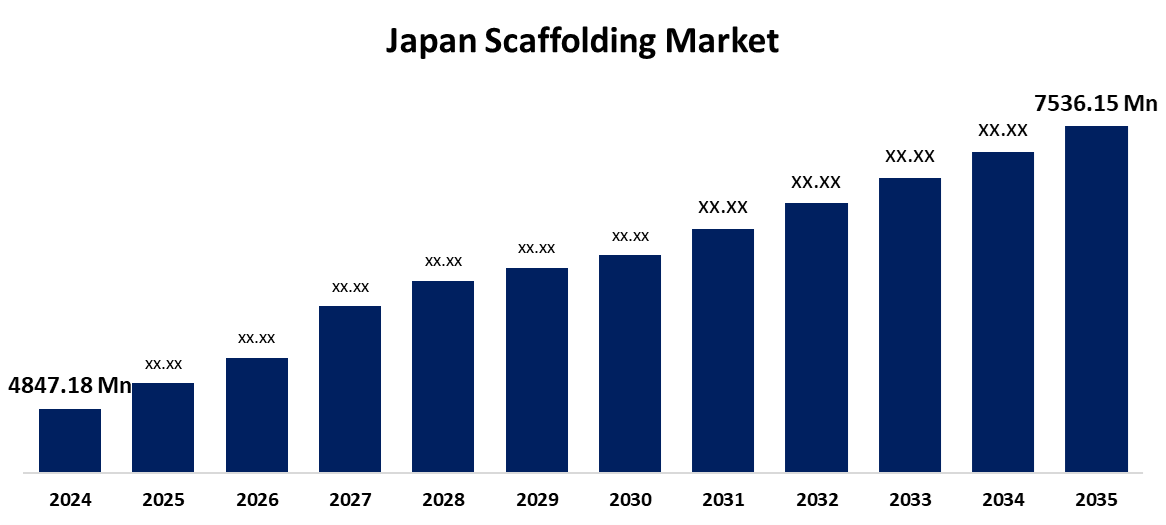

- The Japan Scaffolding Market Size Was Estimated at USD 4,847.18 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.09% from 2025 to 2035

- The Japan Scaffolding Market Size is Expected to Reach USD 7,536.15 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Scaffolding Market is anticipated to reach USD 7,536.15 million by 2035, growing at a CAGR of 4.09% from 2025 to 2035. The market is primarily driven by Japan’s aging infrastructure, which requires constant renovation and retrofitting, and by urban redevelopment projects in cities like Tokyo and Osaka.

Market Overview

The Japan Scaffolding Market Size refers to the industry that provides temporary structures used to support workers and materials during the construction, maintenance, and repair of buildings and infrastructure. These systems are essential for ensuring safety, accessibility, and efficiency on job sites across residential, commercial, and industrial projects. Growing urbanization, a growth in public infrastructure projects, and a boom in residential and commercial development are the main factors propelling the scaffolding market in Japan. Furthermore, the market is expanding due to the use of cutting-edge scaffolding materials and technologies, such as modular and safety-enhanced scaffolding systems. The industry is expanding thanks to trends toward sustainable building methods and regulations that prioritize worker safety. The expansion of construction activity across several industries and continuous infrastructure development are the main drivers of this growth.

Report Coverage

This research report categorizes the market for the Japan scaffolding market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan scaffolding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan scaffolding market.

Japan Scaffolding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,847.18 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.09% |

| 2035 Value Projection: | USD 7,536.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Material |

| Companies covered:: | PERI Group, ADTO Group, Altrad Group, Atlantic Pacific Equipment (AT-PAC), LLC, ULMA C y E, S. Coop., Waco Scaffolding and Equipment Company, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The scaffolding market in Japan is mostly driven by the country's massive infrastructure development projects and fast urbanization. The demand for new residential, commercial, and industrial structures increases as metropolitan areas grow. The Tokyo Metropolitan Government, for example, states that more than 100 high-rise structures are either planned or are being built in the city. In order to sustain complex buildings, this increase in construction activity calls for sophisticated scaffolding systems. Strong scaffolding systems are also necessary for ongoing infrastructure projects. The Chuo Shinkansen maglev line is one of several significant railway development projects currently under way that will necessitate substantial scaffolding during construction, according to the Japan Railway Construction, Transport and Technology Agency.

Restraining Factors

The market is subject to a number of limitations. It is challenging to effectively meet demand in Japan because of high labor costs and a declining trained workforce brought on by the country's aging population. Scaffolding companies face increased operational complexity and compliance expenses due to strict safety rules. Furthermore, logistical difficulties are exacerbated by the lack of storage space in cities, and domestic competitors are under pressure from international companies that provide more sophisticated or less expensive technologies.

Market Segmentation

The Japan scaffolding market share is classified into product type and material.

- The supported scaffolding segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan scaffolding market is segmented by product type into supported scaffolding, suspended scaffolding, rolling scaffolding, and other. Among these, the supported scaffolding segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because it is highly stable, easy to assemble, and widely used in both low-rise and high-rise construction projects across Japan’s dense urban environments.

- The steel scaffolding segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan scaffolding market is segmented by material into steel scaffolding, aluminum scaffolding, and wooden scaffolding. Among these, the steel scaffolding segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. Steel offers superior strength, durability, and load-bearing capacity, which is crucial for Japan’s large-scale infrastructure and earthquake-resistant construction standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan scaffolding market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- PERI Group

- ADTO Group

- Altrad Group

- Atlantic Pacific Equipment (AT-PAC), LLC

- ULMA C y E, S. Coop.

- Waco Scaffolding and Equipment Company

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Scaffolding Market based on the below-mentioned segments:

Japan Scaffolding Market, By Product Type

- Supported Scaffolding

- Suspended Scaffolding

- Rolling Scaffolding

- Other

Japan Scaffolding Market, By Application

- Steel Scaffolding

- Aluminum Scaffolding

- Wooden Scaffolding

Need help to buy this report?