Japan Robotic Tire Inspection System Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software, and Services), By Technology (Automated Optical Inspection, Ultrasonic Inspection, Laser Inspection, and Others), By End-User (Automotive OEMs, Tire Manufacturers, Automotive Service Centers, Airports, Logistics & Transportation, and Others), and Japan Robotic Tire Inspection System Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsJapan Robotic Tire Inspection System Market Insights Forecasts to 2035

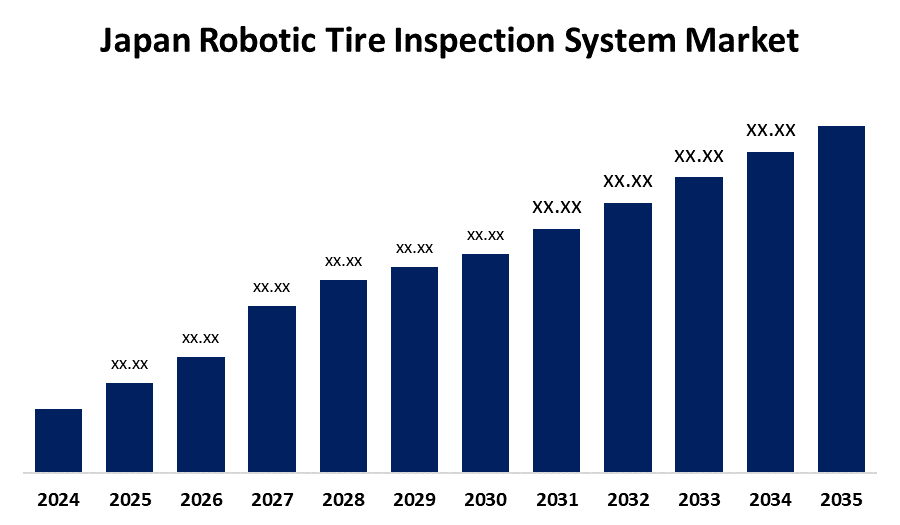

- The Japan Robotic Tire Inspection System Market Size is Expected to Grow at a CAGR of 8.9% from 2025 to 2035

- The Japan Robotic Tire Inspection System Market Size is Expected to Hold a Significant Share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Robotic Tire Inspection System Market Size is expected to hold a significant share by 2035, at a CAGR of 8.9% during the forecast period 2025-2035. The Japan robotic tire inspection system market is growing due to increased demand for automation, aging infrastructure, and increased safety regulations. Integration with AI improves accuracy and makes use in dangerous conditions possible, increasing adoption across industries.

Market Overview

The Japan robotic tire inspection system market refers to automated inspection platforms, cameras, and machine vision based systems that measure tire uniformity, structural integrity, tread wear, and defects through advanced imaging, AI, and robotics. These systems are installed in automotive OEM factories, MRO workshops, and used vehicle inspection centers to maximize safety and efficiency. Japan excels at precision engineering capabilities, robotics dominance, and integration of machine vision and AI for precise defect detection. Opportunities arise from adoption in used car markets with automated tread scanners, growing aftermarket and robotic retrofitting services, and edge AI integration for predictive maintenance and traceability systems.

Report Coverage

This research report categorizes the market for the Japan robotic tire inspection system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan robotic tire inspection system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan robotic tire inspection system market.

Japan Robotic Tire Inspection System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.9% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 179 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Technology and By End-User |

| Companies covered:: | Yaskawa Electric Corporation, Omron, Toyo Tire Corporation, ABB Ltd, Fanuc, KUKA AG, Mitsubishi Electric, Yokohama Rubber Company, Limited, Bridgestone Corporation, Michelin, Rockwell Automation Inc., Kawasaki Heavy Industries, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan robotic tire inspection system market is propelled by the increasing need for automation, accuracy, and efficiency in tire quality testing, particularly in the manufacture and maintenance of automobiles. Growing use of electric vehicles (EVs), stringent safety standards, and requirements to minimize manual inspection errors are hastening deployment. Japan dominance in robotics and machine vision technologies also energizes market growth. Also, the increasing used car market and development of smart factories spur the integration of AI-based tire inspection systems for increased safety and traceability.

Restraining Factors

The Japan robotic tire inspection system market is challenged by a high initial investment, integration with current systems, a lack of skilled resources, and maintenance costs, which as a whole impede adoption, particularly by small sized manufacturers and inspection shops.

Market Segmentation

The Japan robotic tire inspection system market share is classified into component, technology, and end-user.

- The hardware segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan robotic tire inspection system market is segmented by component into hardware, software, and services. Among these, the hardware segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to continuous progress in robotics and the rising need for scalable, modular inspection platforms that support innovation. Manufacturers are focusing on creating rugged, reliable hardware that incorporates well into current production lines and survives the tough automotive and logistics environments, with long term reliability and minimum downtime.

- The automated optical inspection segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan robotic tire inspection system market is segmented by technology into automated optical inspection, ultrasonic inspection, laser inspection, and others. Among these, the automated optical inspection segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their high-speed, non-contact operation makes them suitable for high-speed production lines. Improvements in image processing and AI augment AOI systems, allowing for real-time defect detection, adaptive inspection, low false positives, and increased throughput in manufacturing environments.

- The automotive OEMs segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan robotic tire inspection system market is segmented by end-user into automotive OEMs, tire manufacturers, automotive service centers, airports, logistics & transportation, and others. Among these, the automotive OEMs segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to improved quality control, lower defects in production, and ensuring regulatory compliance. When robotic inspection is incorporated into automated assembly lines, OEMs can maximize throughput and consistency, with each tire going onto a new car, ensuring strict standards.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan robotic tire inspection system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Yaskawa Electric Corporation

- Omron

- Toyo Tire Corporation

- ABB Ltd

- Fanuc

- KUKA AG

- Mitsubishi Electric

- Yokohama Rubber Company, Limited

- Bridgestone Corporation

- Michelin

- Rockwell Automation Inc.

- Kawasaki Heavy Industries

- Others

Recent Developments:

- In February 2025, Bridgestone and Komatsu launched a proof of concept to jointly offer new solutions for mining customers by integrating data from Bridgestone’s iTrack tire monitoring system and Komatsu’s Komtrax Plus. This collaboration aims to improve fuel efficiency and extend tire life through real-time data exchange and analysis.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan robotic tire inspection system market based on the below-mentioned segments:

Japan Robotic Tire Inspection System Market, By Component

- Hardware

- Software

- Services

Japan Robotic Tire Inspection System Market, By Technology

- Automated Optical Inspection

- Ultrasonic Inspection

- Laser Inspection

- Others

Japan Robotic Tire Inspection System Market, By End-User

- Automotive OEMs

- Tire Manufacturers

- Automotive Service Centers

- Airports

- Logistics & Transportation

- Others

Need help to buy this report?