Japan Retail Pharmacy Market Size, Share, and COVID-19 Impact Analysis, By Type of Pharmacy (Chain Pharmacies, Independent Pharmacies, Hospital Pharmacies, Mail Order Pharmacies, Online Pharmacies), By Type of Prescription (Prescription Drugs (Rx), Over-the-Counter (OTC) Drugs), and Japan Retail Pharmacy Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Retail Pharmacy Market Insights Forecasts to 2035

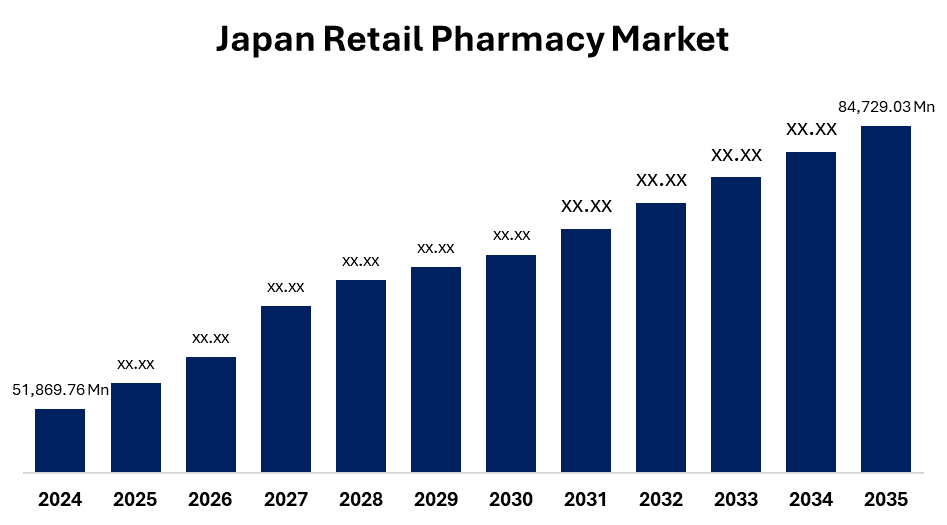

- The Japan Retail Pharmacy Market Size Was Estimated at USD 51,869.76 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.56% from 2025 to 2035

- The Japan Retail Pharmacy Market Size is Expected to Reach USD 84,729.03 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan Retail Pharmacy Market Size is anticipated to reach USD 84,729.03 Million by 2035, growing at a CAGR of 4.56% from 2025 to 2035. Several factors are contributing to the growth of the retail pharmacy industry in Japan, including an aging population, an increasing incidence of chronic illness, and government funding for healthcare services. Multiple factors are additionally driving the demand for medication management and other related services.

Market Overview

Market retail pharmacy means commercial entities in direct sale or the distribution of pharmaceutical products, either by prescription or non-prescription drugs, to consumers through conventional pharmacy and drug store channels, plus online distribution. The retail pharmacy market includes prescription drugs, over-the-counter drugs, dietary supplements, and similar products. The growth of the retail pharmacy market was thereby driven by factors enhancing healthcare services because of support for aged populations and the national expansion of the retail pharmacy network. An aging population that has greater chronic disease prevalence and access to some pharmaceutical services will continue the market growth.

Another driver of growth in the retail pharmacy market is that retail pharmacies provide access and availability to OTC products, which will go hand in hand with the further expansion of the retail pharmacy systems. The retail pharmacy market is leveraging new technology, such as digital health services and pharmacy automation, to improve consumer experience and operational efficiencies. The essential retail pharmacy market players in Japan have the opportunity to improve their digital services through the country's strong digital infrastructure, which enables the establishment of e-prescription services along with online consultations and customized medication management. Through data analytics and artificial intelligence solutions, pharmacies achieve customized medication distribution that results in better health outcomes and stronger patient adherence.

The leading companies operating in retail pharmacy chains can implement artificial intelligence alongside data analytics to enhance inventory control systems and create individualized patient interactions, along with precise marketing strategies. The retail pharmacy industry in Japan operates with some of the same principles and influences as other sectors; however, the fiscal matters of every Pharmacy in Japan are substantially affected by prescriptive government regulations focusing on cost control, innovation, and drug safety. While the National Health Insurance (NHI) and Long-term Care Insurance programs do influence market growth prospects, a combination of regulatory authorities, primarily the Pharmaceuticals and Medical Devices Agency (PMDA) and the Ministry of Health, Labour and Welfare (MHLW) is tasked with assuring drug safety and efficacy.

Report Coverage

This research report categorizes the market for the Japan retail pharmacy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan retail pharmacy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan retail pharmacy market.

Japan Retail Pharmacy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 51,869.76 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.56% |

| 2035 Value Projection: | USD 84,729.03 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 276 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Type of Pharmacy and By Type of Prescription |

| Companies covered:: | Lawson, Inc, FamilyMart Co., Ltd, Matsumoto Kiyoshi Holdings Co., Ltd, Tsuruha Holdings Inc, Aeon Co., Ltd, and Others |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The quick rise in Japan's aging population holds momentous effects for the development of Japan's retail pharmacy sector. Apart from the demographic changes, an upsurge in chronic diseases like diabetes, hypertension, and heart disease brings more volume in pharmacy prescription drug sales, together with demands for continuous health monitoring and preventative health care usage through the retail pharmaceuticals. In Japan, the demand for over-the-counter (OTC) drugs has risen sharply as consumers are more likely to consume OTC drugs to self-medicate and as preventative care via health management increases. Consumers are becoming more proactive with their health and are seeking out remedies for minor health issues, such as allergies and digestive issues. With this particular change in behavior in the population, the growth of over-the-counter product sales and retail pharmacies' product offerings has grown. Today, retail pharmacies are increasingly being developed in technology and digitization. Pharmacy automation technologies, such as e-prescription systems, automatic dispensing machines or devices, and inventory control systems, are being used in pharmacy operations to provide efficiencies, medication error reduction, and faster prescription preparation processes that will improve flow efficiency and customer satisfaction.

Restraining Factors

One of the primary issues facing Japan's retail pharmacy industry is the shortage of trained pharmacists and pharmacy staff. The existing pharmacy workforce is thereby experiencing a greater burden of responsibilities, longer wait times for patients, and less time to provide other value-added services in the way of drug therapy management and patient counseling. The challenges to the retail pharmacy industry in Japan are further aggravated by low profitability, which makes it harder to operate within the narrow margins that exist, and escalated pricing pressures for considerably larger health care systems to collaborate. Reimbursement rates for prescription medicine are continually eroding due to constant government issues changes to drug prices, all to keep health care costs down. Each change takes two or three primary manufacturers out of the market, thereby putting further pressure on pharmacy profits, especially for those pharmacies with a strong reliance on prescriptions.

Market Segmentation

The Japan Retail Pharmacy Market share is classified into type of pharmacy and type of prescription.

- The chain pharmacies segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan retail pharmacy market is segmented by type of pharmacy into chain pharmacies, independent pharmacies, hospital pharmacies, mail order pharmacies, and online pharmacies. Among these, the chain pharmacies segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Their broad geographic access, glossy name recognition, and breadth of service offerings all contribute to their segmented growth. These types of pharmacies enjoy a favourable position being allied with pharmaceutical manufacturers and the efficiency of economies of scale. The chain pharmacies provide the customer with prescription drugs, wellness products, and medical services under one roof. Moreover, the chain pharmacy has gained prominence on account of a well-organized working system, fine service quality, and customer confidence in the brand.

- The prescription drugs (Rx) segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan retail pharmacy market is segmented by type of prescription into prescription drugs (Rx), over-the-counter (OTC) drugs. Among these, the prescription drugs (Rx) segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increasing the incidence of chronic diseases, such as diabetes, heart disease, or cancer, requires long-term use of prescription drugs, which in turn fuel segment growth. The demand for prescription medicines is growing as a result of diagnosing health ailments that occur during the aging process and curing them with rehabilitation therapies, increased diagnosis, and accessible health care. This demand also grows due to the advances in pharmacy and better and stronger prescription drugs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan retail pharmacy market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Lawson, Inc

- FamilyMart Co., Ltd

- Matsumoto Kiyoshi Holdings Co., Ltd

- Tsuruha Holdings Inc

- Aeon Co., Ltd

- Others

Recent Developments:

- In January 2025, Watsons Philippines, a reputable health and beauty retail brand under the SM Group, ended 2024 with 1,166 outlets in line with its regional expansion strategy. The company opened 80 outlets last year, with more than 50 located outside of Metro Manila.

- In June 2024, the ACCC found that the Australian Competition and Consumer Commission issued a warning that the proposed merger between Sigma Healthcare and discount pharmacy giant Chemist Warehouse could reduce competition in Australia's pharmaceutical sector and increase prices for consumers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Retail Pharmacy Market based on the below-mentioned segments:

Japan Retail Pharmacy Market, By Type of Pharmacy

- Chain Pharmacies

- Independent Pharmacies

- Hospital Pharmacies

- Mail Order Pharmacies

- Online Pharmacies

Japan Retail Pharmacy Market, By Type Of Prescription

- Prescription Drugs (Rx)

- Over-the-Counter (OTC) Drugs

Need help to buy this report?