Japan Restorative and Endodontic Dentistry Market Size, Share, and COVID-19 Impact Analysis, By Material (Amalgams, Composites, Glass Ionomer Cements, Metals, and Ceramics), By Instruments (Handheld Instruments and Rotary Instruments), and Japan Restorative and Endodontic Dentistry Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Restorative and Endodontic Dentistry Market Insights Forecasts to 2035

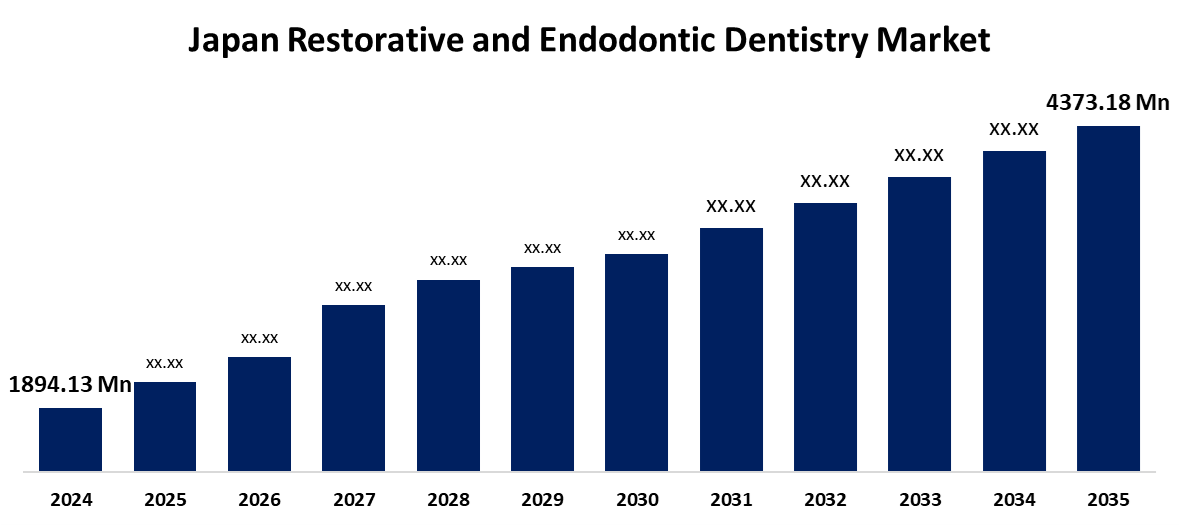

- The Japan Restorative and Endodontic Dentistry Market Size Was Estimated at USD 1,894.13 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.90% from 2025 to 2035

- The Japan Restorative and Endodontic Dentistry Market Size is Expected to Reach USD 4,373.18 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Restorative and Endodontic Dentistry Market Size is anticipated to reach USD 4,373.18 Million by 2035, Growing at a CAGR of 7.90% from 2025 to 2035. The Market Size is driven by Japan’s aging population, which increases the demand for restorative treatments due to tooth loss and dental caries.

Market Overview

The Japan Restorative and Endo Dentistry Market Size focuses on dental procedures and materials used for restoring damaged teeth and treating root canal infections. A major factor driving the market expansion for restorative and endodontic dentistry in Japan is the country's increasingly aging population. For those over 15, the prevalence of severe periodontal disease is 20.6%, and for those over 20, the prevalence of edentulism is 11.7%. In order to cure severe dental problems, the older population frequently needs complex restorative procedures, including crowns, bridges, and implants in addition to root canal therapy. The success of dental health campaigns is demonstrated by the fact that more than half (51.2%) of older persons in Japan have reached the objective of maintaining at least 20 teeth by the time they are 80 years old. Furthermore, as the population ages, preventive dental care and routine dental examinations are becoming more and more important.

Report Coverage

This research report categorizes the market for the Japan restorative and endodontic dentistry market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan restorative and endodontic dentistry market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan restorative and endodontic dentistry market.

Japan Restorative and Endodontic Dentistry Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,894.13 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.90% |

| 2035 Value Projection: | USD 4,373.18 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Material, By Instruments |

| Companies covered:: | Envista, Tokuyama Dental, Septodont USA, GC Corporation, Nobel BioCare, Zimmer Biomet Holdings, Inc., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aging population's growing incidence of dental caries, periodontal disorders, and tooth loss, as well as growing awareness of oral health, are major factors contributing to this growth. Market trends show a notable move toward less invasive procedures and the use of digital dentistry tools that enhance accuracy and patient outcomes, like 3D printing and CAD/CAM systems. The inclusion of dental procedures in insurance plans and government programs encouraging healthcare innovation also assist market growth. This significant increase highlights the growing need for cutting-edge dental techniques and novel materials meant to improve oral health results.

Restraining Factors

The high expense of sophisticated dental operations is one of the constraining factors, as it limits some patients' access. Strict regulations pertaining to dental equipment and materials may impede innovation. Furthermore, expansion may be impeded by the scarcity of qualified specialists for specialty therapies. Challenges can arise from shifting customer preferences toward preventive dentistry over restorative operations and economic volatility.

Market Segmentation

The Japan restorative and endodontic dentistry market share is classified into material and instruments.

- The amalgams segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan restorative and endodontic dentistry market is segmented by material into amalgams, composites, glass ionomer cements, metals, and ceramics. Among these, the amalgams segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their affordability and longevity, amalgams are still frequently used, but more visually acceptable substitutes are gaining ground on them.

- The handheld instruments segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan restorative and endodontic dentistry market is segmented by instruments into handheld instruments and rotary instruments. Among these, the handheld instruments segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. Explosives, forceps, and chisels are examples of handheld tools that are necessary for manual restorative and endodontic procedures.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan restorative and endodontic dentistry market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Envista

- Tokuyama Dental

- Septodont USA

- GC Corporation

- Nobel BioCare

- Zimmer Biomet Holdings, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Restorative and Endodontic Dentistry Market based on the below-mentioned segments:

Japan Restorative and Endodontic Dentistry Market, By Material

- Amalgams

- Composite

- Glass Ionomer Cements

- Metals

- Ceramics

Japan Restorative and Endodontic Dentistry Market, By Instruments

- Handheld Instruments

- Rotary Instruments

Need help to buy this report?