Japan Residential Gas Generators Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Portable and Stationary), By Power Rating (Up to 100 KW and More than 100 KW), By End-Users (Residential and Others), and Japan Residential Gas Generators Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Residential Gas Generators Market Insights Forecasts to 2035

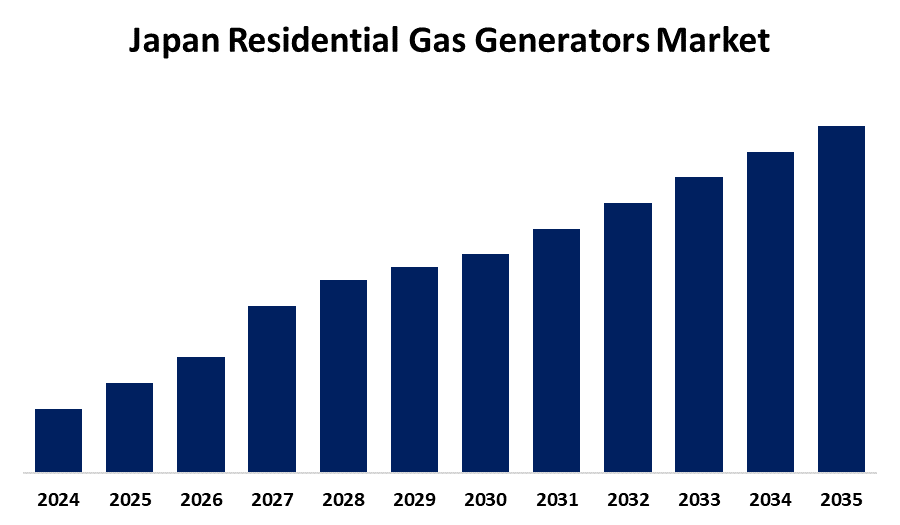

- The Japan Residential Gas Generators Market Size is Expected to Grow at a CAGR of around 8.5% from 2025 to 2035

- The Japan Residential Gas Generators Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Residential Gas Generators Market Size is Anticipated to hold a Significant share by 2035, Growing at a CAGR of 8.5% from 2025 to 2035. This is due to increasing demand for reliable backup power amid rising natural disasters and power outages. Urbanization, energy security concerns, and growing preference for cleaner alternatives to diesel generators are driving sustained growth.

Market Overview

The Japan residential gas generators market is the portion of the power generation business in Japan dedicated to the manufacture, distribution, and utilization of gas-fueled generators for household use. The generators employ natural gas, propane, or biogas to supply backup or emergency power in case of power loss or grid collapse. The Japan residential gas generators market offers good growth prospects spurred by mounting demand for robust backup power systems in light of regular natural disasters and old grid infrastructure. Technology improvements in small, low-emission gas generators and a growing consumer trend toward cleaner energy sources over diesel are offering positive conditions. Government policies on incentives for energy-efficient systems and improving energy security awareness also enhance market prospects. Growing smart home adoption and off-grid lifestyle trends also underpin future residential gas generator demand in Japan. In November 2024, the government of Japan said it would revive electricity and gas subsidies between January and March 2025 to cushion the expense of high fuel prices on domestic users. The move is included in a larger ¥13.5 trillion ($87 billion) stimulus package that is set to cushion low-income households from increasing utility bills.

Report Coverage

This research report categorizes the market for the Japan residential gas generators market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan residential gas generators market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan residential gas generators market.

Japan Residential Gas Generators Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.5% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 250 |

| Tables, Charts & Figures: | 140 |

| Segments covered: | By Product Type, By Power Rating, By End-Users and COVID-19 Impact Analysis. |

| Companies covered:: | Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Kipor Power Co., Ltd., Denyo Co., Ltd., and Others Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan residential gas generators market is dominated by the growing occurrence of natural disasters like earthquakes, typhoons, and heavy snowfall, which increase the demand for a reliable backup power solution. With rising residential energy needs due to urbanization and smart home technology adoption, customers are looking for a continuous power supply to ensure basic home operations. Moreover, the move to cleaner alternative energies and increasing green consciousness are favoring gas generators over diesel varieties because they have lower emissions and improved fuel utilization. Encouraging government policies in favor of disaster preparedness and developments in quieter and more compact generator technologies are also driving market take-up. Increasing electricity prices and grid stability issues further add to the increasing popularity of home-use gas generators in both urban and semi-rural locations in Japan.

Restraining Factors

The Japan residential gas generators market is influenced by restraining factors like high upfront installation costs, low consumer awareness, and strict environmental regulations. Moreover, the presence of alternative backup power sources like solar and battery storage, noise issues, and limited space in urban residential spaces could impede large-scale adoption and curtail market growth over the forecast period.

Market Segmentation

The Japan residential gas generators market share is classified into product type, power rating, and end-user.

- The stationary segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan residential gas generators market is segmented by product type into portable and stationary. Among these, the stationary segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to its reliability, higher power capacity, and suitability for continuous backup in residential settings. As power outages become more frequent and homeowners seek dependable energy solutions, the demand for stationary gas generators is expected to drive strong CAGR growth during the forecast period.

- The more than 100 KW segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan residential gas generators market is segmented by power rating into up to 100 KW and more than 100 KW. Among these, the more than 100 KW segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the increasing demand for high-capacity power backup in large residential complexes and luxury homes. These generators ensure uninterrupted electricity during prolonged outages. Rising energy needs and growing awareness of power reliability will support strong CAGR growth in this segment.

- The residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan residential gas generators market is segmented by end-user into residential and others. Among these, the residential segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to increasing power outages, heightened awareness of energy security, and growing urbanization in Japan. Homeowners are investing in gas generators for reliable backup solutions. Supportive government initiatives and technological advancements are expected to drive strong CAGR growth in the residential sector.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan residential gas generators market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Honda Motor Co., Ltd.

- Yamaha Motor Co., Ltd.

- Kipor Power Co., Ltd.

- Denyo Co., Ltd.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan residential gas generators market based on the below-mentioned segments:

Japan Residential Gas Generators Market, By Product Type

- Portable

- Stationary

Japan Residential Gas Generators Market, By Power Rating

- Up to 100 KW

- More than 100 KW

Japan Residential Gas Generators Market, By End-User

- Residential

- Others

Need help to buy this report?