Japan Rehabilitation Robots Market Size, Share, and COVID-19 Impact Analysis, By Type (Assistive Robot and Therapy Robot), By Patient (Adult and Pediatric), By End-Use (Hospitals & Clinics, Rehabilitation centers, and Other End-Users), and Japan Rehabilitation Robots Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Rehabilitation Robots Market Insights Forecasts to 2035

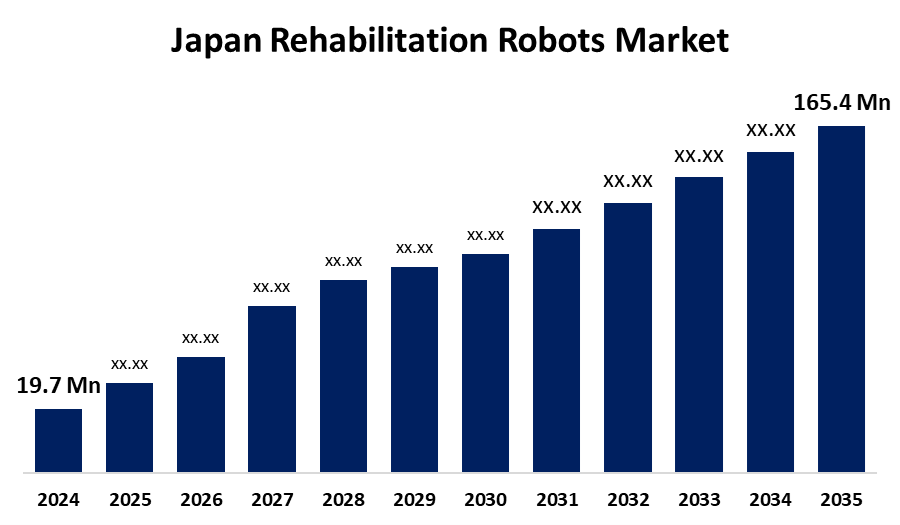

- The Japan Rehabilitation Robots Market Size Was Estimated at USD 19.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 21.34% from 2025 to 2035

- The Japan Rehabilitation Robots Market Size is Expected to Reach USD 165.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The Japan Rehabilitation Robots Market Size is anticipated to Reach USD 165.4 Million by 2035, Growing at a CAGR of 21.34% from 2025 to 2035. The rehabilitation robot market in Japan is growth-led, with factors such as an aging population, rising prevalence of chronic disorders, and technological evolution. All these are spurring the growth of robots for physical rehabilitation, stroke rehabilitation, and daily living assistive devices.

Market Overview

The Japan rehabilitation robots market refers to a robot system, including exoskeletons, therapy robots, and assistive devices, which are made to aid in physical rehabilitation, particularly for stroke, paralysis, and musculoskeletal disorders. Used in clinics, hospitals, senior-care facilities, and home environments, the systems assist with mobility, balance, strength, and independence. Japans strengths are a high healthcare infrastructure, a dense physical therapist population, and close R&D partnerships among academia, industry, and government. Opportunities arise from compact, home-curable devices designed for small living quarters, tele-rehabilitation systems, AI-based personalized therapy, and upper-and lower-extremity exoskeletons.Driving forces are Japans highly aging population, an increase in chronic diseases and stroke prevalence, and healthcare labor shortages, creating the need for therapy automation. Government programs, such as the 2017 Robot Revolution Initiative of "Society 5.0," give considerable funding (USD 55 million for medical/nursing robotics), as well as insurance coverage through PMDA classification and long-term care systems for supporting adoption.

Report Coverage

This research report categorizes the market for the Japan rehabilitation robots market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan rehabilitation robots market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan rehabilitation robots market. Driving forces are Japans highly aging population, an increase in chronic diseases and stroke prevalence, and healthcare labor shortages, creating the need for therapy automation.

Japan Rehabilitation Robots Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 21.34% |

| 2035 Value Projection: | USD 165.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 218 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Type, By Patient |

| Companies covered:: | Toyota Industries Corporation, AlterG, SoftBank Robotics, TMS Co., Ltd., Nidek Co., Ltd., Omron Corporation, Kinovo PLC, Honda, Bionik, Fujitsu Limited, RoboCare Lab Co., Ltd., Ekso Bionics, Myomo, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan rehabilitation robots market is supported by its aging population, the rising prevalence of stroke and mobility disorders, and the growing demand for assisted rehabilitation. Shortages in healthcare labor further fuel the necessity of robotic assistance in therapy and elderly care. Robotic, AI, and wearable tech advances improve system usability and uptake. Moreover, firm industry-academic collaboration and government backing for R&D, like Society 5.0, promote innovation, integration, and wider use of rehabilitation robots in clinical and home-care environments.

Restraining Factors

The Japan rehabilitation robots market has challenges like expensive device prices, fewer reimbursement policies, and complicated regulatory clearances. Moreover, a lack of skilled personnel to work on these sophisticated systems and integration issues in medical facilities is a hindrance to mass adoption and market expansion.

Market Segmentation

The Japan rehabilitation robots market share is classified into type, patient, and end-use.

- The therapy robot segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan rehabilitation robots market is segmented by type into assistive robot and therapy robot. Among these, the therapy robot segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they offer standardized, high-quality rehabilitation, minimizing the demand for individual human therapy. This reduces rehabilitation costs and allows more frequent, longer sessions necessary for effective recovery. Consequently, therapy robots are becoming patients first choice for effective and cost-saving rehabilitation.

- The adult segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan rehabilitation robots market is segmented by patient into adult and pediatric. Among these, the adult segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to the increased rates of stroke and injuries in adults promotes higher demand for rehabilitation services and robotic aid devices. Rehabilitation robots have conventionally been designed and optimized for the adult user, addressing conditions that are more common in the adult population, further increasing their uptake.

- The rehabilitation centers segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan rehabilitation robots market is segmented by end-use into hospitals & clinics, rehabilitation centers, and other end-users. Among these, the rehabilitation centers segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to rehabilitation for conditions such as stroke, spinal cord injuries, brain injuries, orthopedic procedures, and neurological diseases. With this specialization comes the ability to more easily incorporate and implement higher-technology solutions, including rehabilitation robots, into treatment plans, improving outcomes and patient care.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan rehabilitation robots market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toyota Industries Corporation

- AlterG

- SoftBank Robotics

- TMS Co., Ltd.

- Nidek Co., Ltd.

- Omron Corporation

- Kinovo PLC

- Honda

- Bionik

- Fujitsu Limited

- RoboCare Lab Co., Ltd.

- Ekso Bionics

- Myomo

- Others

Recent Developments:

- In June 2024, SoftBank Group announced a joint partnership with Tempus AI to create SB TEMPUS Corp., aiming to provide precision medicine services in Japan. Both sides will invest JPY 15 billion each, using AI to develop healthcare and personalized treatment all over the country.

- In February 2021, Fujitsu launched the FUJITSU Healthcare Solution HOPE ROMREC in Japan, an AI-based rehabilitation solution for clinics and hospitals. It uses sophisticated AI technology to capture shoulder and elbow joint range of motion automatically from videos of patient rehabilitation sessions, improving orthopedic treatment accuracy and precision.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan rehabilitation robots market based on the below-mentioned segments:

Japan Rehabilitation Robots Market, By Type

- Assistive Robot

- Therapy Robot

Japan Rehabilitation Robots Market, By Patient

- Adult

- Pediatric

Japan Rehabilitation Robots Market, By End-Use

- Hospitals & Clinics

- Rehabilitation centers

- Other End-Users

Need help to buy this report?