Japan Refrigerator Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Single Door, Top Freezer, French Door, Bottom Freezer, Side-By-Side, Others), By Distribution (Supermarkets & Hypermarkets, Exclusive Stores, Multi-branded Stores, Online and Others), By End User (Residential, Commercial), and Japan Refrigerator Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsJapan Refrigerator Market Insights Forecasts to 2035

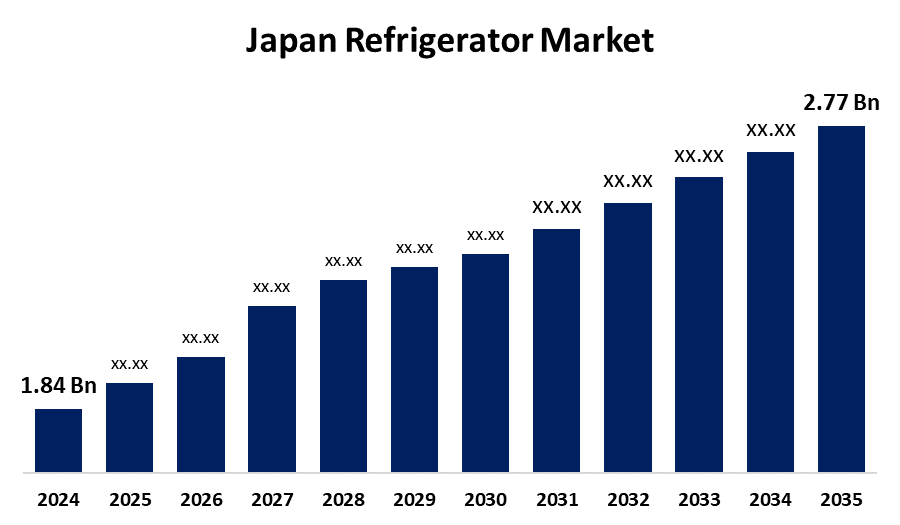

- The Japan Refrigerator Market Size Was Estimated at USD 1.84 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.79% from 2025 to 2035

- The Japan Refrigerator Market Size is Expected to Reach USD 2.77 Billion by 2035

Get more details on this report -

The Japan Refrigerator Market Size is anticipated to reach USD 2.77 Billion by 2035, growing at a CAGR of 3.79% from 2025 to 2035. The refrigerator market in Japan is expanding due to various reasons such as growing focus on energy efficiency, a rising need for smart refrigerators, technological improvements, and the smaller refrigerators in demand due to limited space, especially in urban areas.

Market Overview

The manufacturing, distribution and retailing of refrigerators deal with the global or local refrigerator market. The refrigerator market constitutes many types of refrigerators. The refrigerator market is dynamic because of the changing consumer behavior driven by reasons such as urbanization, new technology, and increased disclosure of environmental sensitivity and energy savings.

Refrigerators in Japan are an essential home appliance to convenience and keep food and other perishable items fresh. The main considerations when consumers are thinking about and choosing a refrigerator in Japan is the perception of efficiency, durability, and function.

The refrigerator market has domestic and foreign players competing in the market with increasing improvement, which excites consumers to purchase their next refrigerator. In the Japanese market, demand for smart refrigerators has increased transparency with artificial intelligence, advanced refrigeration features, internet of things inter-connectivity, and energy conservation. Japan also boasts a distinctive and innovative home appliances culture, for customers who demonstrate a relatively high technological sophistication, and a preference for convenience and ecological conscientiousness.

Japanese manufacturers are enabling features such as, accurate temperature control, total storage capacity, and environmental sustainability to provide their customers with amazing user experiences. This has led to the rise of compact refrigerators because of small living spaces in urban Japan. Due to the trend of urbanization and decreasing household size, there is a further push to compact and conserve space with refrigeration.

Major players in Japan remain focused on developing areas of smart technology, launching energy-efficient models, or even developing space-saving models, all of which successfully stimulate market expansion during the duration.

Report Coverage

This research report categorizes the market for the Japan refrigerator market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan refrigerator market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan refrigerator market.

Japan Refrigerator Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.84 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.79% |

| 2035 Value Projection: | USD 2.77 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Mitsubishi Electric Corporation, Panasonic Corporation, Fujitsu General Limited, Hitachi, Ltd., Hisense Japan Co., Ltd., Yamazen Corporation., Sharp Corporation, IRIS Ohyama Inc., Toshiba Corporation, Haier Japan Sales Co., Ltd. and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The refrigerator market in Japan has experienced consistent growth due to technological developments and smart refrigerators. Smart refrigerators, equipped with Internet of Things (IoT) features, allow users to monitor food items, change temperatures, and receive service alerts all from their smartphone. In addition, when it comes to value-driven consumers, features that enhance convenience capabilities like voice assistants, touchscreens, and AI-enabled energy features are attracting consumers. With the goals of energy efficiency in mind, Japanese companies are also developing more eco-friendly cooling technologies, including vacuum insulation and inverter compressors. Rebates and subsidies for energy-efficient models triggers higher sales demand. Energy efficiency is a huge motivation for the refrigerator industry as manufacturers focus on natural refrigerants and advanced insulated materials, particularly as sustainability becomes a major topic. Due to limited living space in urban areas for Japanese consumers space-saving multipurpose freezers work best in their modern housing designs, which boost demand. As Japanese urban consumer widely more use modular kitchens, the demand for special refrigeration systems is on the rise. The continued demand for urban housing growth and increased population spending power in the urban residential markets will result in market growth.

Restraining Factors

The Japan refrigerator market is primarily restrained by high competition among key players and saturation of market. The major companies in the market are continuing to innovate and push for the needs of consumers in a saturated market. They create tense competition, price wars, and diminishing margins which lead companies to develop new ways to differentiate barriers to entry and also differentiate their offerings. Almost all consumers already own refrigerators, which makes it difficult to make sales because replacement cycles on the purchase of refrigerators are so long, including managing opportunities for growth. In addition, Japan is facing a significant challenge with an aging population and declining birth rates. The refrigerator market is facing headwinds; however, compact refrigerators are increasing in usage, and has high growth rate compared to premium refrigerators with lower margins than usual. Price volatility of raw materials has been affected by trade restrictions, geopolitical issues and an unhinged global supply chain. These rising input costs either force companies to absorb the costs turned into lower profitability or push those to their customer base and potentially lower their sales. Besides, Japan relies on imported raw materials and is therefore vulnerable to external shocks such as shipping delays, tariff disruptions and changes in trade policies.

Market Segmentation

The Japan refrigerator market share is classified into product type and end user.

- The french door segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan refrigerator market is segmented by product type into single door, top freezer, french door, bottom freezer, side-by-side, others. Among these, the french door segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed primarily to their energy efficiency, spacious design and innovative features, such as smart cooling technology that align well with the Japanese affinity for modern appliances. French door refrigerators are large and ideal for Japanese houses, which frequently place a high value on space efficiency. Smart cooling technology also resonates with Japanese consumers' desire for convenience and technology, as it improves food preservation, prolonging shelf life of foodstuffs.

- The residential segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan refrigerator market is segmented by end user into residential, commercial. Among these, the residential segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The majority of Japanese households own refrigerators, and the demand for the purchase of energy-efficient models and replacements are driving the segmental growth. Consumers are increasingly purchasing IoT-enabled smart refrigerators with features such as inventory tracking, remote temperature changes, and maintenance notifications. Urbanization and families becoming smaller in number is leading to an increase of compact and space-saving refrigerators, which is propelling segment growth.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan refrigerator market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mitsubishi Electric Corporation

- Panasonic Corporation

- Fujitsu General Limited

- Hitachi, Ltd.

- Hisense Japan Co., Ltd.

- Yamazen Corporation.

- Sharp Corporation

- IRIS Ohyama Inc.

- Toshiba Corporation

- Haier Japan Sales Co., Ltd.

- Others

Recent Developments:

- In December 2024, Hoshizaki launched 364 new models along with several updated units of its commercial freezer, refrigerator, and refrigerator-freezer models. This will allow the company to finish the transition to lower-impact natural refrigerants, from hydrofluorocarbons (HFCs), for all of its standard commercial refrigerator, freezer, and refrigerator-freezer models sold in Japan by the end of 2024. The company is expected to start shipping the new models in batches between mid-December and itself is supposed to sell these through its 15 sales companies nationwide.

- In April 2024, Hoshizaki increased the number of commercial natural refrigerant-based freezers and refrigerators in the inventory. They decided to take this step after observing the growing demand for sustainable kitchen appliances. The additions included 20 models (12 upright models, 6 table-type refrigerator-freezers, and 2 table-type freezer models).

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Refrigerator Market based on the below-mentioned segments:

Japan Refrigerator Market, By Product Type

- Single Door

- Top Freezer

- French Door

- Bottom Freezer

- Side-By-Side

- Others

Japan Refrigerator Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Exclusive Stores

- Multi-branded Stores

- Online

- Others

Japan Refrigerator Market, By End Users

- Residential

- Commercial

Need help to buy this report?