Japan Real-Time Payment Market Size, Share, and COVID-19 Impact Analysis, By Type (P2P, P2B, B2P), By End User (BFSI, IT & Telecommunications, Retail & E-commerce, Government, Energy & Utilities, Others), and Japan Real-Time Payment Market Insights Forecasts to 2032

Industry: Electronics, ICT & MediaJapan Real-Time Payment Market Insights Forecasts to 2032

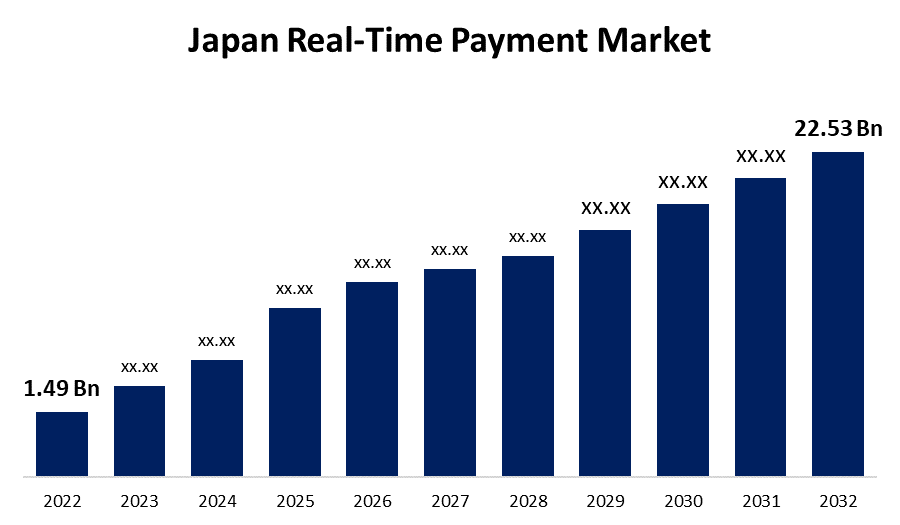

- The Japan Real-Time Payment Market Size was valued at USD 1.49 Billion in 2022.

- The Market is Growing at a CAGR of 31.21% from 2022 to 2032.

- The Japan Real-Time Payment Market Size is expected to reach USD 22.53 Billion by 2032.

Get more details on this report -

The Japan Real-Time Payment Market Size is expected to reach USD 22.53 Billion by 2032, at a CAGR of 31.21% during the forecast period 2022 to 2032.

Market Overview

The term "real-time payment" describes a financial transaction processing system that permits quick and easy money transfers between people, companies, or organizations. In contrast to conventional payment methods, which entail delays because of batch processing or clearing times, real-time payments happen in a matter of seconds and offer a quick and effective way to send money. This technology makes use of sophisticated networks and payment infrastructures to enable instantaneous settlement, frequently around the clock, including on weekends and holidays. Japan is rapidly adopting real-time payments due to the expanding use of smart devices and the growth of online retail commerce. Furthermore, the surge in real-time payments reflects the rising demand for real-time transactions among consumers, which has been sparked by the widespread use of smartphones and other connected devices, which have raised expectations for immediateness. Moreover, as they become a larger portion of the consumer economy, Japan's younger population is calling for a shift to digital to keep up with their technologically savvy lifestyles. Additionally, Japan's adoption of digital payments will likely increase due to significant political efforts to promote digital payment acceptance through consumer rewards and cash discounts.

Report Coverage

This research report categorizes the market for Japan's real-time payment market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japanese real-time payment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan real-time payment market.

Japan Real-Time Payment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 1.49 Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 31.21% |

| 2032 Value Projection: | USD 22.53 Billion |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By End User, and COVID-19 Impact Analysis. |

| Companies covered:: | ACI Worldwide, Mastercard Inc., Finastra, FIS Global, PayPal Holding Inc, Digital Wallet Corporation, Visa Inc., Apple Inc., SIA SpA, Mastercard Inc. and Other Key Vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid spread of smartphones and the uptake of cloud-based payment solutions are responsible for the Japanese market's expansion. Furthermore, the market is anticipated to grow more quickly due to rising customer demand for faster payment settlements and rising government and financial institution investments to encourage the use of real-time payment solutions. The demand for real-time payment solutions is also anticipated to increase as a result of the integration of cutting-edge technologies like artificial intelligence (AI) and the Internet of Things (IoT) into digital payment platforms. Furthermore, In Japan, real-time payments have been acknowledged by governments and regulatory bodies as beneficial for mitigating fraud, improving transparency, and promoting financial inclusion. They have thus aggressively encouraged and mandated the adoption of real-time payment frameworks. In addition, it is anticipated that the real-time payment market in Japan will be driven by the widespread use of mobile devices and the rising acceptance of mobile banking apps.

Restraining Factors

The possibility of breaches of security is a major obstacle to the real-time payments market's expansion. Because these transactions happen quickly, hackers may try to gain unauthorized access to them, which could result in financial fraud, data theft, and service interruptions. If exploited, security flaws could damage user confidence, impede adoption, and cost consumers and companies money. To reduce the risks and promote a secure environment for real-time payments, strong encryption, authentication procedures, and ongoing threat monitoring are required.

Market Segment

- In 2022, the P2B segment accounted for the largest revenue share over the projection period.

Based on the type, the Japan real-time payment market is segmented into P2P, P2B and B2P. Among these, the P2B segment has the largest revenue share over the projection period. P2B payments are terms used to describe financial exchanges between companies and their clients. Integrating a secure payment gateway into a company's online store is one of the easiest and safest ways for them to take payments in real-time.

- In 2022, the retail & e-commerce segment is expected to hold the largest share of the Japan real-time payment market during the anticipation period.

Based on the end user, the Japan real-time payment market is classified into BFSI, IT & telecommunications, retail & e-commerce, government, energy & utilities, and others. Among these, the retail & e-commerce segment is expected to hold the largest share of the Japanese real-time payment market during the anticipation period. The adoption of real-time payment solutions in this market has accelerated due to retailers' and merchants' growing demand for instantaneous payment settlement. These solutions give retailers a competitive edge by giving them a quick and economical way to make payments. Another significant factor fueling this segment's growth is the increasing Japanese preference for mobile-based shopping.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan real-time payment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ACI Worldwide

- Mastercard Inc.

- Finastra

- FIS Global

- PayPal Holding Inc

- Digital Wallet Corporation

- Visa Inc.

- Apple Inc.

- SIA SpA

- Mastercard Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In January 2022, to increase payment options, MoneyGram, a company that specializes in digital peer-to-peer (P2P) payments, partnered with Digital Wallet Corporation. Consequently, Japanese users will have access to the Digital Wallet Corporation-owned Smiles smartphone app, which enables money transfers to more than 200 nations and territories.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan real-time payment market based on the below-mentioned segments:

Japan Real-Time Payment Market, By Type

- P2P

- P2B

- B2P

Japan Real-Time Payment Market, By End User

- BFSI

- IT & Telecommunications

- Retail & E-commerce

- Government

- Energy & Utilities

- Others

Need help to buy this report?