Japan Real Estate Valuation Service Market Size, Share, and COVID-19 Impact Analysis, By Service Type (Residential Valuation, Commercial Valuation, Industrial Valuation, Agricultural Valuation, and Others), By Application (Property Sales, Mortgage and Lending, Investment Analysis, Taxation, and Others), and Japan Real Estate Valuation Service Market Insights, Industry Trend, Forecasts to 2033.

Industry: Banking & FinancialJapan Real Estate Valuation Service Market Insights Forecasts to 2033

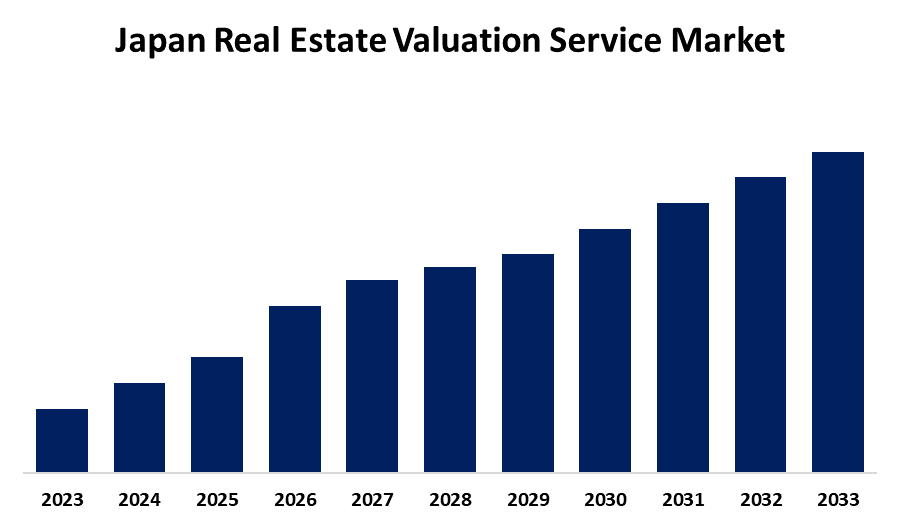

- The Japan Real Estate Valuation Service Market Size is Growing at a CAGR of 6.83% from 2023 to 2033

- The Japan Real Estate Valuation Service Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Japan Real Estate Valuation Service Market Size is Anticipated to hold a significant share By 2033, growing at a CAGR of 6.83% from 2023 to 2033.

Market Overview

The Japan real estate valuation service market refers to the industry focused on property appraisal and valuation services in Japan, ensuring accurate assessments for mortgages, investments, taxation, and regulatory compliance. Additionally, technological developments have played a major role in the expansion of the Japanese real estate valuation services business. The accuracy, effectiveness, and speed of property assessments have increased in Japan as a result of the use of artificial intelligence (AI), machine learning (ML), and big data analytics in valuation procedures. These technologies allow Japanese valuers to provide accurate and quick values by analyzing large volumes of data, such as market movements, property attributes, and economic indicators. The growing regulatory requirements that demand annual property evaluations for taxation and compliance purposes in Japan are another important development factor.

Report Coverage

This research report categorizes the market for Japan real estate valuation service based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan real estate valuation service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan real estate valuation service market.

Japan Real Estate Valuation Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 6.83% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Service Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Sumitomo Realty & Development Co. Ltd, Hulic Co. Ltd, Nomura Real Estate Holdings, Inc., Tokyo Tatemono Co. Ltd, Daibiru Corp, Leopalace21 Corp, Raysum Co. Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The primary causes of this astounding growth are the regulatory constraints, the expanding complexity of transactions in the Japanese real estate market, and the rising need for accurate property evaluations. One of the primary factors propelling the market for real estate valuation services in Japan is the increasing demand for precise property appraisals due to the dynamic nature of the real estate sector. Because of the increase in both residential and commercial real estate transactions, accurate valuation services are now crucial in Japan. Accurate property appraisals provide essential information to interested parties in Japan regarding the value of real estate, which is essential for securing mortgages, making prudent investment decisions, and ensuring fair taxation in Japan.

Restraining Factors

There are risks and difficulties facing the real estate valuation services industry as well. The complexity of regional regulations and compliance requirements is one major barrier. To guarantee accuracy and openness, governments and regulatory agencies enforce strict criteria and norms for property appraisals.

Market Segmentation

The Japan real estate valuation service market share is classified into service type and application.

- The residential valuation segment is expected to hold a significant market share through the forecast period.

The Japan real estate valuation service market is segmented by service type into residential valuation, commercial valuation, industrial valuation, agricultural valuation, and others. Among these, the residential valuation segment is expected to hold a significant market share through the forecast period. This is due to the large number of residential real estate transactions, and residential valuation services are the industry leader. The necessity for precise property values for mortgage and lending purposes, along with the rising demand for homes, drives the expansion of this market.

- The property sales segment is expected to hold a significant market share through the forecast period.

The Japan real estate valuation service market is segmented by application into property sales, mortgage and lending, investment analysis, taxation, and others. Among these, the property sales segment is expected to hold a significant market share through the forecast period. A substantial application segment is represented by property sales since precise valuations are necessary to ascertain the fair market value of properties during transactions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan real estate valuation service market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sumitomo Realty & Development Co. Ltd

- Hulic Co. Ltd

- Nomura Real Estate Holdings, Inc.

- Tokyo Tatemono Co. Ltd

- Daibiru Corp

- Leopalace21 Corp

- Raysum Co. Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Real Estate Valuation Service Market based on the below-mentioned segments:

Japan Real Estate Valuation Service Market, By Service Type

- Residential Valuation

- Commercial Valuation

- Industrial Valuation

- Agricultural Valuation

- Others

Japan Real Estate Valuation Service Market, By Application

- Property Sales

- Mortgage and Lending

- Investment Analysis

- Taxation

- Others

Need help to buy this report?