Japan Ready Mix Concrete Market Size, Share, and COVID-19 Impact Analysis, By Type (Transit Mix, Central Mix, and Shrink Mix), By Application (Residential, Commercial, and Infrastructure), and Japan Ready Mix Concrete Market Insights, Industry Trend, Forecasts to 2035

Industry: Construction & ManufacturingJapan Ready Mix Concrete Market Insights Forecasts to 2035

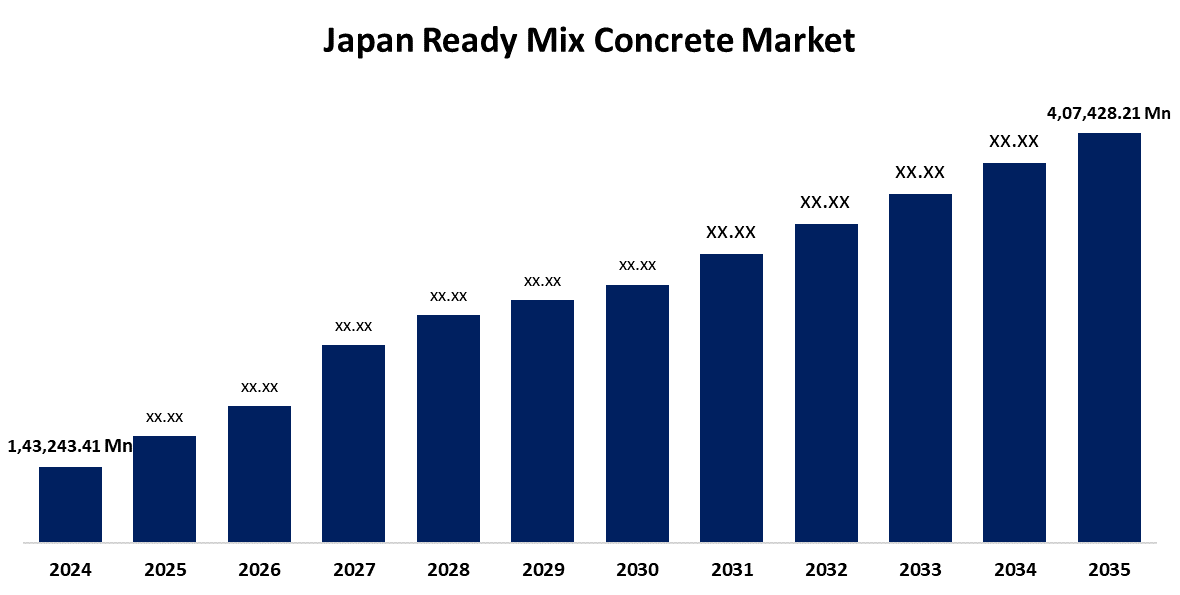

- The Japan Ready Mix Concrete Market Size Was Estimated at USD 1,43,243.41 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.97% from 2025 to 2035

- The Japan Ready Mix Concrete Market Size is Expected to Reach USD 4,07,428.21 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Ready Mix Concrete Market Size is Anticipated to Reach USD 4,07,428.21 Million by 2035, Growing at a CAGR of 9.97% from 2025 to 2035. The Japanese ready-mix concrete market follows a growth trajectory because of urban development needs, infrastructure expansion, and sustainable construction priorities. Urban redevelopment projects combined with smart city initiatives, infrastructure investments, roads and bridges, and rail networks lead to market growth. The market expands through the growing acceptance of precast concrete and high-strength concrete systems and the development of green concrete technologies.

Market Overview

The ready-mix concrete (RMC) market encompasses all operations related to the production, distribution, and on-site use of premixed concrete that consists of cement, sand, aggregates, water, and sometimes additional components. The production of RMC occurs in centralized batching plants. The RMC market maintains its substantial presence in construction because of ongoing infrastructure development alongside urban population expansion and the rising demand for fast building methods. The ready-mix concrete (RMC) market will experience growth as fast-track building projects become essential for residential, commercial, industrial, and infrastructure development. Ready-mix building attracts expanding customer bases through its cost advantages, which include reduced labor expenses and simplified pouring processes. The Japanese ready-mix concrete sector shows a growing commitment to adopting sustainable operating methods. The concrete production sector uses more eco-friendly materials by adding supplementary cementitious materials such as fly ash and slag to minimize carbon emissions. The Japanese ready-mix concrete market will achieve rapid growth through sustainable building practices because these methods remain its primary focus.

Japanese ready-mix concrete market leaders will benefit from technological advancements and urban development, together with their sustainability strategies. The term "green concrete" describes the expanding market for environmentally friendly concrete production methods and sustainable cement manufacturing, which includes carbon capture throughout the future period. During concrete production, the use of recycled aggregates minimizes waste production while advancing environmental sustainability efforts. The Japanese government creates market demand for earthquake-resistant and sustainable concrete in the ready-mix sector by focusing on sustainability and earthquake resilience. The government actively promotes the development of low-carbon concrete technologies which minimize CO2 emissions both in production and during consumption.

Report Coverage

This research report categorizes the market for the Japan ready mix concrete market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan ready mix concrete market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan ready mix concrete market.

Japan Ready Mix Concrete Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,43,243.41 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 9.97% |

| 2035 Value Projection: | 4,07,428.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Asahi Yuka Corporation, Tokuyama Corporation, Sumitomo Osaka Cement, Yokogawa Concrete, Nippon Concrete Industries, Taisei Corporation, Mitsubishi Materials Corporation, Obayashi Corporation, Shimizu Corporation, Kajima Corporation, Tamagawa Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Increasing urbanization and infrastructure development are the primary driving factors for market growth. The ongoing expansion of urban areas creates a rising demand for ready-mix concrete because it serves as an essential material for construction operations. The Japan Ready-Mixed Concrete Association establishes standards and protocols that boost urban development project quality through the utilization of ready-mix concrete, thus enhancing structural strength and protective measures. The Japan ready-mix concrete market will experience substantial expansion based on growing project demands as long as the government continues to allocate resources to these projects. The shift toward sustainable construction alongside Japan's environmental protection goals supports this industry transition. Concrete production that emits low levels of pollution is generating rising popularity because it meets market demands for sustainable building materials and satisfies government standards. Additionally, the 'Green Building Program' implements policies that encourage the use of environmentally-friendly products, including advanced ready-mix concrete blends, which minimize their environmental impact. Furthermore, the Japan ready-mix concrete market experiences growth because technological advancements boost both production efficiency and concrete quality. Digital controls and automated batching systems, and improved mixing techniques have substantially improved concrete production processes. The industry has adopted smart concrete solutions that enable self-healing and environmental adaptation to drive its expansion. Japan's Ready Mix Concrete Market expands due to technological focus which streamlines operations and enhances concrete quality and building durability.

Restraining Factors

The market for ready-mix concrete faces an entry barrier because new companies need substantial initial capital to launch. Ready-mix concrete remains unaffordable for low-income consumers because of its high market price. The ready-mix concrete industry faces significant developmental challenges because most people do not understand these emerging technologies, which show limited sales and installation rates. The production of cement, which plays a crucial role in ready-mix concrete, leads to high levels of CO2 emissions, which cause stricter environmental laws to be implemented. Additionally, Japan's location on the Pacific Ring of Fire makes it vulnerable to earthquakes, requiring high-strength concrete formulations, which results in a major challenge for market growth in the forecasted period.

Market Segmentation

The Japan ready mix concrete market share is classified into type and application.

- The transit mix segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan ready mix concrete market is segmented by type into transit mix, central mix, and shrink mix. Among these, the transit mix segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The transit mix's popularity stems from its ability to provide convenient delivery while ensuring better concrete quality control and adaptable service. The development of infrastructure alongside the building industry's expansion created a strong market for transit-mixed concrete because it minimized segregation risks and accelerated delivery speed. The urban environment needs continuous concrete delivery for efficient and dependable construction projects that are typically large in scale.

- The residential segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan ready-mix concrete market is segmented by application into residential, commercial, and infrastructure. Among these, the residential segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising demand for single-family homes in Japan will most likely lead to an increase in the segment. Population growth combined with rising disposable income in Japan is expected to boost demand for residential buildings over the forecasted period. The ready-mix concrete business will experience positive effects because of this trend. The growth of this sector results from increased residential use of ready-mix concrete in wall, column, and floor applications. The expansion of this market results from government initiatives that support the construction of affordable homes in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan ready-mix concrete market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Asahi Yuka Corporation

- Tokuyama Corporation

- Sumitomo Osaka Cement

- Yokogawa Concrete

- Nippon Concrete Industries

- Taisei Corporation

- Mitsubishi Materials Corporation

- Obayashi Corporation

- Shimizu Corporation

- Kajima Corporation

- Tamagawa Corporation

- Others

Recent Developments:

- In January 2025, ITOCHU Corporation recently announced an agreement with Mitsubishi UBE Cement Corporation and MCi Carbon Pty Ltd, establishing a partnership that will develop carbon-embedded products. Through their mineral carbonation process, MCi transforms CO2 into raw materials suitable for concrete and cement substitutes from steel slag, concrete remnants, and serpentinite minerals.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Ready Mix Concrete Market based on the below-mentioned segments:

Japan Ready Mix Concrete Market, By Type

- Transit Mix

- Central Mix

- Shrink Mix

Japan Ready Mix Concrete Market, By Application

- Residential

- Commercial

- Infrastructure

Need help to buy this report?