Japan Radiotherapy Market Size, Share, and COVID-19 Impact Analysis, By Technology (External Beam Radiotherapy, Internal Beam Radiotherapy/Brachytherapy, Systemic Radiotherapy, Others), By Procedure (External Beam Radiotherapy, Internal Beam Radiotherapy/Brachytherapy, Systemic Radiotherapy, Intravenous Radiotherapy, Oral Radiotherapy, Instillation Radiotherapy, Others), By Application (External Beam Radiotherapy, Internal Beam Radiotherapy), By End-Users (Hospitals, Oncology Clinics, and Ambulatory Radiotherapy Centers), and Japan Radiotherapy Market Insights Forecasts to 2032

Industry: HealthcareJapan Radiotherapy Market Insights Forecasts to 2032

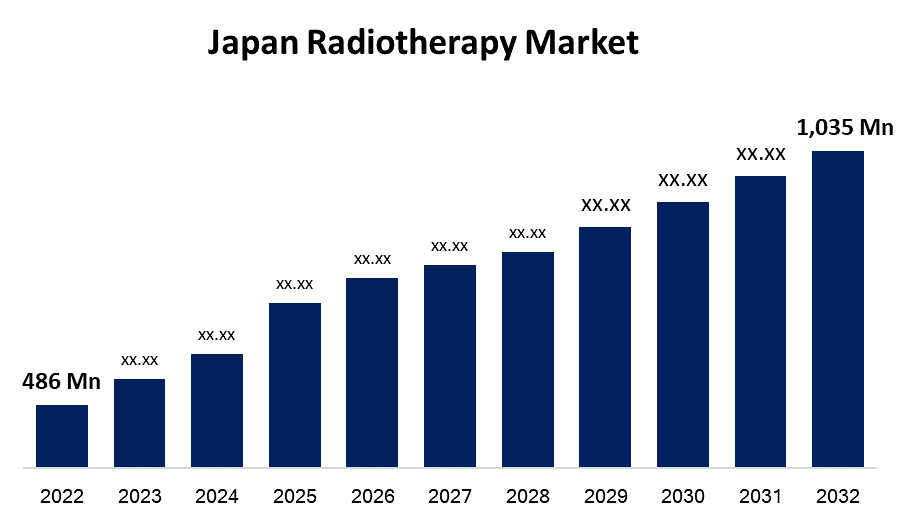

- The Japan Radiotherapy Market Size was valued at USD 486 Million in 2022.

- The Market Size is Growing at a CAGR of 7.8% from 2022 to 2032.

- The Japan Radiotherapy Market Size is expected to reach USD 1,035 Million by 2032.

- Japan is expected To Grow the fastest during the forecast period.

Get more details on this report -

The Japan Radiotherapy Market Size is expected to reach USD 1,035 Million by 2032, at a CAGR of 7.8% during the forecast period 2022 to 2032.

Market Overview

Cancer fatalities have been Japan's leading cause of mortality since 1981, and the number is steadily increasing. Cancers of the gastrointestinal tract account for a substantial proportion of total cancer fatalities, especially in Japan. In Japan, fatality rates have decreased dramatically as a result of technological advancements in radiation machines and improvements in therapeutic treatments. Although deaths from gastric cancer and uterine cervical cancer have decreased, deaths from lung, breast, bowel, prostate, and other cancers have increased dramatically in recent decades. Cancer incidence is also increasing in both number and rate. This is primarily due to a jump in the prevalence of cancer in old individuals in Japan.

Japan is an East Asian developed island nation with a high standard of living. Cancer care consumes 7.3% of all healthcare expenditures. In Japan, this is more common than in countries other than Japan. Furthermore, medical technology constantly evolves and improves, and radiation therapy technologies are no different. Japanese radiation oncology physicians have made significant contributions to the advancement of this specialty. Furthermore, Hitachi is a major Japanese multinational corporation that offers a wide range of medical equipment and services, including radiotherapy equipment.

Report Coverage

This research report categorizes the market for Japan Radiotherapy Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Radiotherapy Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Radiotherapy Market.

Japan Radiotherapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 486 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.8% |

| 2032 Value Projection: | USD 1,035 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Technology, By Procedure, By Application, By End-Users, (Demand, Price, Growth, Competitors, Challenges) |

| Companies covered:: | Hamamatsu Photonics K.K., Shimadzu Corporation, Mitsubishi Electric Corporation, Hitachi Ltd., Toshiba Corporation, IHI Corporation, Sumitomo Heavy Industries Ltd., Elekta K.K., Osaka Heavy Ion Therapy Center. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan ranks as the globally third largest customer base for radiation oncology, and the National Cancer Center Hospital has been one of Japan's major national cancer treatment centers for almost 60 years. Radiotherapy is rapidly evolving in Japan as a result of continual technological advancements and significant capital expenditure. Prostate and lung cancer treatments are likely to dominate the Japanese cancer drug industry over the forecast period, due to the country's huge elderly demographic. Furthermore, various efforts, such as conferences and symposia, have been established in recent years as a result of the benefits of radiation operations. Several radiotherapy-related events are being planned to raise awareness and provide training for radiotherapy treatments among oncologists and radiography professionals. These types of activities are critical in creating awareness about available radiotherapy methods and the advantages they provide, which is predicted to increase demand for and acceptance of radiotherapy devices and treatment in Japan. In addition, raised public-private collaboration and funding for clinical trials to advance cancer diagnosis and treatment are one of the primary reasons driving the explosive development of the Japan radiotherapy market. For example, the National Institutes for Quantum and Radiological Science and Technology (QST), and the National Institute of Radiological Sciences (NIRS), Japan, pioneered heavy ion radiotherapy utilizing carbon ions. From 1994 through the end of 2019, Japan's heavy ion radiation facilities successfully treated over 29,000 patients.

Market Segment

- In 2022, the external beam radiotherapy segment is witnessing a higher growth rate over the forecast period.

Based on the technology type, the Japan Radiotherapy Market is segmented into external beam radiotherapy, internal beam radiotherapy/brachytherapy, systemic radiotherapy, and others. Among these, the external beam radiotherapy segment is witnessing a higher growth rate over the forecast period. External beam radiation products are further classified as linear accelerators, particle therapy systems, and traditional cobalt-60 teletherapy devices. The linear accelerators segment is further subdivided into conventional linear accelerators systems and stereotactic advanced electron/cobalt-60 LINAC systems. The market for stereotactic advanced electron/cobalt-60 linear accelerators is further subdivided into CyberKnife, Gamma Knife, and TomoTherapy. The CyberKnife sub-segment held the greatest market share in 2022, owing to ongoing innovations in the CyberKnife system.

- In 2022, the external beam radiotherapy segment accounted for the largest revenue share of more than 37.8% over the forecast period.

On the basis of procedure type, the Japan Radiotherapy Market is segmented into external beam radiotherapy, internal beam radiotherapy/brachytherapy, systemic radiotherapy, intravenous radiotherapy, oral radiotherapy, instillation radiotherapy, and others. Among these, the external beam radiotherapy segment is dominating the market with the largest revenue share of 37.8% over the forecast period. External beam radiotherapy is divided into five categories: IGRT, IMRT, stereotactic therapy, particle beam therapy, and 3D-CRT. During the projected year, the particle treatment category is expected to have the greatest growth rate in the external beam radiotherapy market by procedures in Japan. This segment's explosive expansion can be credited with events such as a growth in the number of proton therapy centers in Japan, heightened study expenditures in the field of radiation oncology using proton therapy systems, fewer adverse effects associated with proton beam therapy, and longer lifespans of the equipment of proton beam therapy systems when as opposed to photon therapy systems.

- In 2022, the internal beam radiotherapy segment is witnessing significant CAGR growth over the forecast period.

On the basis of application, the Japan Radiotherapy Market is segmented into external beam radiotherapy and internal beam radiotherapy. Among these, the internal beam radiotherapy segment is witnessing significant CAGR growth over the forecasted period. Prostate cancer, gynecological cancer, breast cancer, cervical cancer, penile cancer, and other cancers are the market segments. Within the internal beam radiation applications market, the prostate cancer sector held the biggest market share. Prostate brachytherapy is a modern prostate cancer treatment. LDR and HDR brachytherapy are both employed to treat prostate cancer. Furthermore, in Japan, brachytherapy has become increasingly popular to treat high-risk prostate cancer. Furthermore, because the implanted radioactive seeds move with the gland, brachytherapy eliminates the need to monitor the mobility of the prostate gland.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Radiotherapy Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hamamatsu Photonics K.K.

- Shimadzu Corporation

- Mitsubishi Electric Corporation

- Hitachi Ltd.

- Toshiba Corporation

- IHI Corporation

- Sumitomo Heavy Industries Ltd.

- Elekta K.K.

- Osaka Heavy Ion Therapy Center

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On May 2023, Hitachi, a Japanese multinational business, has delivered a heavy ion therapy system to Taipei Veterans General Hospital, and the equipment has begun treatment. This is the first time a heavy ion therapy system has been used in Taiwan, and it is Hitachi's first heavy ion therapy system outside of Japan. This system has been implemented in Taipei Veterans General Hospital's new Heavy Ion Therapy Center, which consists of two treatment rooms, each with vertical and horizontal ports.

- In September 2022, The International Atomic Energy Agency (IAEA) and Okayama University in Japan have decided to collaborate on Boron Neutron Capture Therapy (BNCT), a non-invasive treatment approach for treating invasive malignant tumors. The International Atomic Energy Agency (IAEA) and Okayama University have a long history of collaboration on BNCT, a neutron-based radiation approach for cancer. This highly targeted approach involves the use of a boron-containing medication that is preferentially taken up by tumor cells, followed by neutron irradiation of the tumor area.

- In August 2022, The National Cancer Center Hospital (NCCH) of Japan upgraded its original Cobalt MRIdian® MRI-Guided Radiation Therapy System to the MRIdian Linac System and treated its first patients, according to ViewRay, Inc. With the MRIdian system, National Cancer Center Hospital will be able to provide modern MRI-guided radiation therapy technology to cancer patients seeking individualized treatment for pancreas, prostate, lung, liver, breast, and oligometastatic malignancies.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Radiotherapy Market based on the below-mentioned segments:

Japan Radiotherapy Market, By Technology Type

- External Beam Radiotherapy

- Linear Accelerators

- Conventional Cobalt-60 Teletherapy Units

- Particle Therapy Systems

- Internal Beam Radiotherapy/Brachytherapy

- Seeds

- Afterloaders

- Applicators

- IORT Systems

- Systemic Radiotherapy

- Iobenguane (I-131)

- Samarium-153

- Rhenium-186

- Yttrium-90

- Radium-223

- Phosphorous-32

- Radio-labelled Antibodies

- Others

- Others

Japan Radiotherapy Market, By Procedure Type

- External Beam Radiotherapy

- Image-guided Radiotherapy

- Intensity-modulated Radiotherapy

- Stereotactic Therapy

- Particle Therapy

- 3D Conformal Radiotherapy

- Internal Beam Radiotherapy/Brachytherapy

- High-dose-rate Brachytherapy

- Low-dose-rate Brachytherapy

- Pulsed-dose-rate Brachytherapy

- Systemic Radiotherapy

- Intravenous Radiotherapy

- Oral Radiotherapy

- Instillation Radiotherapy

- Others

Japan Radiotherapy Market, By Application

- External Beam Radiotherapy

- Prostate Cancer

- Breast Cancer

- Lung Cancer

- Head and Neck Cancer

- Colorectal Cancer

- Other Cancers

- Internal Beam Radiotherapy

- Prostate Cancer

- Gynecological Cancer

- Breast Cancer

- Cervical Cancer

- Penile Cancer

- Other Cancers

Japan Radiotherapy Market, By End-Users

- Hospitals

- Oncology Clinics

- Ambulatory Radiotherapy Centers

Need help to buy this report?