Japan Protein A Resins Market Size, Share, and COVID-19 Impact Analysis, By Product (Natural Protein A Resin and Recombinant Protein A Resin), By Matrix (Agarose-based Matrix, Glass or Silica-based Matrix, and Organic Polymer-based Matrix), By End User (Biopharmaceutical Manufacturers, Clinical Research Laboratories, and Academic Institutes), and Japan Protein A Resins Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Protein A Resins Market Size Insights Forecasts to 2035

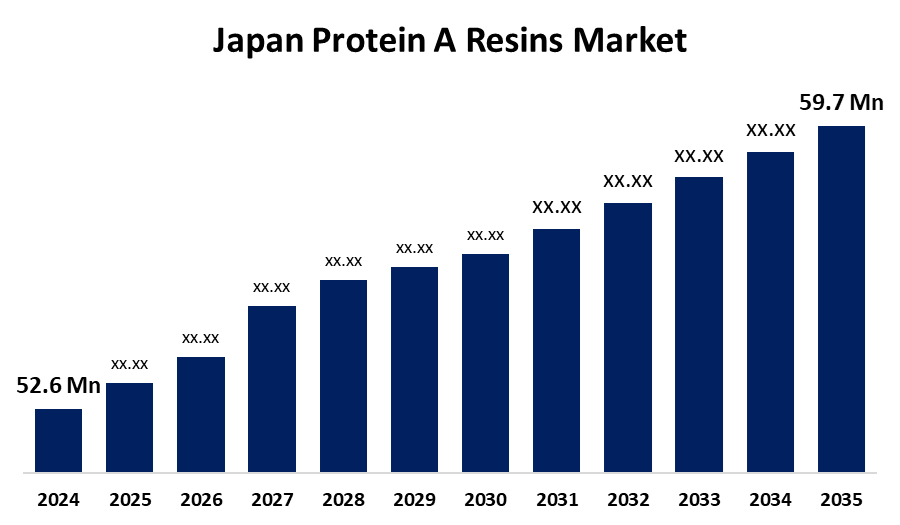

- The Japan Protein A Resins Market Size Was Estimated at USD 52.6 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.16% from 2025 to 2035

- The Japan Protein A Resins Market Size is Expected to Reach USD 59.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Protein A Resins Market Size is anticipated to reach USD 59.7 million by 2035, growing at a CAGR of 1.16% from 2025 to 2035. The Japan protein A resins market is expanding as a result of increasing demand for biopharmaceuticals, namely monoclonal antibodies (mAbs) and biosimilars.

Market Overview

The Japan protein A resins market refers to a proprietary chromatography media used for the separation of monoclonal antibodies (mAbs) and other therapeutic proteins. They are at the hub of the biopharmaceutical industry, with uses in the efficient isolation of target proteins during downstream processing. Japan has a strong biopharmaceutical sector, with major companies such as Daiichi Sankyo, Takeda Pharmaceutical, and Astellas Pharma leading the market. Innovation in resin technology is driven by research and development activity in the nation. The trend towards recombinant protein A resins presents cost opportunities for effective and scalable production. Advances in bioprocessing technologies and new developments in next-generation protein A resins, including recombinant type versions, which boast higher binding capacities and stability, are boosting market growth. The Japan government invests and funds infrastructure to aid the biopharmaceutical industry, increasing the creation of protein purification technologies.

Report Coverage

This research report categorizes the market for the Japan protein A resins market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan protein A resins market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan protein A resins market.

Japan Protein A Resins Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 52.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.16% |

| 2035 Value Projection: | USD 59.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 196 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By Matrix, By End User and COVID-19 Impact Analysis |

| Companies covered:: | JSR Corporation (JSR Life Sciences), Suzhou Nanomicro Technology, Kaneka Corporation, ccc, Takara Bio, Danaher (Cytiva), Thermo Fisher Scientific, Shimadzu Corporation, Fujifilm Diosynth Biotechnologies, Olympus Corporation, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan protein A resins market is driven by increasing demand for monoclonal antibodies (mAbs) used to cure chronic ailments like cancer and autoimmune disease. Technological advancements in bioprocessing technologies and innovative development of recombinant protein A resins with greater binding capacity and stability further increase growth. Moreover, Japan robust biopharmaceutical infrastructure, increasing focus on personalized medicine, and the expanding biosimilars market further drive growth. Government policies supporting R&D and biopharmaceutical innovation also propel market growth.

Restraining Factors

The Japan protein A resins market is constrained by high costs, limited resin reusability due to fouling, and competition from other purification methods. The complexity in production and supply chains also limits widespread adoption and market expansion.

Market Segmentation

The Japan protein A resins market share is classified into product, matrix, and end user.

- The recombinant protein A resin segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan protein A resins market is segmented by product into natural protein A resin and recombinant protein A resin. Among these, the recombinant protein A resin segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their exceptional stability, reproducibility, and resilience to harsh purification conditions, including high salt concentrations and denaturants, making them ideal for research processes as well as industrial-scale biopharmaceutical production. Recombinant protein A resins are genetically engineered to bind irreversibly to the Fc region of immunoglobulin G (IgG), enabling highly selective capture of antibodies.

- The agarose-based matrix segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan protein A resins market is segmented by matrix into agarose-based matrix, glass or silica-based matrix, and organic polymer-based matrix. Among these, the agarose-based matrix segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its strong mechanical strength, biocompatibility, and low nonspecific binding characteristics. It has a porous nature that accommodates high protein binding capacity, and hence it is suitable for analytical and preparative scales of antibody purification. Agarose-based resins find maximum usage in biopharmaceutical manufacturing for the purification of monoclonal antibodies, biosimilars, and recombinant proteins.

- The biopharmaceutical manufacturers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan protein A resins market is segmented by end user into biopharmaceutical manufacturers, clinical research laboratories, and academic institutes. Among these, the biopharmaceutical manufacturers segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to growth in the demand for therapeutic monoclonal antibodies (mAbs), biosimilars, and next generation biologics for cancer, autoimmunity, and chronic infection. Biopharma companies require high purity, large scale production purification systems, and protein A resins remain the industry standard for primary capture in downstream processing.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan protein A resins market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- JSR Corporation (JSR Life Sciences)

- Suzhou Nanomicro Technology

- Kaneka Corporation

- Tosoh Bioscience

- JNC Corporation

- Takara Bio

- Danaher (Cytiva)

- Thermo Fisher Scientific

- Shimadzu Corporation

- Fujifilm Diosynth Biotechnologies

- Olympus Corporation

- Others

Recent Developments:

- In September 2024, JSR Life Sciences released the launch of Amsphere™ A+, a high-performance protein A chromatography resin. It incorporates a proprietary ligand and cutting-edge polymer technology, providing improved binding capacity, alkali stability, and pressure-flow characteristics over its predecessor, Amsphere™ A3. The resin will be exhibited at BPI 2024 in Boston and Bio Japan 2024 in Yokohama.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan protein A resins market based on the below-mentioned segments:

Japan Protein A Resins Market, By Product

- Natural Protein A Resin

- Recombinant Protein A Resin

Japan Protein A Resins Market, By Matrix

- Agarose-based Matrix

- Glass or Silica-based Matrix

- Organic Polymer-based Matrix

Japan Protein A Resins Market, By End User

- Biopharmaceutical Manufacturers

- Clinical Research Laboratories

- Academic Institutes

Need help to buy this report?