Japan Probiotics Dietary Supplements Market Size, Share, and COVID-19 Impact Analysis, By Form (Chewable and Gummies, Capsules, Powders, Tablets and Soft gels, and Others), By End-Use (Adults, Children, Geriatric, and Infants), By Application (Anti-cancer, Bone & Joint Health, Brain/Mental Health, Cardiac Health, Diabetes, Energy & Weight Management, Food Supplements, Gastrointestinal Health, Nutritional Supplements, Sports Fitness, Others), and Japan Probiotics Dietary Supplements Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan Probiotics Dietary Supplements Market Insights Forecasts to 2035

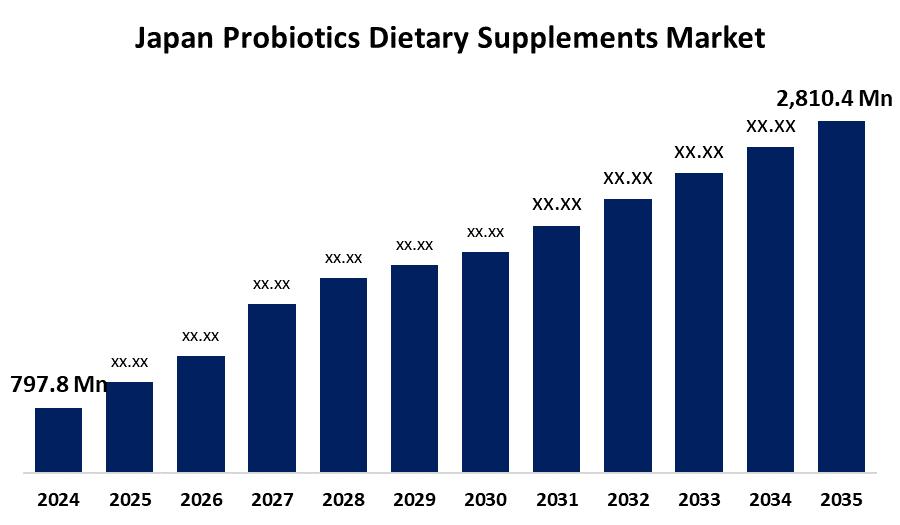

- The Japan Probiotics Dietary Supplements Market Size Was Estimated at USD 797.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.13% from 2025 to 2035

- The Japan Probiotics Dietary Supplements Market Size is Expected to Reach USD 2,810.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan probiotics dietary supplements market Size is anticipated to reach USD 2,810.4 Million by 2035, growing at a CAGR of 12.13% from 2025 to 2035. The market for probiotics and dietary supplements in Japan is seeing intense growth, propelled by increasing health awareness, an aging population, and a cultural trend towards functional foods. The growth is additionally being driven by improved awareness of the advantages of gastrointestinal health, the ease of online shopping, and the emergence of innovative items such as postbiotics.

Market Overview

Japan probiotics dietary supplements market refers to the products that have good bacteria that aid digestive and immune health. Used most often to balance gut flora, the supplements enhance digestion, immunity, and are gaining preference for healthy aging and well-being. Japan's history of eating fermented foods such as miso, natto, and pickles has created a sense of comfort and familiarity with probiotics, thus basing the market heavily on traditional culture. To add to this, advancements in probiotic production and formulation technology have maximized product performance and quality. There is strong potential in building online shopping channels, utilizing personalized nutrition strategies, and bringing plant-based probiotic products to address changing consumer tastes. Prime drivers of this growth are Japan's aging population, which has increased demand for healthy aging and digestive health products. Also contributing is growing consumer education regarding gut health and the health benefits of probiotics. The probiotics sector is supported by the Japanese government through food safety policy that encourages food quality standards and innovation, providing favorable ground for market development.

Report Coverage

This research report categorizes the market for the Japan probiotics dietary supplements market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan probiotics dietary supplements market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan probiotics dietary supplements market.

Japan Probiotics Dietary Supplements Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 797.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 12.13% |

| 2035 Value Projection: | USD 2,810.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 278 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Form, By End-Use and By Application |

| Companies covered:: | Meiji Holdings Co., Ltd., Eisai Co., Ltd., Yakult Honsha Co., Ltd., Suntory Holdings Limited, FANCL Corporation, Morinaga Milk Industry Co., Ltd., Danone S.A., Arla Foods, Inc., Kirin Holdings Company, Limited, Nestle S.A., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan probiotics food supplements market is fueled by increasing awareness of health, particularly digestive health and immune function. Increasingly, an aging population is looking for natural ways to age healthily and is driving demand for probiotic products. Japan's historical cultural acceptance of fermented foods such as miso and natto allows consumers to place their confidence in the use of probiotics. Moreover, the increased interest in functional food, advancements in the technology behind probiotic formulations, and increased online and retail distribution channels further drive the market's constant growth and innovation.

Restraining Factors

The Japan probiotics dietary supplement market is hindered by strict regulatory needs, high manufacturing costs, consumer doubts regarding efficacy and safety, and fierce competition from conventional fermented foods, which hamper the adoption of supplements on a large scale.

Market Segmentation

The Japan probiotics dietary supplements market share is classified into form, end-use, and application.

- The tablets and soft gels segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan probiotics dietary supplements market is segmented by form into chewable and gummies, capsules, powders, tablets and soft gels, and others. Among these, the tablets and soft gels segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Solid dosage forms like tablets are more acceptable due to their portability and long shelf stability, hence, easy to consume on the move. Soft gels, encapsulating the probiotics in a gelatin shell, present an excellent way of protecting the microorganisms from environmental stresses like moisture and light, hence higher stability and viability of the probiotic strains.

- The adults segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan probiotics dietary supplements market is segmented by end-use into adults, children, geriatric, and infants. Among these, the adults segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to increased rates of gastrointestinal disorders among adults, which has driven the creation of probiotic supplements. Adults can take it daily, and it helps to decrease the rate of five gastrointestinal symptoms such as diarrhea, constipation, gas, bloating, and discomfort.

- The nutritional supplements segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan probiotics dietary supplements market is segmented by application into anti-cancer, bone & joint health, brain/mental health, cardiac health, diabetes, energy & weight management, food supplements, gastrointestinal health, nutritional supplements, sports fitness, and others. Among these, the nutritional supplements segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Nutritional supplements, with those containing probiotics, are a general method of wellness by treating certain health issues related to digestion, immunity, and even the mind. Furthermore, as dietary habits change and lifestyles become increasingly busy, people desire easy and effective means of replenishing their nutrients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan probiotics dietary supplements market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Meiji Holdings Co., Ltd.

- Eisai Co., Ltd.

- Yakult Honsha Co., Ltd.

- Suntory Holdings Limited

- FANCL Corporation

- Morinaga Milk Industry Co., Ltd.

- Danone S.A.

- Arla Foods, Inc.

- Kirin Holdings Company, Limited

- Nestle S.A.

- Others

Recent Developments:

- In July 2023, Danone launched Almimama, a probiotic supplement that has been clinically proven to lower mastitis in lactating mothers. Launched in Spain first, the product seeks to promote maternal well-being and increase breastfeeding duration, overcoming one of the main impediments to long-term breastfeeding.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan probiotics dietary supplements market based on the below-mentioned segments:

Japan Probiotics Dietary Supplements Market, By Form

- Chewable and Gummies

- Capsules

- Powders

- Tablets and Soft gels

- Others

Japan Probiotics Dietary Supplements Market, By End-Use

- Adults

- Children

- Geriatric

- Infants

Japan Probiotics Dietary Supplements Market, By Application

- Anti-cancer

- Bone & Joint Health

- Brain/Mental Health

- Cardiac Health

- Diabetes

- Energy & Weight Management

- Food Supplements

- Gastrointestinal Health

- Nutritional Supplements

- Sports Fitness

- Others

Need help to buy this report?