Japan Preventive Risk Analytics Market Size, Share, and COVID-19 Impact Analysis, By Component (Solution and Services), By Deployment (On-premise and Cloud), By Type (Strategic Risks, Financial Risks, Operational Risks, and Compliance Risks), By Industry Vertical (BFSI, IT & Telecom, Retail, Healthcare, Energy & Utilities, Manufacturing, Government & Defense, and Others), and Japan Preventive Risk Analytics Market Insights, Industry Trend, Forecasts to 2032.

Industry: Electronics, ICT & MediaJapan Preventive Risk Analytics Market Insights Forecasts to 2032

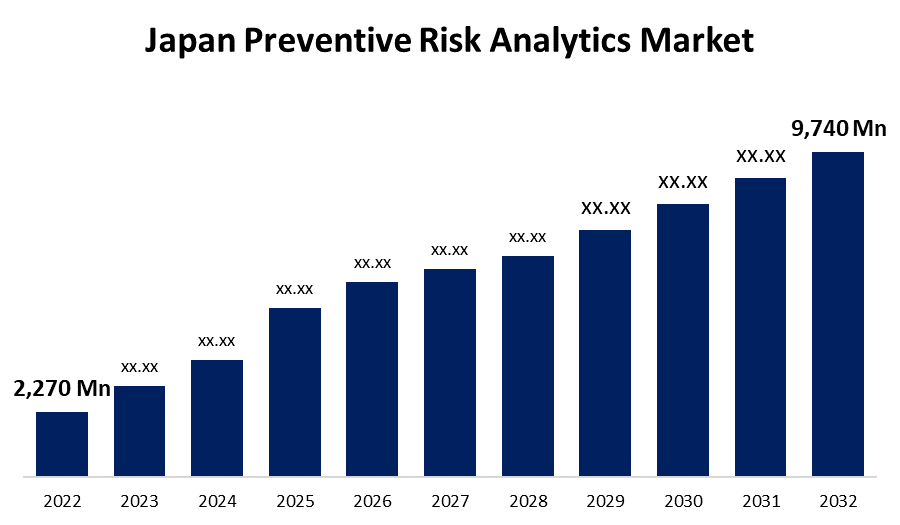

- The Japan Preventive Risk Analytics Market Size was valued at USD 2,270 Million in 2022.

- The Market is Growing at a CAGR of 15.6 % from 2022 to 2032

- The Size is Expected to Reach USD 9,740 Million by 2032.

Get more details on this report -

The Japan Preventive Risk Analytics Market Size was valued at USD 2,270 Million in 2022 and is expected to Grow to USD 9,740 Million by 2032, at a CAGR OF 15.6% during the forecast period 2022-2032.

Market Overview

Organizations employ a certain kind of software called preventive risk analytics to effectively and efficiently manage various risks. Risk analytics tools aid firms in managing and defending against operational risks that may result from internal causes including human error, system failures (which may be connected to software, hardware, networks, etc.), fraud, and cybercrime. This program is renowned for its various characteristics, including the ability to recognize and manage various risks kinds and to take action to avert possible crises. The use of risk analytics tools has made it possible for risk managers to quantify and forecast risk with more accuracy than ever before. Risk analytics is being used by organizations to collect supporting data from diverse security data sources, assess their cyber risks, automate their security processes, and make intelligence-driven choices. As a result of regulations and recommendations like the PCI-DSS and NIST Cybersecurity Framework, enterprises are also under more regulatory pressure from a cyber viewpoint.

Report Coverage

This research report categorizes the market of Japan preventive risk analytics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan mammography market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan mammography market.

Japan Preventive Risk Analytics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2021 |

| Market Size in 2021: | USD 2,270 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 15.6 % |

| 2032 Value Projection: | USD 9,740 Million |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Component, By Deployment, By Type, By Industry Vertical. |

| Companies covered:: | Accenture PLC, Axioms, INC, Capgemini, Fidelity National Information Services, INC, International Business Machines Corporation, Oracle Corporation, Recorded Future, INC., Sap SE, Institute, INC., Verisk Analytics, INC. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan is witnessing a Fintech boom, and the country's investment in the sector has grown dramatically over the past few years and is anticipated to continue to do so in the years to come. Megabanks and other financial institutions in Japan are moving to cooperate with and finance Fintech companies. Additionally, a lot of startup accelerator programs are managed by private businesses to aid Fintech firms, which is advantageous for the industry. Although Japan's Fintech industry is still relatively small in comparison to other countries, the number of venture-backed Fintech companies is growing and they are introducing new financial products and services by combining different information technologies like blockchain, biometric authentication, cloud computing, artificial intelligence (AI), big data analytics, and others. Also, Due to an increase in fraud, money laundering, and terrorist operations, risk analytics has grown in importance inside financial and banking organizations. Risk analytics is also used by financial organizations to increase awareness, reinforce know your employee (KYE) through technology intervention, and make transaction monitoring and surveillance easier. As a result of its many advantages, preventative risk analytics solutions are becoming more and more popular among banks and other financial organizations. For instance, Mizuho Bank and IBM Japan cooperated in August 2017 to achieve more sophisticated and effective risk management.

Restraining Factors

The adoption of solutions utilizing preventative risk analytics may be impacted by Japan's distinctive company culture and decision-making process. Slower acceptance and resistance to change may be caused by conventional hierarchical structures and cautious approaches to risk management. Also, with various businesses, sectors, and regions having different risk profiles and requirements, the Japanese market might be fragmented. This fragmentation may lead to specialized risk analytics solutions catered to certain sectors, restricting the scale and applicability of more comprehensive preventative risk analytics products. Moreover, risk analytics systems may be expensive to implement and operate, requiring investments in technical infrastructure, hiring new staff, and continuing upkeep. Adoption rates may be impacted by cost factors, particularly for small and medium-sized businesses (SMEs) with tight resources.

Market Segment

- In 2022, solutions segment is dominating the largest market share over the forecast period.

On the basis of components, the Japan preventive risk analytics market is segmented into solutions and services. Among these, the solution segment dominates the market share during the forecast period, due to a rise in the amount of data that is exposed. These solutions offer a crystal-clear view of the difficulties and ambiguities associated with a specific procedure. Additionally, it aids in identifying these uncertainties and preventing system failure and other issues that can impair regular company operations. However, the service category is predicted to have considerable growth in the following years. The rising use of preventative risk analytics tools and solutions is driving up demand for pre- and post-deployment services.

- In 2022, the on-premise segment is witnessing a higher growth rate during the forecast period

Based on the deployment, the Japan preventive risk analytics market is bifurcated into on-premise and cloud. Among these, the on-premise segment is expected to have a higher market share value during the forecast period. However, cloud-based solutions are anticipated to gain significantly in popularity over the next years, due to paradigm change in the deployment techniques from on-premise to cloud-based models. Mid-sized organizations may select cloud-based risk analytics solutions since they don't require significant upkeep and don't require a financial investment.

- In 2022, the BFSI segment is leading the largest market growth over the forecast period.

Based on the industry vertical, the Japan preventive risk analytics market is classified into BFSI, IT & telecom, retail, healthcare, energy & utilities, manufacturing, government & defense, and others. Among these, the BFSI segment is expected to have a higher market share value during the forecast period. Banks and other financial organizations can change their risk management practices from a "silo" approach to one that takes a "holistic" perspective of all hazards inside the organization. The requirement to monitor more transactions, for example, is expanding exponentially in operational risk management (ORM), placing pressure on the existing financial infrastructure and creating a need for risk analytics.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan preventive risk analytics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Accenture PLC

- Axioms, INC

- Capgemini

- Fidelity National Information Services, INC

- International Business Machines Corporation

- Oracle Corporation

- Recorded Future, INC.

- Sap SE, Institute, INC.

- Verisk Analytics, INC.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2019 to 2030. Spherical Insights has segmented the Japan Preventive Risk Analytics Market based on the below-mentioned segments:

Japan Preventive Risk Analytics Market, By Component

- Solution

- Services

Japan Preventive Risk Analytics Market, By Deployment

- On-premise

- Cloud

Japan Preventive Risk Analytics Market, By Type

- Strategic Risks

- Financial Risks

- Operational Risks

- Compliance Risks

Japan Preventive Risk Analytics Market, By Industry Vertical

- BFSI

- IT & Telecom

- Retail

- Healthcare

- Energy & Utilities

- Manufacturing

- Government & Defense

- Others

Need help to buy this report?