Japan Precision Electric Motors Market Size, Share, and COVID-19 Impact Analysis, By Type (AC Motors, DC Motors, Stepper Motors, and Servo Motors), By Application (Industrial Machinery, Automotive, Aerospace & Defense, Consumer Electronics, and Renewable Energy Systems), and Japan Precision Electric Motors Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationJapan Precision Electric Motors Market Insights Forecasts to 2035

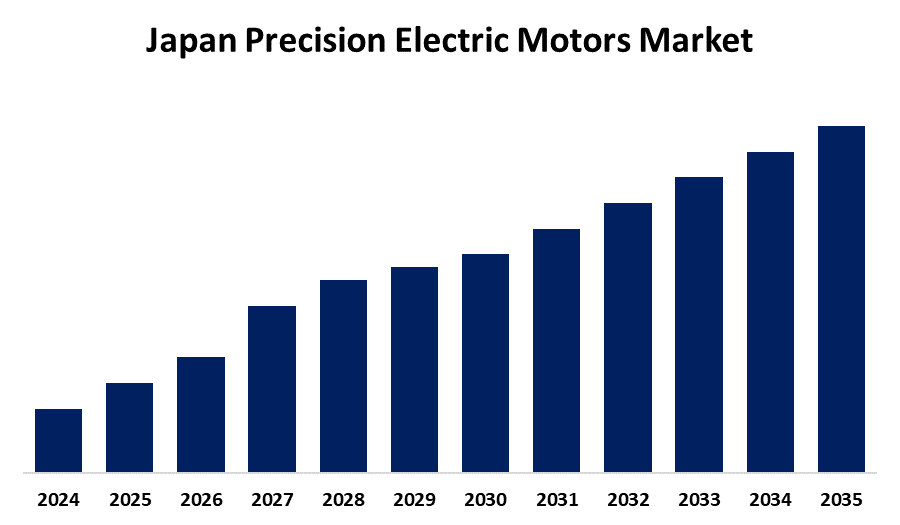

- The Japan Precision Electric Motors Market Size is Expected to Grow at a CAGR of around 7.00% from 2025 to 2035

- The Japan Precision Electric Motors Market Size is Expected to hold a significant share by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Precision Electric Motors Market Size is Anticipated to hold a significant share By 2035, Growing at a CAGR of 7.00% from 2025 to 2035. This is driven by rising demand for energy-efficient solutions in the automotive, robotics, and industrial automation sectors. Technological advancements, growing investments in smart manufacturing, and Japan’s strong focus on miniaturization and high-performance components further support market expansion and long-term adoption across key industries.

Market Overview

Japan precision electric motors market refers to the industry within Japan's electric motor sector that deals with the creation, production, and use of high-precision, compact, and energy-efficient motors. These types of motors are central to industries that need precise motion control, including robotics, vehicle systems, industrial automation, consumer electronics, and aeronautics. Precision electric motor market opportunities are high in Japan due to rising demand from robots, electric vehicles, and factory automation. With Japan leading the call for smart manufacturing and energy efficiency, precision motors contribute significantly to factory equipment upgrades. Medical equipment and consumer electronics growth also fuel high-performance, compact motor innovation. Foreign manufacturers and domestic entrepreneurs alike can take advantage of R&D collaborations, government support, and an available engineering talent pool to start or expand. Export potential is well-covered with Japan's global manufacturing reach. In 2024, Japan's administration announced up to $2.4 billion in subsidies to spur domestic production of electric vehicle (EV) batteries at home, supporting projects by Toyota, Nissan, Panasonic, Subaru, and Mazda, to increase annual battery capacity by 50% to 120 GWh and make the nation more autonomous in EVs.

Report Coverage

This research report categorizes the market for the Japan precision electric motors market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan precision electric motors market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan precision electric motors market.

Japan Precision Electric Motors Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.00% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 106 |

| Segments covered: | By Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Nidec Corporation, Mitsubishi Electric Corporation, Toshiba Corporation, Panasonic Corporation, Yaskawa Electric Corporation, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan's electric motor industry for precision is driven by several key factors. At the top of the list is Japan's leadership in industrial automation and robotics, with electric motors being the base components of robot arms, conveyors, and automatic equipment. Such a rise in automation is prevalent among industries such as automotive, electronics, and food processing. Technology enhancement, which lends more efficiency and performance to electric motors, is the key impetus in Japanese market expansion. With rising energy costs and more stringent environmental regulations, there is growing demand for energy-saving, high-output motors. The Japanese government's aggressive strategy for promoting energy efficiency is one of the propelling forces behind the electric motor market. Other policies and incentives toward minimizing energy consumption and encouraging green technology development have been implemented to foster a support system for expanding the use of electric motors. Adoption of intelligent technologies and IoT by electric motors is another important trend shaping the Japanese market. With industries moving towards digitalization, intelligent electric motors with sensors and communications capabilities to facilitate real-time monitoring and predictive maintenance are being adopted at higher rates.

Restraining Factors

The Japan precision electric motor market is constrained by factors including high production expense, shortage of rare earth, and stiff global competition from low-cost Asian manufacturers. Strict environmental rules and slow shift to superior technology in conventional industries also impede growth, while supply chain disruption and economic fluctuations also hinder market expansion.

Market Segmentation

The Japan precision electric motors market share is classified into type and application.

- The AC motors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan precision electric motors market is segmented by type into AC motors, DC motors, stepper motors, and servo motors. Among these, the AC motors segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to their high efficiency, low maintenance, and widespread use in industrial automation, HVAC, and electric vehicles. Increasing demand for energy-efficient systems and Japan’s strong manufacturing base are expected to drive the continued growth of this segment at a significant CAGR through the forecast period.

- The automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan precision electric motors market is segmented by application into industrial machinery, automotive, aerospace & defense, consumer electronics, and renewable energy systems. Among these, the automotive segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segmental growth is attributed to the increasing adoption of electric vehicles, demand for advanced driver assistance systems, and precision motion control. Japan’s strong automotive industry, coupled with innovation in EV technology and energy-efficient components, is expected to drive sustained growth in this segment throughout the forecast period.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan precision electric motors market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nidec Corporation

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Panasonic Corporation

- Yaskawa Electric Corporation

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan precision electric motors market based on the below-mentioned segments

Japan Precision Electric Motors Market, By Type

- AC Motors

- DC Motors

- Stepper Motors

- Servo Motors

Japan Precision Electric Motors Market, By Application

- Industrial Machinery

- Automotive

- Aerospace & Defense

- Consumer Electronics

- Renewable Energy Systems

Need help to buy this report?