Japan Power Management IC Market Size, Share, and COVID-19 Impact Analysis, By Product (Switching Regulators, Linear Regulators, Voltage Reference, Power Management ASICs/ASSPs, and Others), By Application (Wearable Electronics, Consumers Electronics, Healthcare, Automotive, Industrial & Retail, and Building Control), and Japan Power Management IC Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsJapan Power Management IC Market Insights Forecasts to 2035

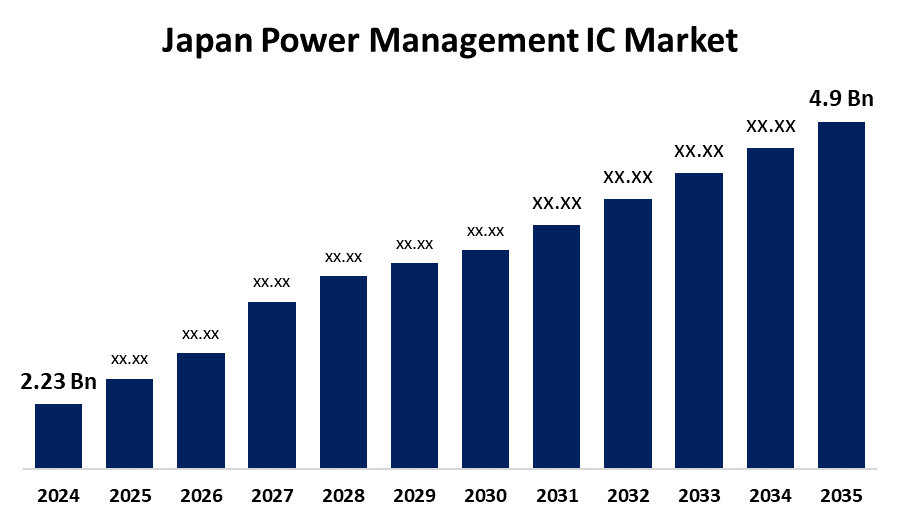

- The Japan Power Management IC Market Size Was Estimated at USD 2.23 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.42% from 2025 to 2035

- The Japan Power Management IC Market Size is Expected to Reach USD 4.9 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Power Management IC Market Size is Anticipated to Reach USD 4.9 Billion by 2035, Growing at a CAGR of 7.42% from 2025 to 2035. The Japan power management IC market is expanding due to a high focus on energy efficiency, technological advancements in consumer electronics, increased adoption of electric vehicles, and government initiatives towards renewable energy and smart grids, all fueling demand for energy optimization solutions.

Market Overview

The Japan power management IC (PMIC) market refers to the industry dedicated to integrated circuits utilized for controlling the power needs of electronic systems through voltage regulation, power sequence control, and improving energy efficiency. PMICs play a crucial role in smartphones, laptops, electric vehicles (EVs), industrial automation, and renewable energy systems. Market growth is led by the growing demand for sustainable electronics, the fast growth in EV and hybrid cars, and the growing use of portable and intelligent devices. Japan excellent semiconductor supply chain, technological innovation, and established automotive and electronics industries form a good foundation for PMIC development and use. Opportunities exist in the conjunction of PMICs with IoT, 5G, and AI-based products, and increased applications in renewable energy and smart grid networks. The Japan government encourages semiconductor growth via R&D incentives, investments, and METI-NEDO schemes to increase local chip manufacturing and encourage sustainable, power conservative electronic infrastructure.

Report Coverage

This research report categorizes the market for the Japan power management IC market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan power management IC market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan power management IC market.

Japan Power Management IC Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.23 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.42% |

| 2035 Value Projection: | USD 4.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Toshiba Corporation, ROHM Semiconductor, Microchip Technology, STMicroelectronics, Maxim Integrated, Semtech, NXP Semiconductors, Analog Devices, Infineon Technologies, Cypress Semiconductor, Renesas Electronics Corporation, Texas Instruments, Mitsubishi Electric Corporation and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan power management IC market is fueled by the need for sustainable electronics, increasing electric vehicle adoption, and enhanced use of portable smart devices. Industrial automation expansion, 5G network development, and IoT ecosystems further boost PMIC integration. Miniaturization focus, technological advancements, and Japan's robust electronics manufacturing infrastructure improve market growth. Government incentives through R&D investments and programs promoting domestic semiconductor manufacturing also take a central position in stimulating demand for modern power management solutions.

Restraining Factors

The Japan power management IC market is hindered by high design complexity, rising development expenses, and reliance on worldwide semiconductor supply chains. Integration issues with developing technologies also slow down mass adoption across some industrial and automotive applications.

Market Segmentation

The Japan power management IC market share is classified into product and application.

- The switching regulators segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan power management IC market is segmented by product into switching regulators, linear regulators, voltage references, power management ASICs/ASSPs, and others. Among these, the switching regulators segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their extreme efficiency and adaptability, they transfer power with minimal heat dissipation, positioning them as necessary for compacting equipment and stringent energy requirements. Ongoing technology innovation, such as integrating sophisticated GaN and SiC materials, continuously improves performance, reliability, and appropriateness for energy-saving applications.

- The consumer electronics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan power management IC market is segmented by application into wearable electronics, consumer electronics, healthcare, automotive, industrial & retail, and building control. Among these, the consumer electronics segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the increasing need for power-saving mobile devices leads to the consumption of advanced ICs, mainly used to manage power in smartphones, laptops, and smart home devices. The segment grows strongly with rising power backup requirements and the growing popularity of smart devices that need efficient energy management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan power management IC market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Toshiba Corporation

- ROHM Semiconductor

- Microchip Technology

- STMicroelectronics

- Maxim Integrated

- Semtech

- NXP Semiconductors

- Analog Devices

- Infineon Technologies

- Cypress Semiconductor

- Renesas Electronics Corporation

- Texas Instruments

- Mitsubishi Electric Corporation

- Others

Recent Developments:

- In March 2024, Toshiba started volume shipments of its SmartMCD™ Series gate driver ICs with embedded MCUs. The first product, TB9M003FG, enables sensorless control of three-phase brushless DC motors in automotive applications like pumps, fans, and blowers. It integrates an Arm® Cortex®-M0 MCU, flash memory, and motor control functions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan power management IC market based on the below-mentioned segments:

Japan Power Management IC Market, By Product

- Switching Regulators

- Linear Regulators

- Voltage Reference

- Power Management ASICs/ASSPs

- Others

Japan Power Management IC Market, By Application

- Wearable Electronics

- Consumer Electronics

- Healthcare

- Automotive

- Industrial & Retail

- Building Control

Need help to buy this report?