Japan Powder Metallurgy Market Size, Share, and COVID-19 Impact Analysis, By Material Type (Ferrous Metals, Non-Ferrous Metals, and Others), By Application (Transportation, Consumer Goods, and Industrial), and Japan Powder Metallurgy Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerJapan Powder Metallurgy Market Insights Forecasts to 2035

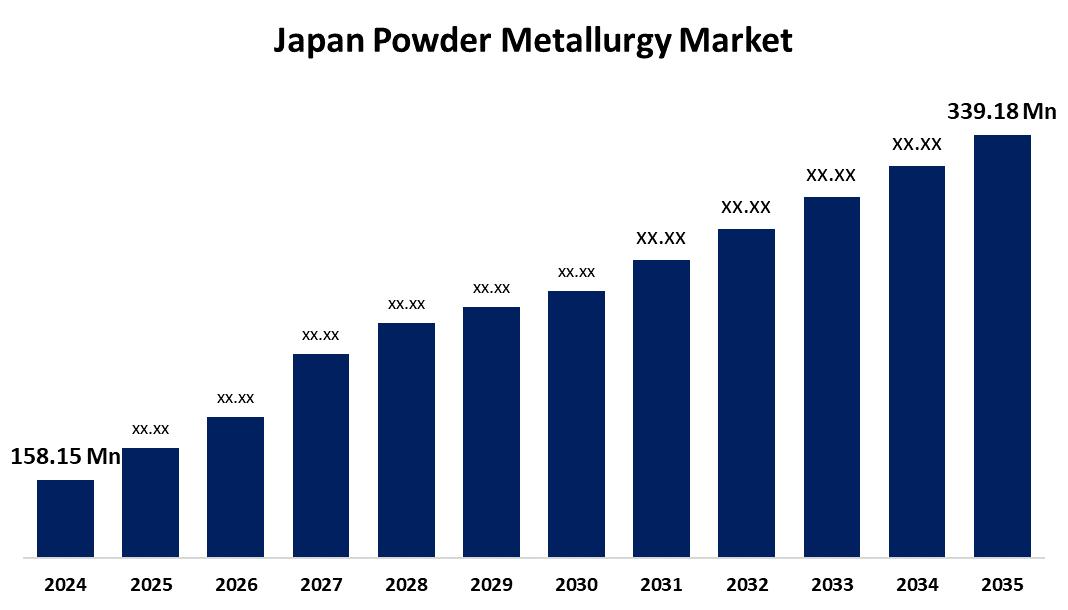

- The Japan Powder Metallurgy Market Size was estimated at USD 158.15 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.18% from 2025 to 2035

- The Japan Powder Metallurgy Market Size is Expected to Reach USD 339.18 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Powder Metallurgy Market Size is Anticipated to Reach USD 339.18 Million by 2035, Growing at a CAGR of 7.18% from 2025 to 2035. Japan's women's apparel market is driven by rising disposable income, increasing demand for high-quality and stylish clothing, and a growing preference for sustainable fashion.

Market Overview

The Japan powder metallurgy market refers to the industry focused on manufacturing metal components using powdered metal, which is then compacted and sintered to create high-strength parts. Growing export prospects and attempts at economic recovery are also helping Japan's PM sector. The export of PM materials, particularly iron powder, has increased significantly, indicating the huge demand for Japan's premium PM products around the world. For example, Japan exported 32.7 million metric tons of iron and steel in 2023, a 1.2% annual growth. This expansion demonstrates Japan's competitive edge in terms of manufacturing capacity and product quality. It is anticipated that the nation's strategic emphasis on diversifying its exports will open up new markets for PMs.

Report Coverage

This research report categorizes the market for the Japan powder metallurgy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan powder metallurgy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan powder metallurgy market.

Japan Powder Metallurgy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 158.15 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 7.18% |

| 2035 Value Projection: | USD 339.18 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 150 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Material Type, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Sumitomo Electric Industries, Ltd., Molyworks Materials Corporation, Sandvik AB, JFE Steel Corporation, Showa Denko K.K., Shanghai CNPC Powder Material Co., Ltd., Daido Steel Co., Ltd. and Others. |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for powder metallurgy (PM) in Japan is expanding due to a number of important factors. The automotive sector is a major buyer of PM components, with producers concentrating on creating vehicles that are lightweight and fuel-efficient. PM technology provides flexible design and cost-effective manufacturing, making it the perfect answer to industry demands. Japan's focus on technological innovation has also resulted in improvements in PM processes, such as the creation of new alloys and improved manufacturing methods. These developments expand the range of PM applications across several industries and improve material characteristics. Furthermore, sustainability activities are important because PM processes are known to be materially efficient and to generate less waste, which is in line with international environmental goals.

Restraining Factors

The powder metallurgy (PM) sector faces major issues as a result of Japan's demographic patterns. A smaller workforce as a result of the country's aging and declining population has resulted in a manpower shortage in PM and other manufacturing industries.

Market Segmentation

The Japan powder metallurgy market share is classified into material type and application.

- The ferrous metals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan powder metallurgy market is segmented by material type into ferrous metals, non-ferrous metals, and others. Among these, the ferrous metals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of their widespread use in industrial and automotive applications, ferrous metals, such as steel and iron powders, dominate the market.

- The consumer goods segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan powder metallurgy market is segmented by application into transportation, consumer goods, and industrial. Among these, the consumer goods segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. A sizable amount is made up of consumer items, and PM makes it possible to produce durable and small components.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan powder metallurgy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Sumitomo Electric Industries, Ltd.

- Molyworks Materials Corporation

- Sandvik AB

- JFE Steel Corporation

- Showa Denko K.K.

- Shanghai CNPC Powder Material Co., Ltd.

- Daido Steel Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan powder metallurgy market based on the below-mentioned segments:

Japan Powder Metallurgy Market, By Material Type

- Ferrous Metals

- Non-Ferrous Metals

- Others

Japan Powder Metallurgy Market, By Application

- Transportation

- Consumer Goods

- Industrial

Need help to buy this report?