Japan Portable Power Station Market Size, Share, and COVID-19 Impact Analysis, By Type (Lithium-ion, Sealed Lead-acid), By Capacity (Less than 100 WH, 100-200 WH, 200-400 WH, 400-1000 WH, 1000-1500 WH, more than 1500 WH), By Application (Automotive, Emergency Power, Off-Grid Power, Others), By Sales Channels (Online, Offline), and Japan Portable Power Station Market Insights Forecasts to 2032.

Industry: Energy & PowerJapan Portable Power Station Market Insights Forecasts to 2032

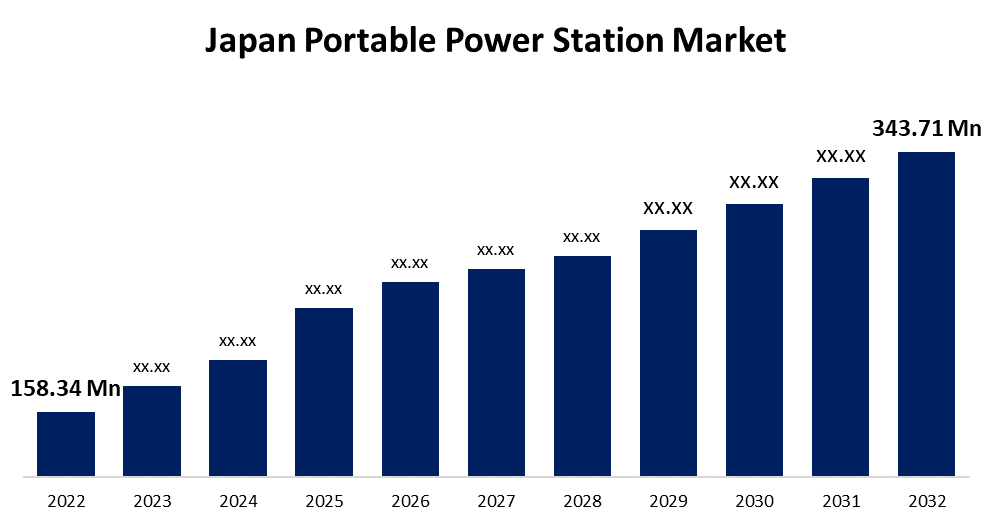

- The Japan Portable Power Station Market Size was valued at USD 158.34 Million in 2022.

- The Market is Growing at a CAGR of 8.0% from 2022 to 2032.

- The Japan Portable Power Station Market Size is expected to reach USD 343.71 Million by 2032.

- Japan is expected to grow the fastest during the forecast period.

Get more details on this report -

The Japan Portable Power Station Market Size is expected to reach USD 343.71 Million by 2032, at a CAGR of 8.0% during the forecast period 2022 to 2032.

Market Overview

With AC, DC, and USB outputs, portable power stations are capable of powering and operating a wide range of electronic devices, from phones to power tools. They are also silent and easy to operate indoors and out, compared to gas-powered generators. Furthermore, when compared to traditional power stations in Japan, portable power stations are employed for a long-time supply of energy through collection, storage, and instant power supply while maintaining ecological sustainability. Through high demand management, portable power stations provide a flexible, more efficient, and increasingly robust power generation network. Portable power stations are typically utilized for electrical failures and long-term energy supplies whenever there is an immediate or emergency requirement for electricity. In addition, because of the expanding millennial generation camping culture who are up to current on modern technologies, Japan has recently seen a sharp rise in the portable power station market. The demand for portable power stations is expected to benefit significantly from the increased popularity of outdoor leisure activities.

Report Coverage

This research report categorizes the market for Japan Portable Power Station Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan Portable Power Station Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segments of the Japan Portable Power Station Market.

Japan Portable Power Station Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 158.34 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 8.0% |

| 2032 Value Projection: | USD 343.71 Million |

| Historical Data for: | 2018-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | By Type, By Capacity, By Application, By Sales Channels and Country Statistics (Demand, Price, Growth, Competitors, Challenges) |

| Companies covered:: | Panasonic Corporation, Toshiba Corporation, Suaoki, Furukawa Battery Co., Ltd., FDK Corporation, ASAGAO JAPAN GK, KYOCERA, Hitachi, Ltd., NEC Corporation, Murata, JERA, SUAOKI, GS Yuasa International Ltd. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Key factors influencing the Japanese portable power station market include a boom in the usage of interactive grid services, aging electrical grid amenities, and a development in the utilization of electrical power in remote locations. Growing prefectures have to supply consistent access to power in remote areas. During the forecast period, the possibility for remote and scattered power systems to distribute electricity around the country is likely to drive the portable power station market in Japan. Furthermore, power stations are popular due to their flexibility to be readily transportable to remote locations. As a result, an increasing number of customers are prepared to invest in portable power stations for their own usage, which is likely to propel the Japan portable power station market throughout the estimated time frame. In addition, these types of power stations are capable of producing electricity from solar, wind, or other renewable sources, making them environmentally conscious alternatives to typical conventional fuel-based generators.

The growing number of people taking advantage of outdoor recreational activities, the expansion of eco-tourism, and the general development of the travel and tourism sector are all predicted to drive the requirement for off-grid or on-the-go energy supplies, boosting demand for the Japan portable power station market. Moreover, worries concerning carbon monoxide and greenhouse gas emissions have prompted major expenditures in clean energy generation in Japan. Portable power stations are often utilized for storing renewable energy and delivering electricity as demanded. As a result, it is predicted that the evolution of technology favoring energy production from renewable sources would drive forward the growth of the Japan market for portable power stations throughout the forecast.

Market Segment

- In 2022, the lithium-ion segment is witnessing a higher growth rate over the forecast period.

Based on the type, the Japan Portable Power Station Market is segmented into lithium-ion and sealed lead-acid. Among these, the lithium-ion segment is witnessing a higher growth rate over the forecast period. The cheap price of operation, low discharging speed, and small installation footprint of lithium-ion batteries are important drivers pushing their wider implementation in smart grid and energy storage systems such as these products. Lithium-ion batteries are a popular battery-operated alternative for a variety of applications such as portable gadgets, vehicles, and stationary usage that require a continuous power source. Throughout the forecast period, these batteries are likely to fuel the Japan portable power station market growth.

- In 2022, the 400-1000 WH segment accounted for the largest revenue share of more than 43.8% over the forecast period.

On the basis of capacity, the Japan Portable Power Station Market is segmented into less than 100 WH, 100-200 WH, 200-400 WH, 400-1000 WH, 1000-1500 WH, and more than 1500 WH. Among these, the 400-1000 WH segment is dominating the market with the largest revenue share of 43.8% over the forecast period. These portable power backup packages deliver electricity from AC outlets for cell or portable devices, providing a charging source of power for home, work, or camping purposes. It is suitable for residential use because it is quiet and does not require gasoline or diesel or emit any odors. The primary technology used in these portable power stations is lithium-ion, which allows for efficient storage of electricity. These are capable of being charged utilizing both direct and solar power, giving more charging choices.

- In 2022, the emergency power segment is witnessing significant CAGR growth over the forecast period.

On the basis of application, the Japan Portable Power Station Market is segmented into automotive, emergency power, off-grid power, and others. Among these, the emergency power segment is witnessing significant CAGR growth over the forecasted period. During crises such as natural catastrophes, blackouts of power, or other unexpected circumstances, these power stations serve as dependable and dependable sources of power. Access to electricity is critical in such situations for communication, illumination, healthcare equipment, and powering important appliances. Portable power stations provide an efficient and simple option, allowing consumers to rapidly restore power to their devices while still maintaining important features.

- In 2022, The electronics segment accounted for the largest revenue share of more than 74.2% over the forecast period.

On the basis of sales channels, the Japan Portable Power Station Market is segmented into online and offline. Among these, the electronics segment is dominating the market with the largest revenue share of 74.2% over the forecast period. The conventional method distribution networks, new electrical outlets, modern retail stores, wholesale suppliers, brick and mortar businesses, and others are examples of offline sales channels. This is due to the availability and promptness of service. Furthermore, Japan has a huge network of retail chains, including supermarkets, hypermarkets, and specialty stores, which increases demand for portable power station in the country's offline segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan Portable Power Station Market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Panasonic Corporation

- Toshiba Corporation

- Suaoki

- Furukawa Battery Co., Ltd.

- FDK Corporation

- ASAGAO JAPAN GK

- KYOCERA

- Hitachi, Ltd.

- NEC Corporation

- Murata

- JERA

- SUAOKI

- GS Yuasa International Ltd

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- On November 2022, FOSSiBOT has launched its F2400 portable power station for pre-order in Japan. The gadget has a 2,048 Wh battery which you can recharge via a wall outlet or solar panels. The device has a maximum power output of 2,400 W with 16 ports, including 100 W USB-C and 18 W USB-A outputs. The power pack is expected to last over 3,500 cycles and fully recharges in around 2 hours via a wall outlet.

Market Segment

This study forecasts revenue at global, regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan Portable Power Station Market based on the below-mentioned segments:

Japan Portable Power Station Market, By Type

- Lithium-ion

- Sealed Lead-acid

Japan Portable Power Station Market, By Capacity

- Less than 100 WH

- 100-200 WH

- 200-400 WH

- 400-1000 WH

- 1000-1500 WH

- More than 1500 WH

Japan Portable Power Station Market, By Application

- Automotive

- Emergency Power

- Off-Grid Power

- Others

Japan Portable Power Station Market, By Sales Channels

- Online

- Offline

Need help to buy this report?