Japan Population Screening Market Size, Share, and COVID-19 Impact Analysis, By Product (Hardware Equipment, Testing / Lab, and Analytics / Interpretation), By Gender (Male and Female), By Geography (Nation and State), By Business (Hospitals, Research Institutes, and Diagnostic Labs), and Japan Population Screening Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Population Screening Market Insights Forecasts to 2035

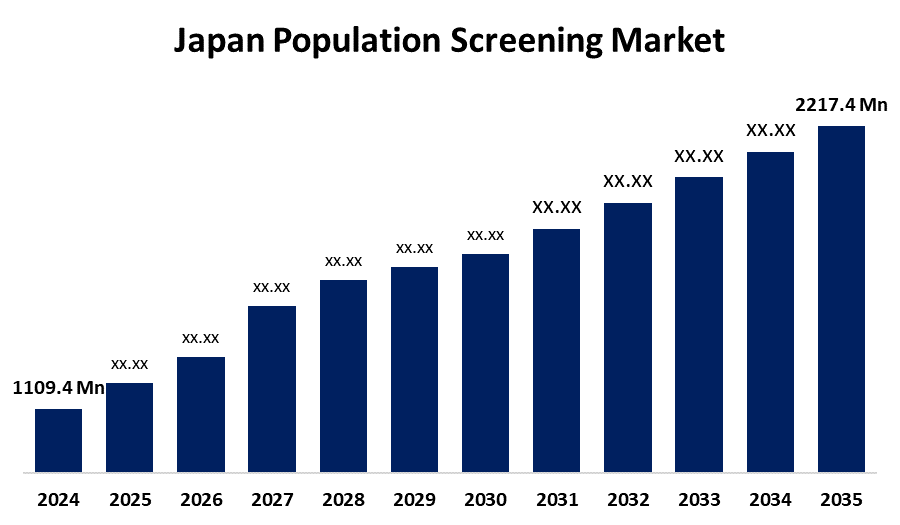

- The Japan Population Screening Market Size Was Estimated at USD 1109.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.5% from 2025 to 2035

- The Japan Population Screening Market Size is Expected to Reach USD 2217.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Population Screening Market Size is anticipated to reach USD 2217.4 Million by 2035, growing at a CAGR of 6.5% from 2025 to 2035. The Japan population screening market is expanding with an aging population, increasing chronic disease incidence, and innovation in technology. Support from the government, more preventive care awareness, and a movement toward precision medicine also fuel the need for early and precise screening.

Market Overview

The Japan market for population screening involves organized screening of asymptomatic people to identify diseases at an early stage, mostly through clinical and in vitro diagnostics like blood work, genetic tests, and imaging scans. These screenings are utilized in hospitals, clinics, and public health programs to detect chronic conditions (cancer, cardiovascular, diabetes) before they develop symptoms. An extensive healthcare infrastructure and comprehensive insurance coverage also increase the accessibility of screening services. There is potential in the increase of genomic and liquid biopsy screening, as well as the use of rapid diagnostics platforms for remote groups. The growth of the market is led by Japan elderly population, which has escalated the prevalence of chronic diseases and the need for proactive diagnosis, in addition to technologies such as AI, automation, and NGS that improve precision and efficacy. Policies such as the Medical Digital Transformation plan by the government support digital health integration, including electronic health records and screening programs.

Report Coverage

This research report categorizes the market for the Japan population screening market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan population screening market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan population screening market.

Japan Population Screening Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1109.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.5% |

| 2035 Value Projection: | USD 2217.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 258 |

| Tables, Charts & Figures: | 111 |

| Segments covered: | By Product, By Gender, By Geography and By Business |

| Companies covered:: | Fujirebio Holdings, Inc., QIAGEN, Agilent Technologies, Quest DiagnosticsRoche Holding, LGC Limited, TAUNS Laboratories, Inc., Sekisui Medical Co., Ltd., Novogene, Thermo Fisher Scientific, Illumina, Takara Bio Inc., and Others |

| Pitfalls & Challenges: | COVID-19 has the potential to impact the global market |

Get more details on this report -

Driving Factors

The Japan population screening market is fueled by an aging population, increasing incidence of chronic conditions, and rising public awareness of early diagnosis. Government-funded initiatives, such as national cancer screening programs and health check-ups, facilitate broad access. Advances in technology like AI, next generation sequencing, and digital imaging boost the accuracy and speed of early detection. Moreover, Japan's universal coverage system provides affordability and stimulates frequent screenings, while increasing investments in preventive medicine further drive demand for population-wide diagnostic solutions across medical conditions.

Restraining Factors

The Japan population screening market is constrained by high expenditure on sophisticated diagnostic technologies, restricted access in rural regions, a lack of trained professionals, and fear of overdiagnosis or false positives, thus giving rise to undue treatment and augmented healthcare burden.

Market Segmentation

The Japan population screening market share is classified into product, gender, geography, and business.

- The hardware equipment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan population screening market is segmented by product into hardware equipment, testing/lab, and analytics/interpretation. Among these, the hardware equipment segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their robust demand for advanced screening devices, high adoption of point-of-care diagnostic equipment, and continued innovations in genetic and imaging-based screening technologies, which increase the diagnostic efficiency, accessibility, and precision in different healthcare environments in Japan.

- The male segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan population screening market is segmented by gender into male and female. Among these, the male segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to some of the screened diseases, like cardiovascular diseases and prostate cancer, are more prevalent in men. This has made there more emphasis on early detection programs on male-predominant diseases so that improvements are achieved through timely diagnosis and intervention.

- The nation segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan population screening market is segmented by geography into nation and state. Among these, the nation segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to large-scale government efforts, robust healthcare infrastructure, and supportive reimbursement policies. Greater public awareness and accessibility of screening programs also fuel growth. Moreover, increasing national investments in early detection and AI-driven technologies put the segment on track to achieve the highest growth.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan population screening market is segmented by business into hospitals, research institutes, and diagnostic labs. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to they provide complete diagnostic facilities and are supported by government-funded programs. Their strength is complemented by specialized units that deal with cancer, genetic, and metabolic screenings, and hence form the core of efficient early disease detection and management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan population screening market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujirebio Holdings, Inc.

- QIAGEN

- Agilent Technologies

- Quest Diagnostics

- Roche Holding

- LGC Limited

- TAUNS Laboratories, Inc.

- Sekisui Medical Co., Ltd.

- Novogene

- Thermo Fisher Scientific

- Illumina

- Takara Bio Inc.

- Others

Recent Developments:

- In May 2025, Fujirebio announced FDA 510(k) clearance for its Lumipulse® G pTau 217/β-Amyloid 1-42 plasma ratio test. As the first FDA-cleared blood-based IVD for detecting amyloid pathology linked to Alzheimer’s disease, it supports earlier diagnosis in patients with cognitive decline.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan population screening market based on the below-mentioned segments:

Japan Population Screening Market, By Product

- Hardware Equipment

- Testing / Lab

- Analytics / Interpretation

Japan Population Screening Market, By Gender

- Male

- Female

Japan Population Screening Market, By Geography

- Nation

- State

Japan Population Screening Market, By Business

- Hospitals

- Research Institutes

- Diagnostic Labs

Need help to buy this report?