Japan Polyacrylonitrile Fiber Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Standard PAN, High Modulus PAN (HM PAN), Medium Modulus PAN (MM-PAN), and Carbon Fiber Precursor PAN), By Application (Apparel & Clothing, Automotive & Transportation, Construction, Industrial, and Medical Industries), and Japan Polyacrylonitrile Fiber Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Polyacrylonitrile Fiber Market Insights Forecasts to 2035

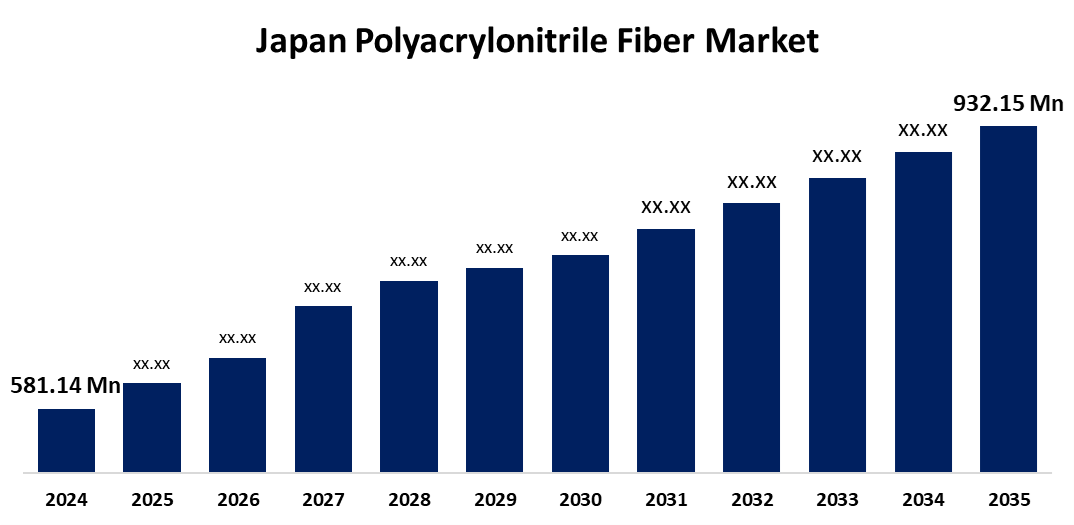

- The Japan Polyacrylonitrile Fiber Market Size Was Estimated at USD 581.14 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.39% from 2025 to 2035

- The Japan Polyacrylonitrile Fiber Market Size is Expected to Reach USD 932.15 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Polyacrylonitrile Fiber Market is anticipated to reach USD 932.15 Million by 2035, Growing at a CAGR of 4.39% from 2025 to 2035. The market is driven by Japan's robust aerospace and automotive industries, which demand lightweight and high-strength materials for enhanced performance and fuel efficiency.

Market Overview

The Japan polyacrylonitrile fiber market encompasses the production, distribution, and application of synthetic fibers derived from polyacrylonitrile. The market's expansion in Japan has been largely attributed to ongoing developments in PAN fiber production and processing technology. The performance and quality of PAN fibers are being improved by advancements in thermal treatment procedures, fiber spinning methods, and polymer chemistry. Manufacturers are now able to create fibers with increased uniformity, tensile strength, and processability thanks to advancements in wet and dry spinning techniques. Additionally, PAN fibers are becoming increasingly commercially viable for a variety of applications due to the development of more economical and energy-efficient production techniques.

Report Coverage

This research report categorizes the market for the Japan polyacrylonitrile fiber market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan polyacrylonitrile fiber market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan polyacrylonitrile fiber market.

Japan Polyacrylonitrile Fiber Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 581.14 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.39% |

| 2035 Value Projection: | USD 932.15 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 170 |

| Tables, Charts & Figures: | 95 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Shandong Haili, Jilin Chemical Fiber, Sateri, Fibrant, Jiangsu Sailboat Petrochemical, Xinjiang Tianye and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing need for strong and lightweight materials in the automotive and aerospace sectors, where PAN fibers are used as carbon fiber precursors, is one of the market's main drivers. Furthermore, market expansion is supported by the growing emphasis on recyclable and sustainable materials in industrial and textile applications. Developments in fiber processing methods are important trends because they improve the quality of PAN fiber and increase its range of applications. The need for carbon fibers made from PAN is further increased by the growing emphasis on renewable energy, especially wind energy. This increase is a result of the growing need for polyacrylonitrile (PAN) fibers, which are widely used in industrial materials, textiles, and carbon fiber precursors.

Restraining Factors

The high cost of production linked to specialized machinery, sophisticated processing techniques, and dependence on raw ingredients produced from petrochemicals, which makes the process vulnerable to price swings, is a major obstacle in the Japanese PAN fiber market. Access to markets may be restricted by this cost burden, particularly for smaller businesses. Furthermore, because PAN-based carbon fibers are non-biodegradable and provide disposal hurdles, recycling them presents environmental challenges.

Market Segmentation

The Japan polyacrylonitrile fiber market share is classified into product type and application.

- The standard PAN segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan polyacrylonitrile fiber market is segmented by product type into standard PAN, high modulus PAN (HM PAN), medium modulus PAN (MM-PAN), and carbon fiber precursor PAN. Among these, the standard PAN segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of its many uses and adaptability, especially in textiles and industrial materials; standard PAN is the most widely used type.

- The apparel & clothing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan polyacrylonitrile fiber market is segmented by application into apparel & clothing, automotive & transportation, construction, industrial, and medical industries. Among these, the apparel & clothing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. PAN fibers are utilized in the apparel industry to create lightweight, long-lasting textiles, particularly for performance and outdoor wear.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan polyacrylonitrile fiber market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Shandong Haili

- Jilin Chemical Fiber

- Sateri

- Fibrant

- Jiangsu Sailboat Petrochemical

- Xinjiang Tianye

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Polyacrylonitrile Fiber Market based on the below-mentioned segments:

Japan Polyacrylonitrile Fiber Market, By Product Type

- Standard PAN

- High Modulus PAN (HM PAN)

- Medium Modulus PAN (MM-PAN)

- Carbon Fiber Precursor PAN

Japan Polyacrylonitrile Fiber Market, By Application

- Apparel & Clothing

- Automotive & Transportation

- Construction

- Industrial

- Medical Industries

Need help to buy this report?