Japan Plasma Therapy Market Size, Share, and COVID-19 Impact Analysis, By Type (Pure Platelet-Rich Plasma, Leukocyte-Rich PRP, Pure Platelet-Rich Fibrin, Leukocyte-Rich Fibrin, and Plasma Proteins), By Application (Orthopedic, Chronic Infectious Diseases, Dermatology, Dental, Cardiac Muscle Injury, and Nerve Injury), By End User (Hospitals & Clinics, and Research Institutions), and Japan Plasma Therapy Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareJapan Plasma Therapy Market Insights Forecasts to 2035

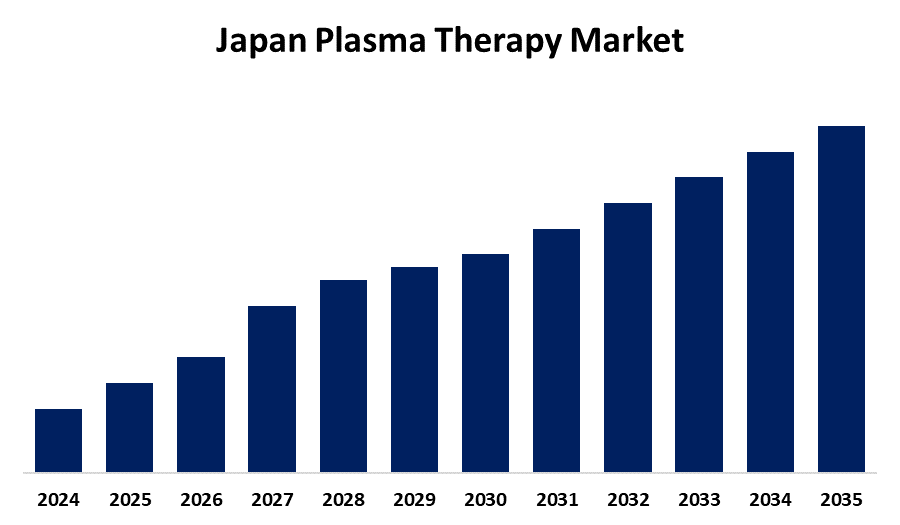

- The Japan Plasma Therapy Market Size is Expected to Grow at a CAGR of 11.7% from 2025 To 2035

- The Japan Plasma Therapy Market Size is Expected to Hold a Significant Share By 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Plasma Therapy Market Size is Expected to hold a significant share By 2035, at a CAGR of 11.7% during the forecast period 2025-2035. The market for Japan plasma therapy is growing due to increasing demand for plasma-derived therapies, technical advancements, and the supportive regulatory environment. Chronic disease incidence, the elderly population, and government initiatives for upgrading healthcare facilities are all fuelling the growth.

Market Overview

The Japan plasma therapy market refers to treatments that use blood plasma components to cure medical disorders. Among these are platelet-rich plasma (PRP) injections for musculoskeletal conditions, plasmapheresis for autoimmune diseases, and plasma-derived products for bleeding diseases and immunodeficiencies. Japan's strong healthcare system and high medical research capacity provide adequate support for the production and use of plasma therapies. The presence of powerful pharmaceutical giants and research centers within the country contributes to its strengths in this area. There is a vast potential for expanding the use of plasma therapies in the treatment of neurological disorders, autoimmune diseases, and aesthetic medicine. Personalized medicine approaches and advances in cell therapy have the ability to offer possibilities for innovation. The elderly population in Japan has led to an increase in the prevalence of chronic and degenerative disorders, and thus, there is a need for advanced therapeutic interventions. The Japanese government prefers the use of regenerative medicine through regulatory frameworks that ensure faster approval of new medicines.

Report Coverage

This research report categorizes the market for the Japan plasma therapy market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan plasma therapy market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan plasma therapy market.

Japan Plasma Therapy Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.7% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Type, By Application, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Takeda Pharmaceutical Company Limited, Plasmatreat Japan, Taiho Pharmaceutical Co., Ltd., Biotest AG, KM Biologics, Fujirebio, Nipro Corporation, Kedrion, Mitsubishi Tanabe Pharma Corporation, Kyowa Kirin Co., Ltd., Grifols, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The drivers of the plasma therapy market growth include Japan's rapidly increasing aging population, rise in the prevalence of chronic and autoimmune diseases, and the increasing demand for cutting-edge, non-invasive treatments. Technologies of plasma extraction and regenerative medicine are leading to driving forces, thus further accelerating market growth. Strong healthcare infrastructure, low R&D spending, and greater awareness of the benefits of plasma therapy also contribute significantly. Government support for novel therapies also accelerates clinical adoption and improves long-term prospects for the market.

Restraining Factors

The Japan plasma therapy market is hampered by such challenges as high cost of treatment, complex manufacturing, regulatory problems, competition from recombinant therapies, and lingering public concerns about safety due to past instances of contamination of blood products.

Market Segmentation

The Japan plasma therapy market share is classified into type, application, and end user.

- The pure platelet-rich plasma segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan plasma therapy market is segmented by type into pure platelet-rich plasma, leukocyte-rich PRP, pure platelet-rich fibrin, leukocyte-rich fibrin, and plasma proteins. Among these, the pure platelet-rich plasma segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to its use in cosmetic, general, cardiovascular, and wound surgery. Platelet-rich plasma therapy purely reduces pre- and post-surgical bleeding risk, along with the regeneration of tendon and ligament fibers and healing of soft tissues.

- The orthopedic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan plasma therapy market is segmented by application into orthopedic, chronic infectious diseases, dermatology, dental, cardiac muscle injury, and nerve injury. Among these, the orthopedic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increased incidence of sports injuries and the demand for minimally invasive procedures. Plasma therapy is applied to correct numerous orthopedic conditions, including rotator cuff, quadriceps, hamstring, Achilles tendon, and tennis elbow injuries.

- The hospitals & clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan plasma therapy market is segmented by end user into hospitals & clinics, and research institutions. Among these, the hospitals & clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the plasma fractionation products being increasingly used off-label in hospitals to treat various diseases, and improved infrastructure and healthcare services. Besides, there is a high demand for plasma fractionation products owing to the advanced disorders that can be treated in contemporary clinical practices.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan plasma therapy market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Takeda Pharmaceutical Company Limited

- Plasmatreat Japan

- Taiho Pharmaceutical Co., Ltd.

- Biotest AG

- KM Biologics

- Fujirebio

- Nipro Corporation

- Kedrion

- Mitsubishi Tanabe Pharma Corporation

- Kyowa Kirin Co., Ltd.

- Grifols

- Others

Recent Developments:

- In September 2024, Takeda Pharmaceutical launched its plasma-derived treatment, Ceprotin (lyophilized human protein C concentrate), for complications of blood clotting with congenital protein C deficiency. The drug is approved for the prevention and treatment of venous thrombosis and purpura fulminans.

- In March 2023, Takeda announced that it would make around 100 billion yen in investment to construct a new factory for plasma-derived therapies (PDTs) in Osaka, Japan. This is Takeda's biggest ever manufacturing capacity growth investment in Japan.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan plasma therapy market based on the below-mentioned segments

Japan Plasma Therapy Market, By Type

- Pure Platelet-Rich Plasma

- Leukocyte-Rich PRP

- Pure Platelet-Rich Fibrin

- Leukocyte-Rich Fibrin

- Plasma Proteins

Japan Plasma Therapy Market, By Application

- Orthopedic

- Chronic Infectious Diseases

- Dermatology

- Dental

- Cardiac Muscle Injury

- Nerve Injury

Japan Plasma Therapy Market, By End User

- Hospitals & Clinics

- Research Institutions

Need help to buy this report?