Japan Pharmaceutical Packaging Market Size, Share, And COVID-19 Impact Analysis, By Packaging Type (Primary, Secondary, and Tertiary), By Drug Type (Oral Drugs, Injectable, Topical, Ocular/ Ophthalmic, Nasal, Sublingual, Pulmonary, Transdermal, IV Drugs, Others), By End-User (Pharma Manufacturing, Contract Packaging, Retail Pharmacy, Institutional Pharmacy), and Japan Pharmaceutical Packaging Market Insights, Industry Trend, Forecasts to 2033

Industry: HealthcareJapan Pharmaceutical Packaging Market Insights Forecasts to 2033

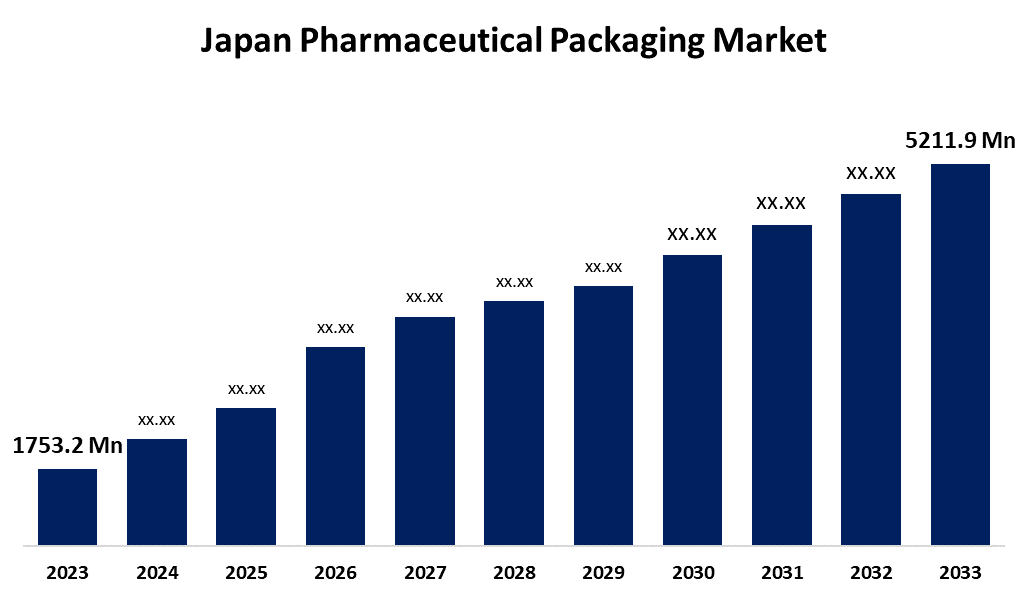

• The Japan Pharmaceutical Packaging Market Size Was Valued at around USD 1753.2 Million in 2023.

• The Japan Pharmaceutical Packaging Market Size is Expected to Grow at a CAGR of around 11.51% from 2023 to 2033.

• The Japan Pharmaceutical Packaging Size is Expected to Reach USD 5211.9 Million by 2033.

Get more details on this report -

The Japan Pharmaceutical Packaging Market Size is predicted to Grow from USD 1753.2 Million in 2023 to USD 5211.9 Million by 2033 at a CAGR of 11.51% during the forecast period. The pharmaceutical packaging forms experiencing high growth in the Japanese pharmaceutical packaging industry are blister packs and pre-filled syringes. Blister packs are more in demand due to their ability to dispense single doses, which improves patient compliance and insulates drugs against environmental conditions.

Market Overview

The Japan pharmaceutical packaging market is the sector responsible for designing, producing, and supplying drug packaging solutions in Japan. The market incorporates different types of packaging, materials, and packaging technologies that focus on the safety, effectiveness, and compliance of drugs from production through patient consumption. Additionally, the pharma companies are looking to curb plastic waste and opt for sustainable materials due to Japan's commitment towards environmental issues. The phenomenon contributes to the appeal of the packaging sector and helps the government in its mission to make sustainability a success. Furthermore, technological advancements such as intelligent packaging, which allows the use of NFC tags or QR codes in medicine traceability, are unfolding. Such breakthroughs enhance comprehensive drug management through enhanced security capabilities and provision of patients and professionals with helpful data.

Report Coverage

This research report categorizes the Japan pharmaceutical packaging market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyzes the key growth drivers, opportunities, and challenges influencing the Japan pharmaceutical packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyzes their core competencies in each sub-segment of the Japan pharmaceutical packaging market.

Japan Pharmaceutical Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023 : | USD 1753.2 Million |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 11.51% |

| 2033 Value Projection: | USD 5211.9 Million |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Packaging Type, By Drug Type, By End-User And COVID-19 Impact Analysis |

| Companies covered:: | Oji Holdings, Amcor, Takigawa, Nippon Paper, WestRock, Stora Enso, Mitsui Bussan Packaging Co., Ltd., Namicos, Körber, Nipro Corporation, Rengo Co., Ltd.,, Hosokawa Yoko Co. ltd, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

Japan pharmaceutical packaging market is boosted by an elderly population, prevalence of chronic disease, and need for safe and easy-to-use packaging. Support from governments with regard to environmentally friendly materials, technological innovations in the form of smart packaging, and growth of personalized medicine complement market growth even further. Each of these synergistically increases compliance, drug safety, and environment-friendliness, making Japan a global pharma packaging major with excellent future growth potential.

Restraints & Challenges

Japan's strict environmental laws are forcing the pharmaceutical packaging industry to become more sustainable. Blister packs, which are widely used in the sector, tend to have non-recyclable materials such as PVC, which adds to plastic waste. The dilemma is how to balance the requirement for effective, sterilized packaging with the need to minimize plastic use. This requires innovation in alternative materials, which can be technologically demanding and expensive.

Market Segmentation

The Japan pharmaceutical packaging market share is classified into packaging type, drug type, and end-user.

- The primary segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on packaging type, the Japan pharmaceutical packaging market is classified into primary, secondary, and tertiary. Among these, the primary segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is because of its direct contribution to maintaining drug integrity, assuring dosage accuracy, and adhering to stringent regulatory requirements. Increased demand for unit-dose packaging, prefilled syringes, and blister packs also helps fuel its high anticipated growth throughout the forecast period.

- The oral drug segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on drug type, the Japan pharmaceutical packaging market is classified into oral drugs, injectable, topical, ocular/ ophthalmic, nasal, sublingual, pulmonary, transdermal, IV drugs, and others. Among these, the oral drug segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This owing to its convenience of dosing, patient compliance, and affordability. Sustained demand for tablets and capsules in chronic and acute treatments, as well as evolving oral drug delivery formulations, fuels its growth at a high CAGR during the forecast period.

- The pharma manufacturing segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period.

Based on end-user, the Japan pharmaceutical packaging market is classified into pharma manufacturing, contract packaging, retail pharmacy, institutional pharmacy. Among these, the pharma manufacturing segment held the largest share in 2023 and is expected to grow at a significant CAGR during the forecast period. This is because of the increased production of branded and generic medicines, greater investment in sophisticated packaging technologies, and stringent regulatory requirements for traceability and safety. Ongoing innovation and automation of pharmaceutical manufacturing processes are likely to further accelerate its growth substantially.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan pharmaceutical packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Oji Holdings

- Amcor

- Takigawa

- Nippon Paper

- WestRock

- Stora Enso

- Mitsui Bussan Packaging Co., Ltd.

- Namicos

- Korber

- Nipro Corporation

- Rengo Co., Ltd.,

- Hosokawa Yoko Co. ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Key Market Developments

- In September 2024, Berlin Packaging, an American company, purchased Nissho Jitsugyo Co., Ltd. This is a Japanese firm that sells packaging products and services to diverse markets throughout the country. Berlin Packaging hopes to support its position in the Asia-Pacific region and improve its capacity to serve clients in Japan with its international packaging solutions through this purchase.

Market Segment

This study forecasts revenue at the global, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan pharmaceutical packaging market based on the below-mentioned segments

Japan Pharmaceutical Packaging Market, By Packaging Type

- Primary

- Secondary

- Tertiary

Japan Pharmaceutical Packaging Market, By Drug Type

- Oral Drugs

- Injectable

- Topical

- Ocular/ Ophthalmic

- Nasal

- Sublingual

- Pulmonary

- Transdermal

- IV Drugs

- Others

Japan Pharmaceutical Packaging Market, By End-User

- Pharma Manufacturing

- Contract Packaging

- Retail Pharmacy,

- Institutional Pharmacy

Need help to buy this report?