Japan Pet Food Market Size, Share, and COVID-19 Impact Analysis, By Animal Type (Dog, Cat, Bird, Others), By Distribution Channel (Supermarkets & Hypermarkets, Online Stores, Specialty Stores, Others), and Japan Pet Food Market Insights Forecasts to 2032

Industry: Food & BeveragesJapan Pet Food Market Insights Forecasts to 2032

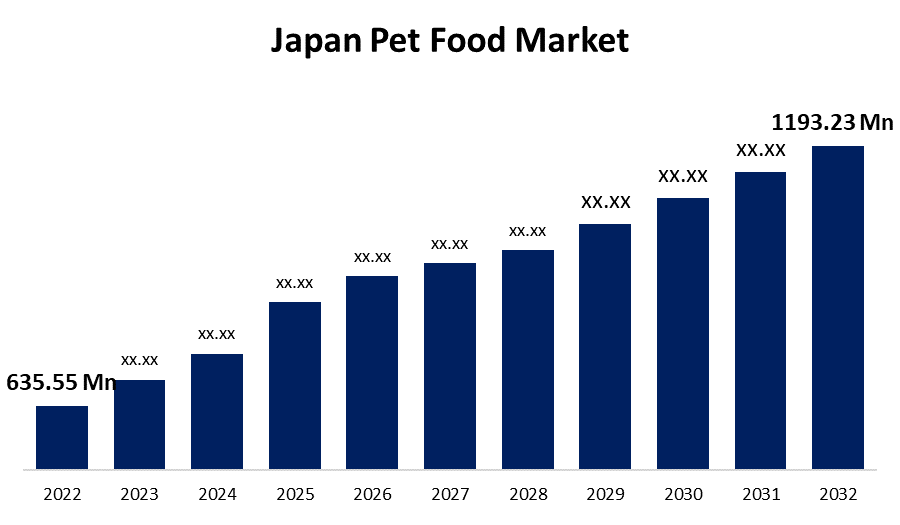

- The Japan Pet Food Market Size was valued at USD 635.55 Million in 2022.

- The Market is Growing at a CAGR of 6.5% from 2022 to 2032.

- The Japan Pet Food Market Size is expected to reach 1193.23 Million by 2032.

Get more details on this report -

The Japan Pet Food Market Size is expected to reach USD 1193.23 Million by 2032, at a CAGR of 6.5% during the forecast period 2022 to 2032.

Market Overview

Pet food is defined as processed extracts from plants or animals that are safe for pets to eat. It has been meticulously formulated to provide a balanced blend of essential nutrients for a dog’s health and well-being. Fish derivatives, animal derivatives, fruit and vegetable derivatives, cereal and cereal by-products, fats and oils, vitamins and minerals, and other additives are common in pet food. This type of food provides numerous health benefits for pets, including increased immunity, weight maintenance, increased life expectancy, reduced risk of skin ailments and allergies, and reduced digestive disorders. It also provides a convenient and time-saving solution for pet owners. In Japan, pet is considered as a family member, therefore Japanese take good care of their pets. Rising per capita income, rising disposable income, and pet humanization are the major factors driving the Japan pet food market. As a result, there has been a shift toward a focus on pet health, as well as an increase in consumer spending on a variety of premium and super-premium high-quality pet foods, as well as specialized healthy and therapeutic pet foods. This is compelling manufacturers to create high-quality foods with a focus on natural and organic ingredients. Dry food is the most popular product in Japan. However, due to the high digestibility of wet food, demand for wet food is increasing.

Report Coverage

This research report categorizes the market for Japan pet food market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan pet food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan pet food market.

Japan Pet Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD 635.55 Million |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 6.5% |

| 2032 Value Projection: | USD 1193.23 Million |

| Historical Data for: | 2019-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 120 |

| Segments covered: | COVID-19 Impact Analysis, By Animal Type, By Distribution Channel, |

| Companies covered:: | Mars Inc, Nestle SA, Colgate Palmolive (Hill’s Pet Nutrition), Maruha Nichiro Holdings Inc, Nutriara Alimentos Ltd., Royal Canin, Hill’s Pet Nutrition, Unicharm, and Others key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rising rate of pet ownership in Japan, particularly in developing areas, is expected to be one of the primary market drivers. Rising urbanization and pet humanization are encouraging pet owners to choose nutritious and high-quality food for their pets, which is boosting the Japan pet food market's growth rate. Consumer’s rising per capita income motivates them to spend on healthy and organic food products for their pets to improve their health. Furthermore, the easy availability of products in a variety of price ranges is promoting growth in the Japanese pet food market. They provide consumers with varying financial status and a variety of options. Rising pet food manufacturer’s innovation to positively influence the market. The key Japan market players are focusing on launching a variety of pet food products to meet the needs of various types of animals of varying ages. This is expected to drive growth in Japan's pet food market during the forecast period.

Restraining Factors

Pet food comes under the most highly regulated food products, especially across the Japan markets. In the Japan markets, pet animal foods are examined stringently at every stage, from the ingredients utilized in the food preparation to their sales and marketing. The high stringency associated with commercialization can be a major restraining factor for the growth of the Japan pet food market. Moreover, lower acceptance for premium or high-priced pet food across some developing markets can also be an obstacle to the growth of the Japan pet food market.

Market Segment

- In 2022, the cat segment accounted for the largest revenue share over the forecast period.

Based on animal type, Japan pet food market is segmented into dogs, cats, birds, and others. Among these, the cat segment has the largest revenue share over the forecast period. Customers in Japan spend a lot of money on premium dry cat food. Cats are gaining popularity, particularly due to the increasing urbanization and apartment living trend. With the increased popularity of cats as pets, cat food manufacturers have increased their efforts to provide more cat food options. Gourmet products for cats play a major role in driving Japan pet food market growth over the forecast period, as cat owners are increasingly feeding their cats premium food treats and mixers, and manufacturers are entering the lucrative Japanese cat food market.

- In 2022, the specialty stores segment accounted for the largest revenue share over the forecast period.

Based on distribution channels, the Japan pet food market is segmented into supermarkets & hypermarkets, online stores, specialty stores, and others. Among these, the specialty stores segment has the largest revenue share over the forecast period. The most common distribution channel for pet foods in Japan is through importers and wholesalers to specialized pet food stores, and in some cases, secondary wholesalers to retailers. In the case of Japanese manufacturers that own production facilities abroad, products are imported directly inside the company or through its subsidiaries and then distributed to the retailers through wholesalers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within Japan’s pet food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mars Inc

- Nestle SA

- Colgate Palmolive (Hill's Pet Nutrition)

- Maruha Nichiro Holdings Inc

- Nutriara Alimentos Ltd.

- Royal Canin

- Hill's Pet Nutrition

- Unicharm

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In April 2021, In Japan, V-planet introduced vegan dog food. Through Japanese distributor Whoolefoods Inc., the products are 100% plant-based, nutritionally complete, and non-GMO, including vegan kibble.

- In April 2021, Unicharm introduced AllWell cat food. The recipes include a patented formula that the company claims are the world's first 'dietary fibre blending technology' for reducing meal regurgitation. According to the brand, reducing regurgitation ensures that cats can absorb all of the nutrients in the cat food, avoiding malnutrition.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented Japan pet food market based on the below-mentioned segments:

Japan Pet Food Market, By Animal Type

- Dog

- Cat

- Birds

- Others

Japan Pet Food Market, By Distribution Channel

- Supermarkets & Hypermarkets

- Online Stores

- Specialty Stores

- Others

Need help to buy this report?