Japan Peritoneal Dialysis Market Size, Share, and COVID-19 Impact Analysis, By Type (Continuous Ambulatory Peritoneal Dialysis (CAPD) and Automated Peritoneal Dialysis (APD)), By Product (Peritoneal Dialysis Machines, Dialysis Solutions, Dialysis Catheters, and Others), and Japan Peritoneal Dialysis Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Peritoneal Dialysis Market Insights Forecasts to 2035

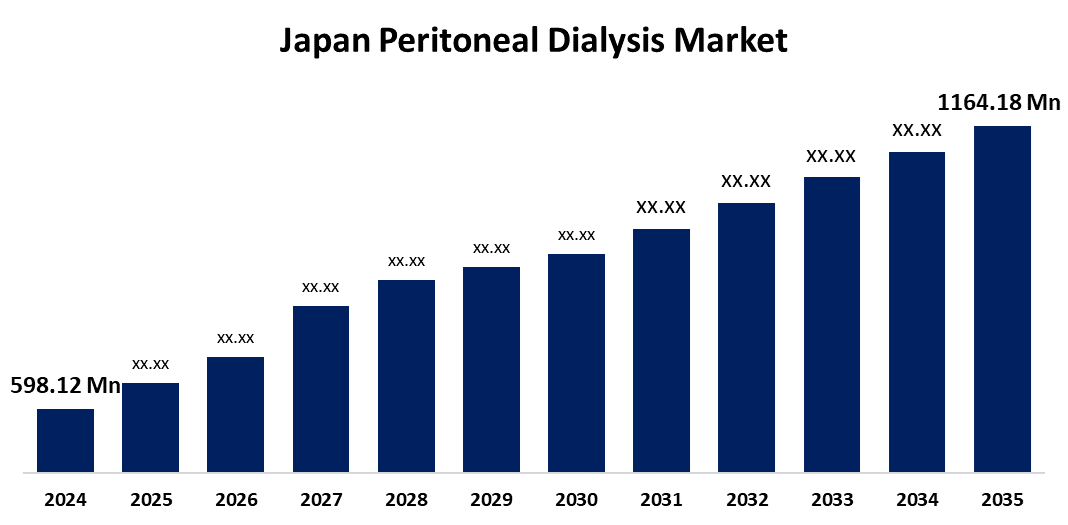

- The Japan Peritoneal Dialysis Market Size Was Estimated at USD 598.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.24% from 2025 to 2035

- The Japan Peritoneal Dialysis Market Size is Expected to Reach USD 1164.18 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Peritoneal Dialysis Market Size is anticipated to reach USD 1164.18 Million by 2035, growing at a CAGR of 6.24% from 2025 to 2035. The growing prevalence of chronic kidney disease (CKD) and a rapidly aging population in Japan are major drivers of the peritoneal dialysis market. The government’s push for home-based dialysis to reduce hospital burden also supports PD adoption.

Market Overview

The Japan peritoneal dialysis market refers to the segment of renal care focused on treating end-stage renal disease (ESRD) through peritoneal dialysis (PD), a home-based therapy that uses the patient’s peritoneum to filter waste from the blood. It includes PD solutions, catheters, cyclers, and related services. A sizable portion of the population of Japan is over 65, making it one of the oldest countries in the world. The need for dialysis treatments rises as the population ages and becomes more vulnerable to diseases like kidney failure. The convenience and adaptability of home dialysis treatments appeal to older patients, which makes peritoneal dialysis a desirable alternative that is promoting their uptake. As the number of senior people rises, the trend toward home-based therapies is anticipated to continue, which will further propel market growth.

Report Coverage

This research report categorizes the market for the Japan peritoneal dialysis market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan peritoneal dialysis market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan peritoneal dialysis market.

Japan Peritoneal Dialysis Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 598.12 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.24% |

| 2035 Value Projection: | USD 1164.18 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Type, By Product and COVID-19 Impact Analysis |

| Companies covered:: | Nipro Corporation, Baxter International Inc., Fresenius Medical Care, Terumo Corporation, Asahi Kasei Medical Co., Ltd., Huaren Pharmaceutical Co., Ltd., JMS Co., Ltd. and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The aging population, the rising incidence of renal disorders, and the expanding use of home-based dialysis treatments are the main factors propelling the peritoneal dialysis market in Japan. Peritoneal dialysis is a feasible option for the growing need for easy and affordable substitutes for in-center hemodialysis as the number of patients with chronic kidney disease increases. Additionally, improving patient outcomes and treatment efficiency are technological developments in automated peritoneal dialysis equipment, dialysate solutions, and catheters. Peritoneal dialysis is also becoming more widely available in Japan thanks to government programs and healthcare reforms. Peritoneal dialysis is becoming more widely used as a result of the shift towards remote monitoring and home healthcare, which gives patients more treatment alternatives.

Restraining Factors

Peritoneal dialysis has several advantages, but its uptake in Japan is restricted because of patient worries about self-administration and the possibility of infections such peritonitis. Because of the frequent supervision, a lot of senior patients also like in-center hemodialysis. The adoption of PD is further hampered by the initial training needed and the absence of caregiver support in single-person households. Furthermore, the lack of knowledge and the predilection of doctors for hemodialysis in cities serve as obstacles to the broader implementation of PD.

Market Segmentation

The Japan peritoneal dialysis market share is classified into type and product.

- The continuous ambulatory peritoneal dialysis (CAPD) segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan peritoneal dialysis market is segmented by product type into continuous ambulatory peritoneal dialysis (CAPD) and automated peritoneal dialysis (APD). Among these, the continuous ambulatory peritoneal dialysis (CAPD) segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. CAPD is still a popular technique, particularly for patients who would rather employ a manual, non-automated procedure. Although this kind of dialysis offers more flexibility, it also necessitates a high level of patient engagement because it needs patients to complete exchanges multiple times during the day.

- The peritoneal dialysis machines segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan peritoneal dialysis market is segmented by product into peritoneal dialysis machines, dialysis solutions, dialysis catheters, and others. Among these, the peritoneal dialysis machines segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The ability of peritoneal dialysis equipment, especially automated systems, to support home-based dialysis is a growing trend in Japan is driving up demand for these machines.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan peritoneal dialysis market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nipro Corporation

- Baxter International Inc.

- Fresenius Medical Care

- Terumo Corporation

- Asahi Kasei Medical Co., Ltd.

- Huaren Pharmaceutical Co., Ltd.

- JMS Co., Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Peritoneal Dialysis Market based on the below-mentioned segments:

Japan Peritoneal Dialysis Market, By Type

- Continuous Ambulatory Peritoneal Dialysis (CAPD)

- Automated Peritoneal Dialysis (APD)

Japan Peritoneal Dialysis Market, By Product

- Peritoneal Dialysis Machines

- Dialysis Solutions

- Dialysis Catheters

- Others

Need help to buy this report?