Japan Passive Optical Networks Market Size, Share, and COVID-19 Impact Analysis, By Components (Optical Line Terminal (OLT), Optical Network Terminal (ONT), and Optical Splitters), By Structure (Gigabit Passive Optical Networks (GPON), Ethernet Passive Optical Networks (EPON), Wavelength Division Multiplexing Passive Optical Networks (WDM-PON), and Others), and Japan Passive optical networks Market Insights, Industry Trend, Forecasts to 2033.

Industry: Information & TechnologyJapan Passive Optical Networks Market Insights Forecasts to 2033

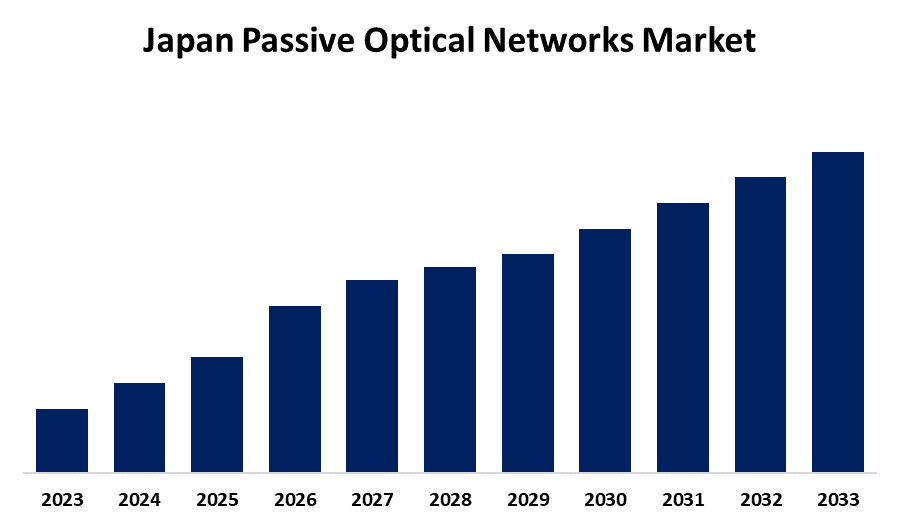

- The Japan Passive Optical Networks Market is Growing at a CAGR of from 2023 to 2033

- The Japan Passive Optical Networks Market Size is Expected to hold a significant share by 2033

Get more details on this report -

The Japan Passive Optical Networks Market Size is Anticipated to hold a significant share by 2033, Growing at a CAGR of from 2023 to 2033.

Market Overview

The Japan passive optical networks (PON) market refers to the industry focused on the deployment and advancement of fiber-optic-based network solutions in Japan. The use of passive optical networks is also being accelerated by the rising need for flexible and scalable network architectures. PON arrangements provide scalability and flexibility that are challenging to attain with conventional copper-based networks by supporting numerous data transmission types, such as voice, video, and internet, using a single optical fiber. Japan, with its advanced telecommunications infrastructure, has been actively investing in PON technology to support its growing digital economy and high-speed connectivity demands. Service providers are especially drawn to this capability in expanding and heavily populated urban areas where infrastructure expansion is essential. In Japan, densely populated cities like Tokyo and Osaka require robust network solutions, making PON a preferred choice for ensuring seamless connectivity and efficient data transmission.

Report Coverage

This research report categorizes the market for the Japan passive optical networks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan passive optical networks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan passive optical networks market.

Japan Passive Optical Networks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 240 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Components, By Structure and COVID-19 Impact Analysis |

| Companies covered:: | ZTE Corporation, Nokia, Calix, Fujitsu, Mitsubishi Electric Corporation, NXP Semiconductors, ADTRAN Inc., Huawei Technologies Co. Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing need for high-capacity network solutions that can handle the exponential rise in data traffic is one of the main factors propelling the Passive Optical Network (PON) market's expansion in Japan. In the age of cloud computing, online streaming services, and the Internet of Things (IoT), fiber-optic technology—which serves as the backbone of PON—is perfectly suited to managing massive data volumes. Japan, known for its advanced telecommunications infrastructure, has been actively investing in PON technology to support its high-speed internet demands and digital transformation initiatives. PON technology growth is being driven by the growing need for continuous, high-speed connectivity as consumer and business activities move more and more online. The requirement for PON is further increased by the move toward smart city initiatives and the growing use of 5G networks, which call for reliable backhaul solutions.

Restraining Factors

The market for passive optical networks is not without difficulties, despite the encouraging prospects. The high initial cost of establishing fiber optic networks is one of the main obstacles, which can be a deterrent for smaller service providers and those that operate in areas with limited funding.

Market Segmentation

The Japan passive optical networks market share is classified into components and structure.

- The optical line terminal (OLT) segment is expected to hold a significant market share through the forecast period.

The Japan passive optical networks market is segmented by components into optical line terminal (OLT), optical network terminal (ONT), and optical splitters. Among these, the optical line terminal (OLT) segment is expected to hold a significant market share through the forecast period. Data transmission and reception to and from the ONTs are handled by optical line terminals, which are situated at the service provider's central site.

- The gigabit passive optical networks (GPON) segment is expected to hold a significant market share through the forecast period.

The Japan passive optical networks market is segmented by structure into gigabit passive optical networks (GPON), ethernet passive optical networks (EPON), wavelength division multiplexing passive optical networks (WDM-pon), and others. Among these, the gigabit passive optical networks (GPON) segment is expected to hold a significant market share through the forecast period. One of the most popular types is GPON, which provides high bandwidth and effective long-distance data transfer. Telecom providers seeking to offer full broadband services to a large consumer base favor GPON due to its scalability and dependability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan passive optical networks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- ZTE Corporation

- Nokia

- Calix

- Fujitsu

- Mitsubishi Electric Corporation

- NXP Semiconductors

- ADTRAN Inc.

- Huawei Technologies Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the Japan Passive Optical Networks Market based on the below-mentioned segments

Japan Passive Optical Networks Market, By Components

- Optical Line Terminal (OLT)

- Optical Network Terminal (ONT)

- Optical Splitters

Japan Passive Optical Networks Market, By Structure

- Gigabit Passive Optical Networks (GPON)

- Ethernet Passive Optical Networks (EPON)

- Wavelength Division Multiplexing Passive Optical Networks (WDM-PON)

- Others

Need help to buy this report?