Japan Paper and Paperboard Packaging Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Corrugated Boxes, Bags & Sacks, Folding Cartons, Wraps, Cups & Trays, and Others), By Material (Recycled Paper, Virgin Paper, Kraft Paper, and Others), By Application (Food and Beverage, Personal Care & Homecare, Pharmaceutical & Healthcare, Retail & E-commerce, Automotive, and Others), and Japan Paper and Paperboard Packaging Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Paper and Paperboard Packaging Market Insights Forecasts to 2035

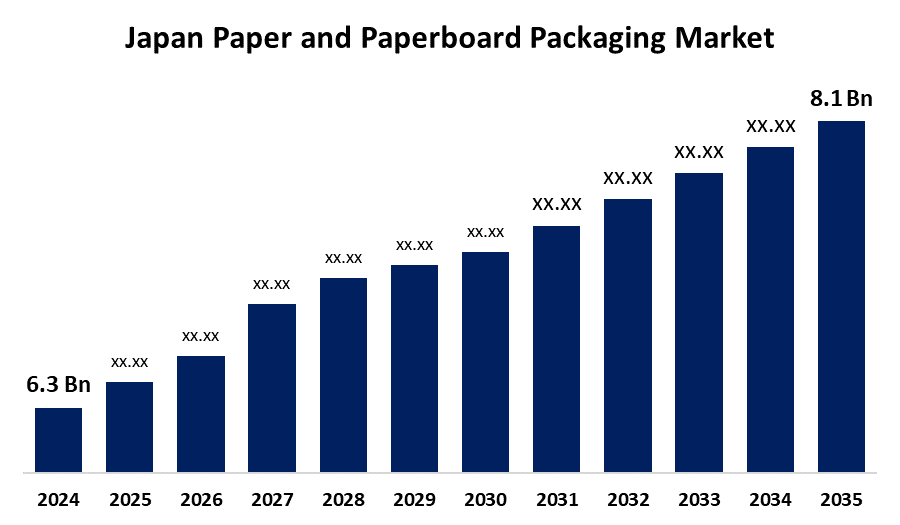

- The Japan Paper and Paperboard Packaging Market Size Was Estimated at USD 6.3 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 2.31% from 2025 to 2035

- The Japan Paper and Paperboard Packaging Market Size is Expected to Reach USD 8.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Paper and Paperboard Packaging Market is Anticipated to Reach USD 8.1 Billion by 2035, Growing at a CAGR of 2.31% from 2025 to 2035. The Japan paper and paperboard packaging market is growing due to rising environmental consciousness, government efforts to curb plastic waste, and the increase in demand for eco-friendly packaging solutions.

Market Overview

The Japan paper and paperboard packaging market refers to the sector dedicated to manufacturing and supplying packaging materials based on paper, such as cartons, boxes, and wrapping paper, mainly for food, beverage, drugs, cosmetics, and online shopping products. These materials provide light-weight, recyclable, and biodegradable packaging alternatives, which are popular in green packaging. Chances are that the formulation of smart and functional packaging, along with the implementation of high-end printing and coating technologies. The market is driven by heightened consumer consciousness of environmental problems, escalated demand for green alternatives to plastic, and growth in the e-commerce industry. Japan's robust recycling infrastructure, technological advancements, and superior production capacities further fuel market expansion. There are government policies, including Japan's Plastic Resource Circulation Strategy and single-use plastic reduction activities, driving people toward the direction of paper-based options.

Report Coverage

This research report categorizes the market for the Japan paper and paperboard packaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each sub-market. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan paper and paperboard packaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan paper and paperboard packaging market.

Japan Paper and Paperboard Packaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.3 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 2.31% |

| 2035 Value Projection: | USD 8.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Material, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Nippon Paper Industries, Amcor Japan, Oji Holdings Corp., Toppan Inc., Takemoto Yohki Co., Ltd., Rengo Co., Ltd., Sealed Air Japan, Toyo Seikan Group Holdings, Ltd., Smurfit Kappa Group, Japan Pulp & Paper Co., Ltd and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan paper and paperboard packaging market is fueled by a rise in demand for sustainable and green packaging solutions, in line with consumer attitudes and government regulation towards environmental responsibility. The growth of e-commerce and food delivery further enhances the demand for strong, light packaging. Also, advances in biodegradable and recyclable material sustain market growth. Japan's ageing population and urban living also promote demand for convenient, smaller pack sizes, while design innovation and functionality boost the demand for paper-based packaging across sectors.

Restraining Factors

The Japan market for paper and paperboard packaging is facing several challenges. Increasing raw material prices, labor shortages, and supply chain interruptions put pressure on production capacity. Ageing demographics and strict labor reforms compound labor shortages. External worldwide economic uncertainties influence material availability and logistics, undermining market stability.

Market Segmentation

The Japan paper and paperboard packaging market share is classified into product type, material, and application.

- The corrugated boxes segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan paper and paperboard packaging market is segmented by product type into corrugated boxes, bags & sacks, folding cartons, wraps, cups & trays, and others. Among these, the corrugated boxes segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to strengthen their product branding and to fulfill specific packaging needs. The corrugated boxes are manufactured from recycled material and can be customized in different sizes & designs.

- The recycled paper segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan paper and paperboard packaging market is segmented by material into recycled paper, virgin paper, kraft paper, and others. Among these, the recycled paper segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to that they are an economical solution in comparison to other materials, while they also satisfy the sustainable packaging laws. The prohibition on single-use plastic by the government and increasing customer demand for environmentally friendly packaging are driving the expansion of this material

- The food and beverage segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan paper and paperboard packaging market is segmented by application into food and beverage, personal care & homecare, pharmaceutical & healthcare, retail & e-commerce, automotive, and others. Among these, the food and beverage segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the rising consumers' demand for sustainability and regulations. The growing demand for convenience food and on-the-go consumption has boosted the demand for lightweight and convenient packaging solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan paper and paperboard packaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Paper Industries

- Amcor Japan

- Oji Holdings Corp.

- Toppan Inc.

- Takemoto Yohki Co., Ltd.

- Rengo Co., Ltd.

- Sealed Air Japan

- Toyo Seikan Group Holdings, Ltd.

- Smurfit Kappa Group

- Japan Pulp & Paper Co., Ltd.

- Others

Recent Developments:

- In October 2024, Japan Pulp & Paper Co., Ltd. announced that BJ Ball Limited, a subsidiary of its Ball & Doggett Group, has taken over a flexible packaging business in New Zealand. Further, Ball & Doggett Pty Ltd, another subsidiary of the Group, has purchased a sign & display business in Australia, reinforcing its presence in both industries in Oceania.

- In July 2024, Rengo Co., Ltd. acquired 100% of Shibata Cardboard Co., Ltd. as a subsidiary. Founded in 1962, Shibata Cardboard is a manufacturer of corrugated boxes with a solid domestic customer base in Toyohashi, Aichi Prefecture. Rengo aims to promote cooperation among Shibata Cardboard and its factory, and other Rengo Group companies, to solidify its corrugated packaging business in eastern Aichi and surrounding regions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan paper and paperboard packaging market based on the below-mentioned segments:

Japan Paper and Paperboard Packaging Market, By Product Type

- Corrugated Boxes

- Bags & Sacks

- Folding Cartons

- Wraps

- Cups & Trays

- Others

Japan Paper and Paperboard Packaging Market, By Material

- Recycled Paper

- Virgin Paper

- Kraft Paper

- Others

Japan Paper and Paperboard Packaging Market, By Application

- Food and Beverage

- Personal Care & Homecare

- Pharmaceutical & Healthcare

- Retail & E-commerce

- Automotive

- Others

Need help to buy this report?