Japan Paint Additives Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Acrylics, Fluoropolymers, Urethanes, Metallic Additives, and Others), By Application (Rheology Modification, Biocide Impact Modification, Wetting and Dispersion, Anti-Foaming, and Others), By End-use (Industrial, Automotive, Architectural, Wood and Furniture, and Others), and Japan Paint Additives Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsJapan Paint Additives Market Insights Forecasts to 2035

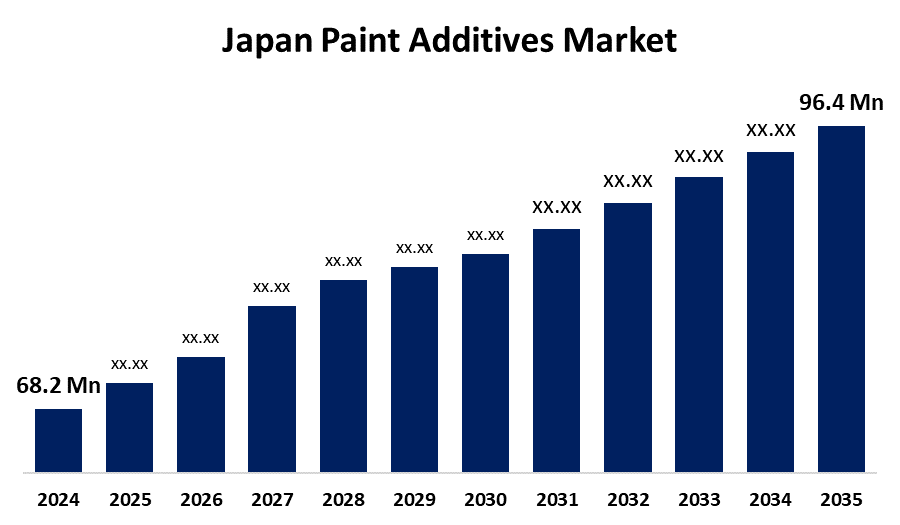

- The Japan Paint Additives Market Size Was Estimated at USD 68.2 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.2% from 2025 to 2035

- The Japan Paint Additives Market Size is Expected to Reach USD 96.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan paint additives market is anticipated to reach USD 96.4 million by 2035, growing at a CAGR of 3.2% from 2025 to 2035. The Japan market for paint additives increases with growing construction and automotive industries, increasing demand for high-performance, environmentally friendly coatings, technological development in formulations, and stringent environmental regulations, propelling innovative, sustainable paint additives development and uptake across industries.

Market Overview

The Japan market for paint additives refers to chemical additives used in paints to improve characteristics like durability, drying time, corrosion resistance, and finish. These additives find broad application in various industries such as automotive, construction, aerospace, and furniture to improve paint performance and satisfy application-specific requirements. Product development and adoption are supported by Japan's robust manufacturing base and focus on technology. The scope for the growth of bio-based and low-VOC additives is in keeping pace with environmental legislations and customer demand for eco-friendly products. Market growth is fueled by growing demand from the construction and automotive industries, as well as technological innovation and development in sustainable and environmentally friendly additive technologies. Government policies encouraging green building practices and tighter emission norms add to market growth. The interdependent partnership between paint manufacturers and additive producers also enables personalized solutions to match changing industry requirements.

Report Coverage

This research report categorizes the market for the Japan paint additives market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan paint additives market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan paint additives market.

Japan Paint Additives Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 68.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.2% |

| 2035 Value Projection: | USD 96.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 114 |

| Segments covered: | By Product Type, By Application, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Daikin Industries, Arakawa Paint Industry Co., Ltd., BASF, Shin Etsu Chemical, AGC Coatec Co., Ltd, Asahi Kasei, Nippon Paint, Mitsui Chemicals, Cabot Corporation, Michelman Japan LLC, Evonik Industries, San Nopco Limited, Kyoeisha Chemical, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan paint additives market is boosted by increasing demand from automotive and construction, which need resistant, high-performance coatings. Rising focus on environmentally friendly, low-VOC additives to achieve strict environmental controls also drives growth. Technological innovation allows for the production of new additives that increase paint characteristics such as drying time and corrosion protection. Furthermore, increased consumer awareness of sustainable products and government support of green building practices also contribute to the drive for adopting innovative paint additives in Japan.

Restraining Factors

The Japan paint additives market is restricted by high raw material prices, stringent environmental regulations, and stiff competition. Volatility in the price of ingredients and sophisticated compliance impose operating costs, while substitute low-priced materials threaten profitability, collectively holding back market expansion and profitability.

Market Segmentation

The Japan paint additives market share is classified into product type, application, and end-use.

- The acrylics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan paint additives market is segmented by product type into acrylics, fluoropolymers, urethanes, metallic additives, and others. Among these, the acrylics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they promote durability of paint, water resistance, and retention of color, and are suited for interior and exterior applications. They resist peeling, cracking, and fading, are compatible with low-VOC, water-based systems, and contribute to indoor air quality, providing a sustainable, user, and environmentally friendly solution to traditional additives.

- The rheology modification segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan paint additives market is segmented by application into rheology modification, biocide impact modification, wetting and dispersion, anti-foaming, and others. Among these, the rheology modification segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its essential function in enhancing the consistency, stability, and application properties of paint. This division improves flow control, avoids sag, and provides for even coating, thus playing a critical role in high-performance paint quality in diverse industries and applications.

- The industrial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan paint additives market is segmented by end-use into industrial, automotive, architectural, wood and furniture, and others. Among these, the industrial segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the extensive uses in machinery, equipment, and infrastructure. The coatings need to be highly durable, resistant to corrosion, and function under severe conditions. Demand for long-term, protective coatings in manufacturing and heavy industries propels strong demand for advanced paint additives.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan paint additives market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Daikin Industries

- Arakawa Paint Industry Co., Ltd.

- BASF

- Shin Etsu Chemical

- AGC Coatec Co., Ltd

- Asahi Kasei

- Nippon Paint

- Mitsui Chemicals

- Cabot Corporation

- Michelman Japan LLC

- Evonik Industries

- San Nopco Limited

- Kyoeisha Chemical

- Others

Recent Developments:

- In April 2024, Shin-Etsu Chemical acquired Setex Technologies’ biomimicry-based dry adhesive technology, inspired by gecko feet, to expand into new markets. This innovative friction and adhesion technology, combined with Shin-Etsu’s material expertise, enables applications across various industries without chemical adhesives, targeting corporate markets while Setex focuses on consumer use.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan paint additives market based on the below-mentioned segments:

Japan Paint Additives Market, By Product Type

- Acrylics

- Fluoropolymers

- Urethanes

- Metallic Additives

- Others

Japan Paint Additives Market, By Application

- Rheology Modification

- Biocide Impact Modification

- Wetting and Dispersion

- Anti-Foaming

- Others

Japan Paint Additives Market, By End-use

- Industrial

- Automotive

- Architectural

- Wood and Furniture

- Others

Need help to buy this report?