Japan Pain Management Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Neuromodulation and Neurostimulation Devices, Analgesic Infusion Pumps, and Ablation Devices), By Applications (Cancer Pain, Neuropathic Pain, Facial and Migraine Pain, Musculoskeletal Pain, and Others), and Japan Pain Management Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Pain Management Devices Market Insights Forecasts to 2035

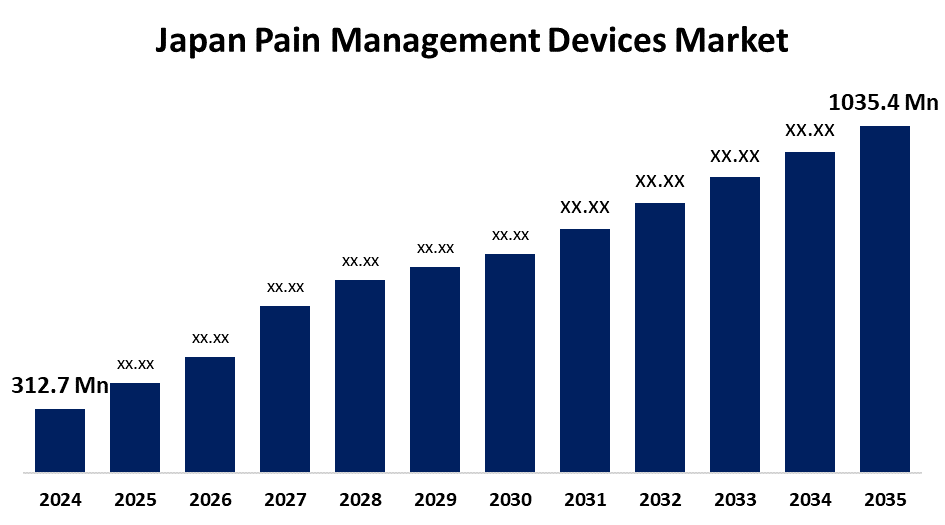

- The Japan Pain Management Devices Market Size Was Estimated at USD 312.7 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 11.5% from 2025 to 2035

- The Japan Pain Management Devices Market Size is Expected to Reach USD 1035.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan pain management devices market is anticipated to reach USD 1035.4 million by 2035, growing at a CAGR of 11.5% from 2025 to 2035. The Japan pain management devices market is growing due to a rise in chronic diseases, an aging population, and ongoing technological advancements. A rise in cases of arthritis and diabetes, as well as increased awareness about alternative pain management, is fueling the demand for innovative pain management devices in all types of healthcare facilities.

Market Overview

The Japan pain management devices market refers to advanced medical devices such as neurostimulators and infusion pumps to diagnose, monitor, and manage acute and chronic pain conditions. These appliances are utilized for managing long-term and short-term chronic conditions like neuropathic, musculoskeletal, cancer-related, and facial pain, and provide alternatives to opioids. Competitive advantages of the market are its sophisticated healthcare infrastructure, high adoption of minimally invasive and neuromodulation therapies by hospitals, and robust local distribution channels. Opportunities lie in customized pain solutions, home care, telemedicine integration, and hospital and rehab center collaborations. Market drivers are Japan's ageing population at a fast pace, increased prevalence of chronic pain, rising healthcare spend, and government support for pain relief technologies. Initiatives by the government, such as MHLW/PMDA's investment, reimbursement incentives for nerve stimulator uptake, and support under Japan's Medical Device Law, also improve the ecosystem.

Report Coverage

This research report categorizes the market for the Japan pain management devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan pain management devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan pain management devices market.

Japan Pain Management Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 312.7 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 11.5% |

| 2035 Value Projection: | USD 1035.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, By Applications and COVID-19 Impact Analysis |

| Companies covered:: | Omron Corporation, Hisamitsu Pharmaceutical Co., Inc., Stryker Corporation, B. Braun Melsungen AG, Nipro, Medtronic, Nihon Kohden Corporation, Abbott Laboratories, Medi Tec Co., Ltd., Terumo Corporation, Nevro Corp., Boston Scientific Corporation, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan pain management devices market is influenced by an ageing population, rising incidence of chronic conditions, and expanding demand for alternatives to opioids. Advances in neurostimulation technology, radiofrequency ablation, and wearable technology improve treatment efficacy and patient comfort. Accelerating healthcare spending and increasing insurance coverage drive device uptake. Moreover, the government's focus on increasing geriatric care and the development of minimally invasive pain therapies further fuels market growth, stimulating the adoption of cutting-edge pain management devices in clinical and homecare settings.

Restraining Factors

The Japan market for pain management devices is inhibited by expenses, limited reimbursement, and strict regulatory clearances. Lack of trained professionals in neuromodulation and availability of low-cost pharmaceutical options also inhibit universal adoption and delay overall market growth.

Market Segmentation

The Japan pain management devices market share is classified into type and applications.

- The neuromodulation and neurostimulation devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan pain management devices market is segmented by type into neuromodulation and neurostimulation devices, analgesic infusion pumps, and ablation devices. Among these, the neuromodulation and neurostimulation devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their demonstrated effectiveness in the treatment of various chronic pain syndromes with minimal invasiveness. They provide adjustable, focused pain relief, increasing patient quality of life. Expanded use in hospitals and pain clinics, combined with advances such as implantable stimulators and wearable devices, fuels their robust market performance and expansion.

- The neuropathic pain segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan pain management devices market is segmented by applications into cancer pain, neuropathic pain, facial and migraine pain, musculoskeletal pain, and others. Among these, the neuropathic pain segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the very high incidence of conditions such as diabetic neuropathy and postherpetic neuralgia. Its multifaceted nature typically necessitates sophisticated interventions such as neurostimulation, with demand generating in this application segment and fuelling the overall market development.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan pain management devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Omron Corporation

- Hisamitsu Pharmaceutical Co., Inc.

- Stryker Corporation

- B. Braun Melsungen AG

- Nipro

- Medtronic

- Nihon Kohden Corporation

- Abbott Laboratories

- Medi Tec Co., Ltd.

- Terumo Corporation

- Nevro Corp.

- Boston Scientific Corporation

- Others

Recent Developments:

- In June 2024, Medasense partnered with Nihon Kohden to exclusively distribute its AI-powered nociception monitor in Japan, pending regulatory approval. The device uses the NOL Index to provide real-time, objective pain monitoring, optimizing analgesia. Clinical studies show it reduces intraoperative opioid use and improves post-operative pain scores and patient recovery outcomes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan pain management devices market based on the below-mentioned segments:

Japan Pain Management Devices Market, By Type

- Neuromodulation and Neurostimulation Devices

- Analgesic Infusion Pumps

- Ablation Devices

Japan Pain Management Devices Market, By Applications

- Cancer Pain

- Neuropathic Pain

- Facial and Migraine Pain

- Musculoskeletal Pain

- Others

Need help to buy this report?