Japan Orthopedic Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Joint Replacement/Orthopedic Implants, Sports Medicine, Orthobiologics, and Others), By End Use (Hospitals and Outpatient Facilities), and Japan Orthopedic Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Orthopedic Devices Market Size Insights Forecasts to 2035

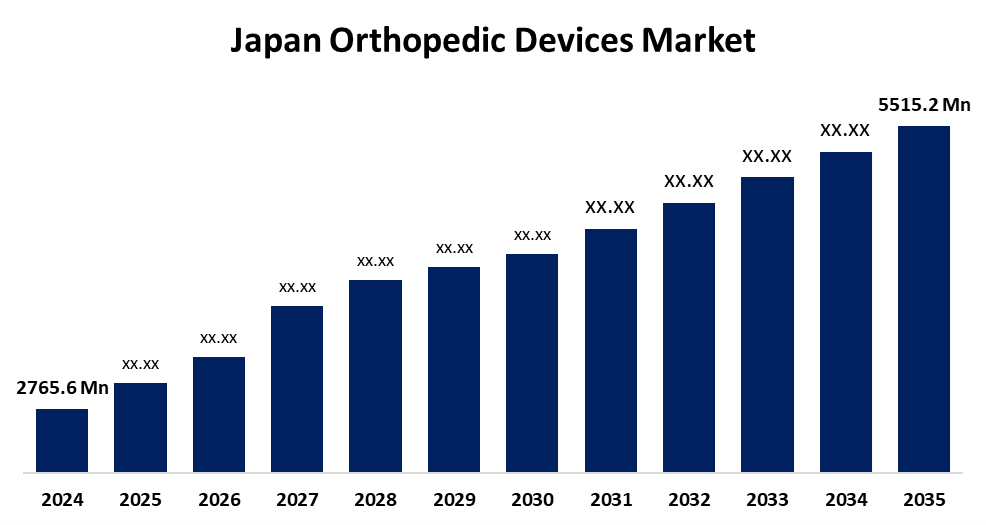

- The Japan Orthopedic Devices Market Size Was Estimated at USD 2765.6 million in 2024

- The Market Size is Expected to Grow at a CAGR of Around 6.48 % from 2025 to 2035

- The Japan Orthopedic Devices Market Size is Expected to Reach USD 5515.2 million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Orthopedic Devices Market Size is anticipated to reach USD 5515.2 million by 2035, growing at a CAGR of 6.48 % from 2025 to 2035. The orthopedic devices market in Japan is driven by various factors, including rising prevalence of orthopedic disorders, rising aging population, rising number of road accidents, availability of advanced orthopedic devices, and rapid development in healthcare infrastructure.

Market Overview

The devices that are used to treat, diagnose, and manage musculoskeletal conditions are known as orthopedic devices. The Japan orthopedic devices market refers to the design, manufacturing, and distribution of equipment and accessories to treat musculoskeletal conditions, including bones, joints, and muscles. These devices can be broadly classified into two categories: external devices, such as braces and splints, which give support and stability from the outside of the body, and implants, which are implanted inside the body to replace or support bones and joints. Orthopedic device includes joint replacement/orthopedic implants, sports medicine, and orthobiologics. Japan's rising geriatric population is a major contributor to the orthopedic interventions, especially joint replacements, as elderly citizens seek to maintain mobility. The need for orthopaedic equipment has increased in Japan as a result of a 12% rise in injuries brought on by increased sports activity. An increasing number of young athletes and investments in sports infrastructure are fueling the market expansion.

Report Coverage

This research report categorizes the market for the Japan orthopedic devices market based on various segments and regions, and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan orthopedic devices market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan orthopedic devices market.

Japan Orthopedic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2765.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.48 % |

| 2035 Value Projection: | USD 5515.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Product, By End Use and COVID-19 Impact Analysis |

| Companies covered:: | Mizushima Seiki, Nippon Sigmax, Olympus Corporation, Teijin Nakashima Medical Co., Kyocera Corporation, HOYA Technosurgica, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of orthopedic conditions like osteoarthritis, osteoporosis, and sports injuries is a key factor fueling market expansion. The aging population is more susceptible to degenerative joint diseases, which has led to the higher demand for orthopedic treatments. Advancements in orthopedic devices, including minimally invasive surgical techniques and advanced materials, are transforming treatment options. Technologies like 3D printing and computer-assisted surgery are making orthopedic procedures more accurate and efficient. Additionally, government support and funding for advanced orthopedic technologies are improving access to care, driving growth in Japan’s orthopedic devices market.

Restraining Factors

High R&D costs for orthopedic devices limit market entry for smaller firms and can lead to higher prices, reducing patient access to essential treatments. Additionally, orthopedic device recalls due to flaws or poor outcomes can damage reputation, cause legal costs, and reduce customer trust, which further limits the market expansion.

Market Segmentation

The Japan orthopedic devices market share is classified into product and end use.

- The joint replacement/orthopedic implants segment held the dominant share of the market in 2024 and is expected to grow at a rapid CAGR during the forecast period.

The Japan orthopedic devices market is segmented by product into joint replacement/orthopedic implants, sports medicine, orthobiologics, and others. Among these, joint replacement/orthopedic implants held the dominant share of the market in 2024 and are expected to grow at a rapid CAGR during the forecast period. This is due to a rise in the number of joint replacement surgeries. Additionally, advanced orthopedic implants and rapid development in healthcare infrastructure play a crucial role in segmental growth.

- The hospitals segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan orthopedic devices market is segmented by end use into hospitals and outpatient facilities. Among these, the hospitals segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to substantial infrastructure and the range of available therapeutic options. Additionally, the rising number of hospital admissions for bone fractures and injuries from road accidents would propel market expansion.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan orthopedic devices market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mizushima Seiki

- Nippon Sigmax

- Olympus Corporation

- Teijin Nakashima Medical Co.

- Kyocera Corporation

- HOYA Technosurgica

- Others

Recent Developments

- In March 2024, Intellijoint Surgical received regulatory approval for its Intellijoint KNEE system in Japan, marking its second orthopedic product entry into the world’s largest computer-assisted surgical navigation market.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan orthopedic devices market based on the below-mentioned segments:

Japan Orthopedic Devices Market, By Product

- Joint Replacement/Orthopedic Implants

- Sports Medicine

- Orthobiologics

- Others

Japan Orthopedic Devices Market, By End Use

- Hospitals

- Outpatient Facilities

Need help to buy this report?