Japan Operating Room Integration Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Audio Video Management System, Display System, Documentation Management and Recording System, and Others), By Application (General Surgery, Orthopedic Surgery, Neurosurgery, and Others), By End Use (Hospitals, Ambulatory Surgical Centers (ASCs), and Others), and Japan Operating Room Integration Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Operating Room Integration Market Insights Forecasts to 2035

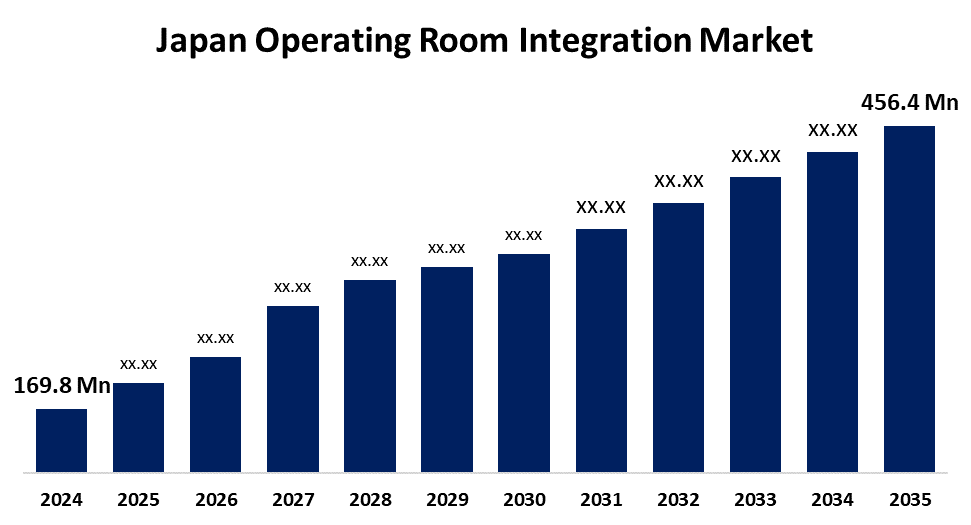

- The Japan Operating Room Integration Market Size Was Estimated at USD 169.8 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.4% from 2025 to 2035

- The Japan Operating Room Integration Market Size is Expected to Reach USD 456.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The Japan Operating Room Integration Market Size is anticipated to reach USD 456.4 Million by 2035, growing at a CAGR of 9.4% from 2025 to 2035. The Japan operating room integration market is growing due to advances in technology, expansion in robotic surgery adoption, and growing demand for minimally invasive procedures with improved surgical accuracy, reduced recovery time, and better overall patient outcomes.

Market Overview

The Japan operating room integration (ORI) market refers to holistic systems that consolidate surgical devices, imaging, anesthesia, lighting, documentation, and electronic health records into a unified, digitally controlled setting. These solutions improve workflow productivity, enable complex procedures, improve patient safety, and provide concurrent availability of critical data and imaging during surgeries. The increasing focus on efficient and streamlined surgical procedures prompts hospitals to embrace integrated OR solutions to minimize human error and increase utilization. The areas of opportunity include increasing hybrid OR installations, remotely enabled surgeries, and AI based workflow solutions.

Report Coverage

This research report categorizes the market for the Japan operating room integration market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan operating room integration market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan operating room integration market.

Japan Operating Room Integration Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 169.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.4% |

| 2035 Value Projection: | USD 456.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 116 |

| Segments covered: | By Device Type, By Application and By End Use |

| Companies covered:: | FUJIFILM Holdings Corporation, Barco NV, Olympus Corporation, EIZO Corporation, Karl Storz, Getinge AB, Steris Corporation, Sony Group Corporation, Barco NV, Doricon Medical Systems, Merivaara Oy, Stryker Corporation, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan operating room integration (ORI) market growth is underpinned by a growing elderly population, rising demand for minimally invasive and robotic procedures, and a higher incidence of chronic diseases like cancer and cardiovascular disease. Hospitals are looking to increase surgical efficacy, minimize blunders, and improve patient results through consolidated digital solutions. Furthermore, government initiatives in terms of investments in healthcare infrastructure and pro-reimbursement policies further propel the use of sophisticated OR technologies at the nations medical facilities.

Restraining Factors

The Japan operating room integration market is constrained by expensive initial setup and continuing operational expenses, interoperability issues connecting heterogeneous medical devices and software, and a shortage of qualified staff capable of running sophisticated integrated OR systems, all hindering mass adoption.

Market Segmentation

The Japan operating room integration market share is classified into device type, application, and end use.

- The documentation management and recording system segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan operating room integration market is segmented by device type into audio video management system, display system, documentation management and recording system, and others. Among these, the documentation management and recording system segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the urgent necessity of centralizing and organizing surgical data, patient information, and imaging effectively, enabling concurrent access, compliance, and optimized surgical workflow in integrated operating environments.

- The general surgery segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan operating room integration market is segmented by application into general surgery, orthopedic surgery, neurosurgery, and others. Among these, the general surgery segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to its high procedure volume and wide applicability to various healthcare environments. The need for optimized surgical workflows, real time access to data, and precision tools in general surgeries propels higher adoption of integrated OR systems than other specialized surgical disciplines.

- The hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan operating room integration market is segmented by end use into hospitals, ambulatory surgical centers (ASCs), and others. Among these, the hospitals segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the hospitals carrying out a high number of sophisticated operations, maintaining larger budgets, and having better infrastructures, which make them initial adopters of integrated OR systems. Their demand for efficiency and safety motivates ongoing investment in OR integration technologies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan operating room integration market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- FUJIFILM Holdings Corporation

- Barco NV

- Olympus Corporation

- EIZO Corporation

- Karl Storz

- Getinge AB

- Steris Corporation

- Sony Group Corporation

- Barco NV

- Doricon Medical Systems

- Merivaara Oy

- Stryker Corporation

- Others

Recent Developments:

- In January 2020, FUJIFILM Corporation announced the launch of its Systems Integration (SI) business under its Medical Systems and Endoscopy Division, starting in the U.S. market. Designed to integrate imaging and data in operating rooms and interventional suites, the SI platform connects Fujifilm’s capture devices with its Synapse Enterprise Imaging for comprehensive patient data management.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan operating room integration market based on the below-mentioned segments:

Japan Operating Room Integration Market, By Device Type

- Audio Video Management System

- Display System

- Documentation Management and Recording System

- Others

Japan Operating Room Integration Market, By Application

- General Surgery

- Orthopedic Surgery

- Neurosurgery

- Others

Japan Operating Room Integration Market, By End Use

- Hospitals

- Ambulatory Surgical Centers (ASCs)

- Others

Need help to buy this report?