Japan Online Accommodation Market Size, Share, and COVID-19 Impact Analysis, By Platform Type (Mobile application, Website), By Booking Type (Third-Party Online Portals, Direct/Captive portals), and Japan Online Accommodation Market Insights Forecasts to 2032

Industry: Electronics, ICT & MediaJapan Online Accommodation Market Size Insights Forecasts to 2032

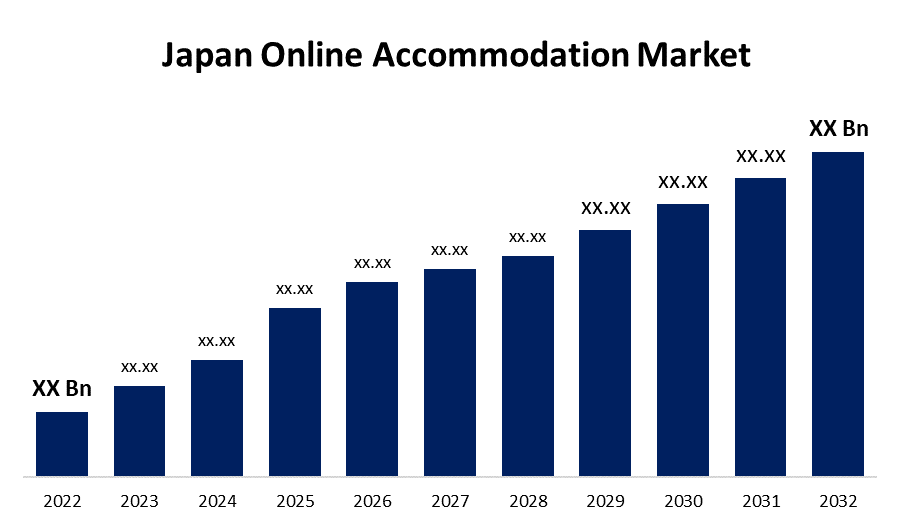

- The Japan Online Accommodation Market Size was valued at USD XX Billion in 2022.

- The Market Size is Growing at a CAGR of 7.83% from 2022 to 2032.

- The Japan Online Accommodation Market Size is expected to reach XX Billion by 2032.

Get more details on this report -

The Japan Online Accommodation Market Size is expected to reach USD XX Billion by 2032, at a CAGR of 7.83% during the forecast period 2022 to 2032.

Market Overview

A digital system that assists in managing reservations and bookings for lodging providers, including hotels, resorts, hostels, and vacation rentals, is known as an accommodation booking system. In recent years, there has seen a significant evolution in the online accommodation market in Japan, driven by both shifts in consumer preferences and technological advancements. Japan has long been known for its hospitality and offers a wide range of lodging options, from traditional ryokans to contemporary hotels. Another important factor driving growth is the rising popularity of domestic players like Rakuten Travel and Jalan, as well as international players like Booking.com and Airbnb, among both domestic and foreign travellers. The growing desire for distinctive and localized experiences is one of the major market trends. As a result, more conventional ryokans, boutique guesthouses, and even accommodations in temples are being listed and reserved online. Additionally, there has been a spike in online reservations since Japan is hosting significant festivities. Encouraging platforms to improve their user experience and user interface to serve a wider audience, which includes people who do not speak Japanese, such factors will boost Japan's market growth in the forecast period.

Report Coverage

This research report categorizes the market for Japan's online accommodation market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japanese online accommodation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japanese online accommodation market.

Japan Online Accommodation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2022 |

| Market Size in 2022: | USD XX Billion |

| Forecast Period: | 2022-2032 |

| Forecast Period CAGR 2022-2032 : | 7.83% |

| 2032 Value Projection: | XX Billion |

| Historical Data for: | 2020-2021 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Platform Type, By Booking Type |

| Companies covered:: | Rakuten Travels, Japan Online Traveler, JTB Group, JAPANiCAN, Booking.com, Bear Luxe, Jalan.Net, and others. |

| Pitfalls & Challenges: | Covid-19 Empact,Challenges,Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for travel accommodations in Japan has grown significantly in recent years. Due to the proliferation of internet platforms and travel agencies, booking accommodations has become easier. The government's emphasis on infrastructure development has made Japan easier to access, drawing more tourists from abroad and stimulating the lodging sector. Luxurious lodging is becoming more and more in demand as disposable incomes rise, and online reservations are now easier through the digitalization trend. While businesses are concentrating on creating new services and features to accommodate shifting traveller preferences, investments in cutting-edge technologies like automation and virtual reality are enhancing the overall customer experience. Utilizing mobile applications and loyalty programs can improve customer satisfaction and retention. Thus, such factors will boost Japanese market growth in the forecast period.

Restraining Factors

The incidences of the improper use of the user's financial information by untrusted independent booking portals decrease consumer trust towards utilizing such services, consequently restraining market growth.

Market Segment

- In 2022, the websites segment accounted for the largest revenue share over the forecast period.

Based on the platform type, the Japanese online accommodation market is segmented into mobile applications and websites. Among these, the websites segment has the largest revenue share over the forecast period. Compared to mobile applications, customers can more easily check customer reviews, loyalty points, and different offers on the websites of travel agencies. Larger customer preferences for travel booking services via internet portals follow from this. The greater income from this market segment is a result of the widespread availability of user-friendly online booking portals.

- In 2022, the third-party online portals segment accounted for the largest revenue share over the forecast period.

Based on the booking type, the Japan online accommodation market is segmented into third-party online portals, and direct/captive portals. Among these, the third-party online portals segment has the largest revenue share over the forecast period. the market because of the enormous quantity of third-party online travel agencies listed on search engines like Google, Yahoo, and others. As a result, this segment generates higher revenues. Furthermore, the launch of virtual reality-based websites by these businesses is probably going to encourage segment growth even more.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan online accommodation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rakuten Travels

- Japan Online Traveler

- JTB Group

- JAPANiCAN

- Booking.com

- Bear Luxe

- Jalan.Net

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In June 2022, Expanding Sabre's presence in Japan, Sabre inked a distribution deal with Bear Luxe and a business-to-business membership portal. The Japanese company will be able to communicate with corporate travel buyers through to Sabre's corporate booking tools. Through the deep retail focus of the Sabre SynXis Booking Engine, this partnership will also allow the Bear Luxe platform to drive direct bookings, increase engagement, and trigger conversions.

Market Segment

This study forecasts revenue at regional, and country levels from 2021 to 2032. Spherical Insights has segmented the Japan online accommodation market based on the below-mentioned segments:

Japan Online Accommodation Market, By Platform Type

- Mobile application

- Website

Japan Online Accommodation Market, By Booking Type

- Third-Party Online Portals

- Direct/Captive portals

Need help to buy this report?