Japan On-the-go Healthy Snacks Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cereal and Granola Bar, Nuts/Seed Snacks, Biscuits and Cookies, Dried Fruits, Meat Snacks, Healthy Beverages, and Others), By Nutritional Content (Gluten-Free, Low-Fat, Sugar-Free, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Speciality Stores, Convenience Stores, Online, and Others), and Japan On-the-go Healthy Snacks Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesJapan On-the-go Healthy Snacks Market Insights Forecasts to 2035

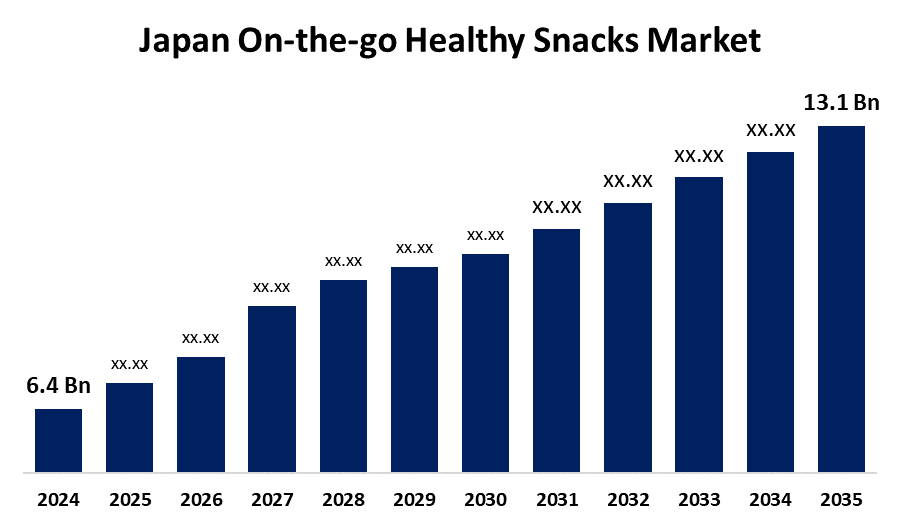

- The Japan On-the-go Healthy Snacks Market Size Was Estimated at USD 6.4 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.73% from 2025 to 2035

- The Japan On-the-go Healthy Snacks Market Size is Expected to Reach USD 13.1 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan on-the-go Healthy Snacks Market Size is anticipated to reach USD 13.1 Billion by 2035, Growing at a CAGR of 6.73% from 2025 to 2035. Japan's on-the-go healthy snacking market is experiencing robust growth, driven by health consciousness, a growing older population, and busy lifestyles. Consumers seek convenient, healthy items that support their health needs and selections, driving product innovation and distribution.

Report Coverage

This research report categorizes the market for the Japan on-the-go healthy snacks market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan on-the-go healthy snacks market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan on-the-go healthy snacks market.

Japan On-the-go Healthy Snacks Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6.4 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.73% |

| 2035 Value Projection: | USD 13.1 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 244 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Product Type, By Nutritional Content and By Distribution Channel |

| Companies covered:: | Morinaga & Co., Ltd., AEON TOPVALU Co., Ltd., Calbee, Inc., Asahi Group Food, Ltd., Ito En, Meiji Holdings Co., Ltd., Lotte Group, Ezaki Glico Co., Ltd., Fujiya, Otsuka Holdings Co., Ltd., Nestle, Mondelez International, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Japan on-the-go healthy snacks market is motivated by increasing health consciousness, a rapidly aging population seeking functional and nutrient-rich foods, and busy urban lives that necessitate convenience. Increasing demand for clean-label, low-calorie, and high-protein foods also propels growth. In addition, popularity of conventional foodstuffs like seaweed and soy in new snack forms underpins demand, combined with strong retail distribution through convenience stores and internet channels.

Restraining Factors

The Japan on-the-go healthy snack is constrained by high product cost, rural Japanese low awareness, cynicism from consumers about health claims, and intense competition from traditional snacks and convenience foods at lower prices.

Market Segmentation

The Japan on-the-go healthy snacks market share is classified into product type, nutritional content, and distribution channel.

- The nuts/seed snacks segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan on-the-go healthy snacks market is segmented by product type into cereal and granola bar, nuts/seed snacks, biscuits and cookies, dried fruits, meat snacks, healthy beverages, and others. Among these, the nuts/seed snacks segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to there is an increasing demand for plant-based protein, heart-healthy lipids, and clean-label products. Their convenience, satiety, and association with natural nutrition drive strong consumer demand.

- The gluten-free segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan on-the-go healthy snacks market is segmented by nutritional content into gluten-free, low-fat, sugar-free, and others. Among these, the gluten-free segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is owing to they reduce chronic inflammation in celiac disease sufferers. The increasing health awareness, growing gluten sensitivity, and need for gut-friendly foods. The consumer perceives gluten-free foods as cleaner and healthier options aligned with modern wellness and eating habits.

- The supermarkets and hypermarkets segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan on-the-go healthy snacks market is segmented by distribution channel into supermarkets and hypermarkets, speciality stores, convenience stores, online, and others. Among these, the supermarkets and hypermarkets segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to their solid brand identity, diverse product line, and consumer trust, which has established them as the leaders. Their accessibility, promotions, and ability to showcase new health-focused products attract a varied, health-conscious customer base.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan on-the-go healthy snacks market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Morinaga & Co., Ltd.

- AEON TOPVALU Co., Ltd.

- Calbee, Inc.

- Asahi Group Food, Ltd.

- Ito En

- Meiji Holdings Co., Ltd.

- Lotte Group

- Ezaki Glico Co., Ltd.

- Fujiya

- Otsuka Holdings Co., Ltd.

- Nestle

- Mondelez International

- Others

Recent Developments:

• In November 2024, Meiji, a Japanese confectionery giant, revealed the release of Spicy Crisp as a nutrient-dense snack produced using innovative cacao granules. This product, which includes whole wheat flour and spices, is healthy while minimizing cacao waste. It will be launching on Amazon and in retail stores and marks Meiji's focus on sustainability and healthy snacking in Japan.

• In June 2024, Tokyo-based Otsuka Pharmaceutical and its South Korean subsidiary, Korea Otsuka, commenced marketing of the soy nutrition bar "SOYJOY" in South Korea. SOYJOY is offered in four flavors and supports healthy snacking as consumers increasingly become health-conscious.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan on-the-go healthy snacks market based on the below-mentioned segments:

Japan On-the-go Healthy Snacks Market, By Product Type

- Cereal and Granola Bar

- Nuts/Seed Snacks

- Biscuits and Cookies

- Dried Fruits

- Meat Snacks

- Healthy Beverages

- Others

Japan On-the-go Healthy Snacks Market, By Nutritional Content

- Gluten-Free

- Low-Fat

- Sugar-Free

- Others

Japan On-the-go Healthy Snacks Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Specialty Stores

- Convenience Stores

- Online

- Others

Need help to buy this report?