Japan Oil and Gas Security and Service Market Size, Share, and COVID-19 Impact Analysis, By Security (Physical Security and Network Security), By Services (Risk Management Services, System Design, Integration, Consulting, and Managed Services), By Operation (Upstream, Midstream, and Downstream), By Application (Exploring and Drilling, Transportation, Pipelines, Distribution and Retail Services, and Others), and Japan Oil and Gas Security and Service Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Oil and Gas Security and Service Market Size Insights Forecasts to 2035

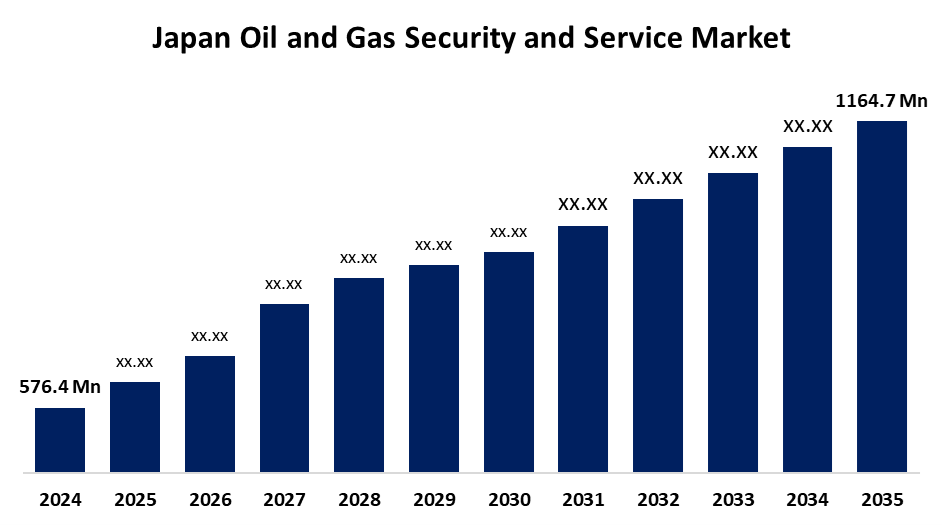

- The Japan Oil and Gas Security and Service Market Size Was Estimated at USD 576.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.6% from 2025 to 2035

- The Japan Oil and Gas Security and Service Market Size is Expected to Reach USD 1164.7 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the Japan Oil and Gas Security and Service Market Size is anticipated to reach USD 1164.7 million by 2035, growing at a CAGR of 6.6% from 2025 to 2035. The Japan oil and gas security and service market is growing due to foreign energy dependence, growth in demand, and a focus on security and sustainability. Demand for advanced security solutions is further boosted by AI and automation technology adoption.

Market Overview

The Japan oil and gas security and service market refers to solutions to safeguard the nations oil and gas facilities, ensuring their safety, reliability, and adherence to regulatory standards. These services are vital to safeguard oil refineries, pipelines, storage facilities, and offshore platforms against threats like cyberattacks, natural disasters, and terrorism. The market strengths are Japan highly advanced technological infrastructure and efficient regulatory mechanisms that ensure high safety and environmental protection levels. Opportunities exist in leveraging innovative technologies such as AI, IoT, and blockchain for simultaneous monitoring, predictive analytics, and cybersecurity. Market drivers for Japan are heavy reliance on imported oil and gas, increasing energy demand, and rising geopolitical tensions. Government initiatives such as funding for infrastructure resilience and stricter energy security regulations are driving market growth.

Report Coverage

This research report categorizes the market for the Japan oil and gas security and service market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan oil and gas security and service market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan oil and gas security and service market.

Japan Oil and Gas Security and Service Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 576.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.6% |

| 2035 Value Projection: | USD 1164.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Security, By Services, By Operation, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Nippon Sanso, ENEOS Corporation, Mitsui & Co., Tokyo Gas, Idemitsu Kosan, Cosmo Energy, Toho Gas, Chubu Electric Power, Osaka Gas, JGC Holdings, Toyo Engineering, Mitsubishi Corporation, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Japan oil and gas security and service market is driven by the country's heavy reliance on imported oil and gas, growing energy demand, and rising geopolitical tensions. Growing cyber attacks and the need to develop robust infrastructure also drive market growth. Japan high interest in energy security and diversification, together with technological advancements like AI and IoT, is driving demand for increased security solutions. In addition, efforts by the government to improve energy infrastructure and security promote further market development.

Restraining Factors

The Japan oil and gas security and service market is limited by costly implementation, complex regulatory frameworks, and limited populations of trained professionals. Additionally, the rapid pace of technology development and integration issues with legacy applications discourage effortless adoption and expandability.

Market Segmentation

The Japan oil and gas security and service market share is classified into security, services, operation, and application.

- The physical security segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan oil and gas security and service market is segmented by security into physical security and network security. Among these, the physical security segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Oil and gas plants are possible targets for sabotage and terrorism and therefore require effective physical security. Trained personnel, intrusion detection with perimeter security, and access control are crucial to prevent and minimize such threats.

- The managed services segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan oil and gas security and service market is segmented by service into risk management services, system design, integration, consulting, and managed services. Among these, the managed services segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to they offer access to experienced experts, helping oil and gas companies rise above budget constraints for IT security. The services provide a cost-effective solution, offering top-quality security technologies and expertise without the significant capital expenses in infrastructure and staff.

- The midstream segment held dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan oil and gas security and service market is segmented by operation into upstream, midstream, and downstream. Among these, the midstream segment dominated the market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is attributed to the growing demand for security services protect key oil and gas infrastructure, especially as natural gas and LNG's growing energy consumption broadens. Digitized midstream operations face new cyber threats, underscoring the value of security services for guarding pipelines, storage, and control systems against the threats of cyberattack, disrupting business and physical damage.

- The pipelines segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan oil and gas security and service market is segmented by application into exploring and drilling, transportation, pipelines, distribution and retail services, and others. Among these, the pipelines segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Security products play a significant role in the protection of pipelines over their entire lifespan, especially in remote areas where sabotage, theft, and vandalism are common. Pipeline surveillance systems, leak detection systems, and security patrols deter and respond to these threats, preserving pipeline integrity and operational safety.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan oil and gas security and service market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nippon Sanso

- ENEOS Corporation

- Mitsui & Co.

- Tokyo Gas

- Idemitsu Kosan

- Cosmo Energy

- Toho Gas

- Chubu Electric Power

- Osaka Gas

- JGC Holdings

- Toyo Engineering

- Mitsubishi Corporation

- Others

Recent Developments:

- In March 2022, Taiyo Nippon Sanso Co., Ltd. developed the Intelligent Gas Supplying System (IGSS) to optimize gas supply operations using digital technology for automated cylinder transport and efficient inspections. To handle growing factory scale and data complexity, they adopted Mitsubishi Electric's GENESIS64™ SCADA software to upgrade their monitoring capabilities.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan oil and gas security and service market based on the below-mentioned segments:

Japan Oil and Gas Security and Service Market, By Security

- Physical Security

- Network Security

Japan Oil and Gas Security and Service Market, By Services

- Risk Management Services

- System Design

- Integration

- Consulting

- Managed Services

Japan Oil and Gas Security and Service Market, By Operation

- Upstream

- Midstream

- Downstream

Japan Oil and Gas Security and Service Market, By Application

- Exploring and Drilling

- Transportation

- Pipelines

- Distribution

- Retail Services

- Others

Need help to buy this report?