Japan Offline Payment Service Provider Market Size, Share, and COVID-19 Impact Analysis, By Category (Card Payment, POS System, QR Payments, Wallet Payments, and Others), By Organization Size (SMEs and Large Enterprises), and Japan Offline Payment Service Provider Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyJapan Offline Payment Service Provider Market Insights Forecasts to 2035

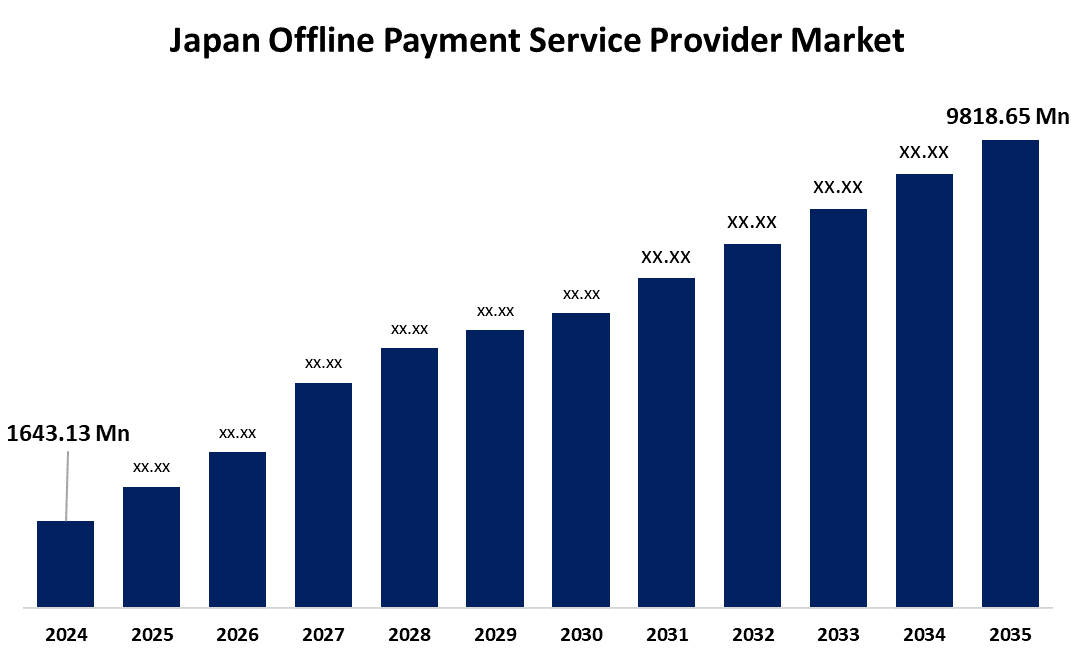

- The Japan Offline Payment Service Provider Market Size was Estimated at USD 1643.13 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 17.65% from 2025 to 2035

- The Japan Offline Payment Service Provider Market Size is Expected to Reach USD 9818.65 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Offline Payment Service Provider Market Size is anticipated to reach USD 9818.65 Million by 2035, Growing at a CAGR of 17.65% from 2025 to 2035. The Japan offline payment service provider market is driven by the continued reliance on cash transactions, despite the rise of digital payments. Additionally, government initiatives promoting financial inclusion and the expansion of point-of-sale (POS) infrastructure in retail and hospitality sectors are fueling market growth.

Market Overview

The Japan offline payment service provider (payment facilitator) market refers to the industry focused on facilitating cashless transactions through card payments, POS systems, QR payments, and digital wallets for businesses and consumers in Japan. The market for offline payment services in Japan is mostly driven by government laws and initiatives. With lofty goals like reaching a 40% cashless payment ratio by 2025, the Japanese government has placed a great deal of focus on promoting the shift to cashless payments. The government has implemented a number of incentives to accomplish this goal, such as financial aid for businesses who use cashless payment methods and advertising efforts meant to raise customer awareness. Due to incentives for businesses and customers to switch to digital payment methods, these policies have fostered an atmosphere that has allowed payment facilitators to flourish and supported a strong market expansion.

Report Coverage

This research report categorizes the market for the Japan offline payment service provider market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan offline payment service provider market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan offline payment service provider market.

Japan Offline Payment Service Provider Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1643.13 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 17.65% |

| 2035 Value Projection: | USD 9818.65 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 169 |

| Tables, Charts & Figures: | 110 |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for offline payment service providers in Japan is expanding due to a number of important factors. Personalized client experiences, faster processing speeds, and increased transaction security are all benefits of technological integration, especially the application of AI and ML. Government programs designed to encourage cashless transactions have also been quite important. By providing subsidies and incentives to both customers and service providers, the Japanese government has set ambitious goals to increase the percentage of cashless payments. Additionally, consumer behavior is changing, with a growing preference for online shopping fueling the need for effective physical payment methods. Additionally, the market is greatly influenced by the ongoing growth of the e-commerce industry since companies need smooth payment systems to handle the increasing volume of online transactions.

Restraining Factors

Installing and maintaining offline payment systems might come with hefty operational costs. In order to satisfy the expectations of a high-volume market, payment facilitators must invest a significant amount of money in infrastructure, manage intricate transaction networks, and guarantee system stability.

Market Segmentation

The Japan offline payment service provider market share is classified into category and organization size.

- The card payment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan offline payment service provider market is segmented by category into card payment, POS system, QR payments, wallet payments, others. Among these, the card payment segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. Credit and debit cards are widely used for safe and effective transactions by both consumers and companies.

- The SMEs segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan offline payment service provider market is segmented by organization size into SMEs and large enterprises. Among these, the SMEs segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. MEs are a market that is expanding as more small and medium-sized enterprises use digital payment systems to improve operational effectiveness.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan offline payment service provider market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Square Japan

- AirPAY

- PayPay

- Rakuten Pay

- Smartpay

- GMO PG

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan offline payment service provider market based on the below-mentioned segments:

Japan Offline Payment Service Provider Market, By Category

- Card Payment

- POS System

- QR Payments

- Wallet Payments

- Others

Japan Offline Payment Service Provider Market, By Organization Size

- SMEs

- Large Enterprises

Need help to buy this report?