Japan Off the Road Tire Market Size, Share, and COVID-19 Impact Analysis, By Type (Radial, Bias, and Solid Tires), By Application (Construction, Agriculture, Mining, Industrial, and Port Operations), and Japan Off the Road Tire Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Off the Road Tire Market Insights Forecasts to 2035

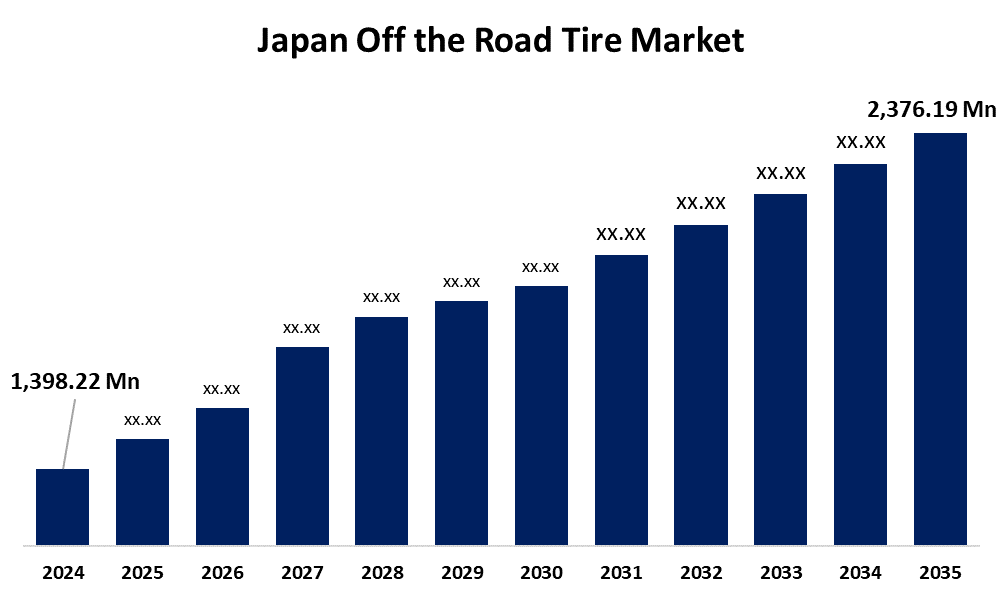

- The Japan Off the Road Tire Market Size was Estimated at USD 1,398.22 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.94% from 2025 to 2035

- The Japan Off the Road Tire Market Size is Expected to Reach USD 2,376.19 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Off the Road Tire Market Size is anticipated to reach USD 2,376.19 Million by 2035, Growing at a CAGR of 4.94% from 2025 to 2035. The Japan off-the-road (OTR) tire market is driven by robust infrastructure development and advancements in agricultural mechanization. Government investments in public works projects, such as highways and urban expansion, have increased demand for heavy machinery, fueling the need for durable OTR tires.

Market Overview

The Japan off-the-road (OTR) tire market refers to the industry focused on specialized tires designed for heavy-duty vehicles used in construction, mining, agriculture, and industrial applications. The demand for off-the-road (OTR) tires is mostly driven by Japan's rapid expansion in infrastructure development and building projects. For example, according to IMARC Group, the main factors influencing the demand for OTR tires are the growing construction sector and the rise of large-scale projects like highways, bridges, tunnels, and industrial buildings. Heavy-duty equipment like excavators, bulldozers, and cranes are becoming more and more necessary as a result of the Japanese government's ongoing emphasis on urbanization and public works initiatives like highway extension, airport development, and railway networks. These devices need specialist, long-lasting OTR tires that can withstand challenging operating circumstances.

Report Coverage

This research report categorizes the market for the Japan off the road tire market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan off the road tire market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan off the road tire market.

Japan Off the Road Tire Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,398.22 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 4.94% |

| 2035 Value Projection: | USD 2,376.19 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | The Goodyear Tire & Rubber Company, Carlisle (Meizhou) Rubber Products Co. Ltd, Titan International, Inc., Maxam Tire, Bridgestone Corporation, Guizhou Tire Co. Ltd., and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for OTR tires in Japan is being driven primarily by improvements in agricultural mechanization and strong infrastructure development. Large-scale public works projects like highways and urban expansion funded by the Japanese government have increased demand for heavy equipment like bulldozers and excavators, which need for specific off-road tires. These programs increase the country's infrastructure while simultaneously generating a steady need for strong, long-lasting tires. Simultaneously, the agriculture industry's modernization, which prioritizes mechanization, has increased demand for high-quality tires to support tractors and other farming machinery. The need for tires that can endure a range of field conditions rises as a result of this change, which also makes farming more efficient.

Restraining Factors

The high cost of manufacturing is one of the main issues facing the off-the-road (OTR) tire sector in Japan. To ensure longevity and performance, the development of specialized OTR tires necessitates precision engineering, premium raw materials, and cutting-edge technology. These elements add to the high cost of production as a whole.

Market Segmentation

The Japan off the road tire market share is classified into type and application.

- The radial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan off the road tire market is segmented by type into radial, bias, and solid tires. Among these, the radial segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The market is dominated by radial tires because of their exceptional performance, longevity, and fuel economy. Although bias tires are less expensive initially, they are usually only utilized in certain situations that don't need for fast speeds.

- The mining segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan off the road tire market is segmented by application into construction, agriculture, mining, industrial, and port operations. Among these, the mining segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of Japan's manufacturing and resource extraction industries need durable and specialized tires, mining and industrial applications are important.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan off the road tire market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- The Goodyear Tire & Rubber Company

- Carlisle (Meizhou) Rubber Products Co. Ltd

- Titan International, Inc.

- Maxam Tire

- Bridgestone Corporation

- Guizhou Tire Co. Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan off the road tire market based on the below-mentioned segments:

Japan Off the Road Tire Market, By Type

- Radial

- Bias

- Solid Tires

Japan Off the Road Tire Market, By Application

- Construction

- Agriculture

- Mining

- Industrial

- Port Operations

Need help to buy this report?