Japan Off-Highway High-Performance Vehicles Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (ATVs, UTVs, Dirt Bikes, Off-Road Trucks, and Others), By Engine Type (Gasoline, Diesel, Electric, Hybrid, and Others), and Japan Off-highway High-Performance Vehicles Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationJapan Off-Highway High-Performance Vehicles Market Insights Forecasts to 2035

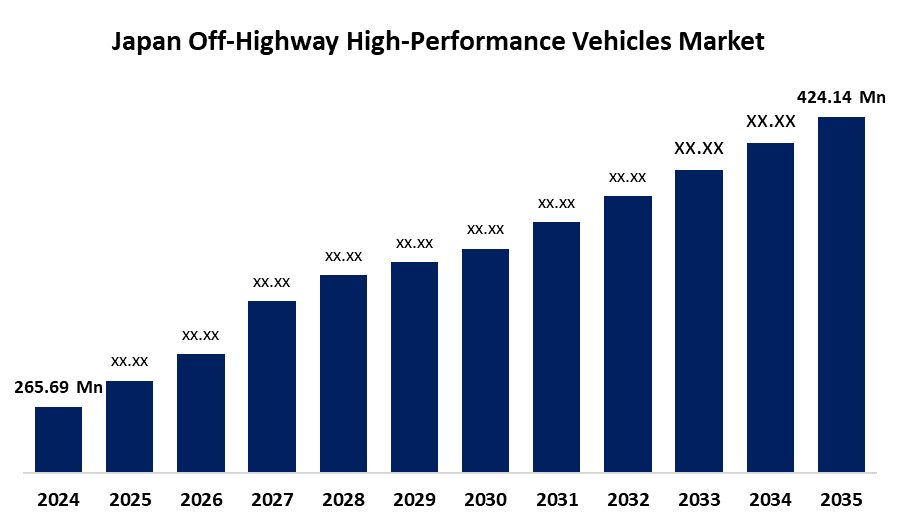

- The Japan Off-Highway High-Performance Vehicles Market Size Was Estimated at USD 265.69 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.34% from 2025 to 2035

- The Japan Off-Highway High-Performance Vehicles Market Size is Expected to Reach USD 424.14 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the Japan Off-Highway High-Performance Vehicles Market is anticipated to reach USD 424.14 million by 2035, growing at a CAGR of 4.34% from 2025 to 2035. The market is driven by rising infrastructure development, expanding agricultural and mining sectors, and technological advancements in vehicle electrification and automation.

Market Overview

The Japan off-highway high-performance vehicles market refers to specialized vehicles designed for rugged terrains, including ATVs, UTVs, dirt bikes, and off-road trucks. The growth of the agricultural industry is another important factor propelling the market for off-highway high-performance vehicles in Japan. A technological revolution is taking place in Japan's agricultural sector, despite obstacles like an aging farming population and a shortage of fertile land. According to the Ministry of Agriculture, Forestry and Fisheries (MAFF), the use of sophisticated farming equipment has been steadily rising. For example, MAFF's annual survey on agricultural mechanization revealed that over the past ten years, there has been a steady increase in the number of high-performance tractors (those with more than 50 horsepower) in use throughout Japan. The government's "Smart Agriculture" program, which was started to encourage the adoption of cutting-edge technologies in farming, has also increased demand for sophisticated agricultural equipment.

Report Coverage

This research report categorizes the market for the Japan off-highway high-performance vehicles market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan off-highway high-performance vehicles market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan off-highway high-performance vehicles market.

Japan Off-Highway High-Performance Vehicles Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 265.69 Million |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 424.14 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Vehicle Type, By Engine Type and COVID-19 Impact Analysis |

| Companies covered:: | Honda Motor Co. Ltd., Polaris, Inc., Yamaha Motor Co. Ltd, Kawasaki Heavy Industries, Ltd., BRP, Inc., Textron, Inc., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Japan's market for off-highway high-performance vehicles is mostly driven by the country's continuous urbanization and infrastructural development. The domestic market for construction equipment has been rising consistently in recent years, according to the Japan Construction Equipment Manufacturers Association (CEMA). For example, CEMA stated that in fiscal year 2022, over 80,000 units of construction equipment were sold in Japan, a notable increase from the previous year. Large-scale infrastructure projects and urban development initiatives are mostly to blame for this spike in demand. The "National Resilience" initiative, which attempts to fortify the nation's infrastructure against natural disasters, is another example of the Japanese government's dedication to infrastructure spending. The government has set aside large sums of money for building and remodeling projects as part of this program.

Restraining Factors

High upfront expenditures, intricate maintenance needs, and stringent environmental laws that impact emissions and fuel economy are some of the limiting considerations. Further obstacles to wider acceptance include the lack of infrastructure for charging electric off-road vehicles, competition from conventional fuel-powered versions, and variable raw material costs.

Market Segmentation

The Japan off-highway high-performance vehicles market share is classified into vehicle type and engine type.

- The ATVs segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan off-highway high-performance vehicles market is segmented by vehicle type into ATVs, UTVs, dirt bikes, off-road trucks, and others. Among these, the ATVs segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. ATVs are still widely used for both leisure and business purposes, and the Japan Automobile Manufacturers Association (JAMA) reports that sales are increasing gradually.

- The electric segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan off-highway high-performance vehicles market is segmented by engine type into gasoline, diesel, electric, hybrid, and others. Among these, the electric segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. Electric off-highway vehicle registrations increased by 30% last year, according to the Ministry of Economy, Trade and Industry (METI), demonstrating the growing popularity of electric cars. This expansion is especially pronounced in urban and ecologically delicate regions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan off-highway high-performance vehicles market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Honda Motor Co. Ltd.

- Polaris, Inc.

- Yamaha Motor Co. Ltd

- Kawasaki Heavy Industries, Ltd.

- BRP, Inc.

- Textron, Inc.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan Off-Highway High-Performance Vehicles Market based on the below-mentioned segments:

Japan Off-Highway High-Performance Vehicles Market, By Vehicle Type

- ATVs

- UTVs

- Dirt Bikes

- Off-Road Trucks

- Others

Japan Off-Highway High-Performance Vehicles Market, By Engine Type

- Gasoline

- Diesel

- Electric

- Hybrid

- Others

Need help to buy this report?