Japan Nursing Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Breastfeeding Aids, Maternity and Nursing Wear, Hygiene and Sanitation, and Postpartum Recovery), By Usability (Reusable and Disposable), By Distribution Channel (Pharmacies & Retail Stores, and E-Commerce), and Japan Nursing Products Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Nursing Products Market Insights Forecasts to 2035

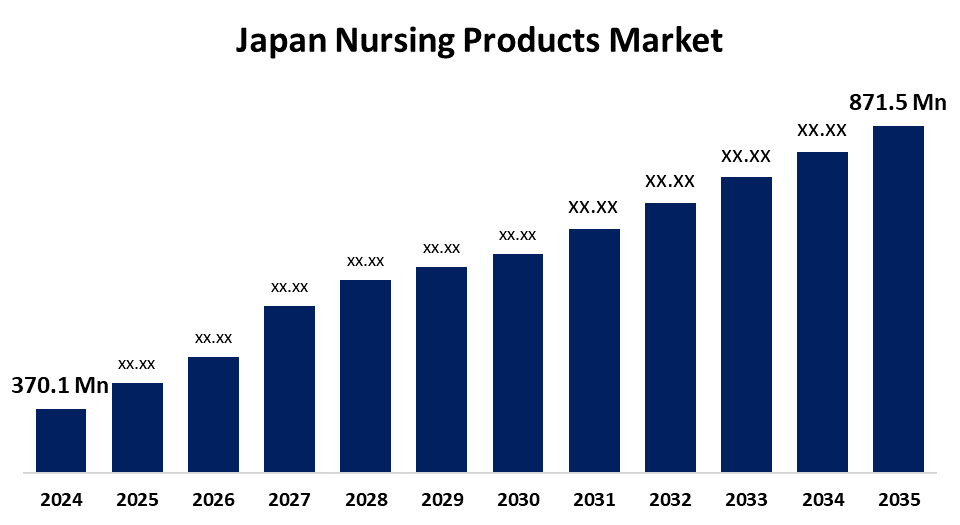

- The Japan Nursing Products Market Size Was Estimated at USD 370.1 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.1% from 2025 to 2035

- The Japan Nursing Products Market Size is Expected to Reach USD 871.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The Japan nursing products market Size is anticipated to reach USD 871.5 Million by 2035, growing at a CAGR of 8.1% from 2025 to 2035. The Japan nursing products market develops at a high rate due to its aging society, growing chronic conditions, and demand for home care. Government policies in support of technological advances like AI and robots, in addition to the prevailing policies, drive market growth and enhance the quality of care.

Market Overview

The market for Japan nursing products refers to a wide variety of products that cater to ensuring the health and well-being of persons, especially the elderly and those with long-term care needs. Products in this market are breast pumps, nipple creams, nursing pillows, and pressure ulcer and wound care dressings. Japan's nursing products market is assisted by sophisticated technological integration, such as intelligent wound care dressings and artificial intelligence-driven home healthcare solutions for improving treatment efficacy and patient outcomes. The growth of home healthcare services also offers growth opportunities, as patients and households find the convenience and individualized care of home-based solutions appealing. Major driving factors behind this growth are Japan's fast-growing aging population, where people above the age of 65 are around 30% of the overall population. The rising rate of chronic diseases, such as cardiovascular diseases and diabetes, also creates a need for constant care and support. The government of Japan facilitates the sector by implementing policies that encourage home-based care, subsidies for cutting-edge medical technology, and investment in robotic nursing solutions in order to alleviate shortages in the workforce and increase care efficiency.

Report Coverage

This research report categorizes the market for the Japan nursing products market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Japan nursing products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Japan nursing products market.

Japan Nursing Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 370.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 8.1% |

| 2035 Value Projection: | USD 871.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product Type, By Usability and By Distribution Channel |

| Companies covered:: | Nipro Corporation, Nihon Kohden Corporation, Canon Medical Systems, Omron Corporation, LEXI Co., Ltd., Menicon, Shimadzu Corporation, Fukuda, Sysmex, JEX Co., Ltd., Konica Minolta, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for Japan nursing products is fueled by its fast-growing aging population, which increases demands on long-term and home care solutions considerably. The increasing incidence of chronic conditions like diabetes and cardiovascular diseases likewise drives this demand. The advance of technologies, like smart care for wounds and AI-powered devices, raises the level of care and accessibility. Moreover, cultural demands to age in place and active government sponsorship through healthcare policies and subsidies support market growth, establishing Japan as a major platform for innovative nursing care products.

Restraining Factors

The market for nursing products in Japan is constrained by high R&D expenses, stringent regulatory demands, supply chain interference, increased product costs, late market entry, especially on the part of small businesses, and a lack of trained caregivers, all of which reduce product availability, affordability, and overall market expansion.

Market Segmentation

The Japan Nursing Products Market share is classified into product type, usability, and distribution channel.

- The breastfeeding aids segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan nursing products market is segmented by product type into breastfeeding aids, maternity and nursing wear, hygiene and sanitation, and postpartum recovery. Among these, the breastfeeding aids segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the increasing population of women returning to work, or who cannot directly nurse, has created a strong demand for breast pumps and other breastfeeding-assisted products. It is the ease and mobility that push the market for the pumps. Nursing bras, nipple shields, breast milk storage bottles, and pumps support breastfeeding, hence being the market leaders for selling the most.

- The reusable segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan nursing products market is segmented by usability into reusable and disposable. Among these, the reusable segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The reusable segment is attributed to its environmental significance and cost-effectiveness. Most mothers are switching to reusable products compared to disposables, which is a move towards increased environmental awareness. Particularly with reusable nursing pads, as they are less wasteful, gentle on the skin, and offer sustenance of value in the long term, being sought after by most consumers.

- The pharmacies & retail stores segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The Japan nursing products market is segmented by distribution channel into pharmacies and retail stores, and e-commerce. Among these, the pharmacies & retail stores segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to their accessibility, instant service, and popularity among consumers. Most majority of mothers prefer purchasing nursing products from retail outlets and pharmacies owing to the fact that they can view the products and make informed decisions with the assistance of a trained advisor.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the Japan nursing products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Nipro Corporation

- Nihon Kohden Corporation

- Canon Medical Systems

- Omron Corporation

- LEXI Co., Ltd.

- Menicon

- Shimadzu Corporation

- Fukuda

- Sysmex

- JEX Co., Ltd.

- Konica Minolta

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at Japan, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the Japan nursing products market based on the below-mentioned segments:

Japan Nursing Products Market, By Product Type

- Breastfeeding Aids

- Maternity and Nursing Wear

- Hygiene and Sanitation

- Postpartum Recovery

Japan Nursing Products Market, By Usability

- Reusable

- Disposable

Japan Nursing Products Market, By Distribution Channel

- Pharmacies & Retail Stores

- E-Commerce

Need help to buy this report?