Japan Nuclear Imaging Market Size, Share, and COVID-19 Impact Analysis, By Modality (Position Emission Tomography, Single Photon Emission Computed Tomography), By Application (Cardiology, Oncology), and Japan Nuclear Imaging Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareJapan Nuclear Imaging Market Insights Forecasts to 2035

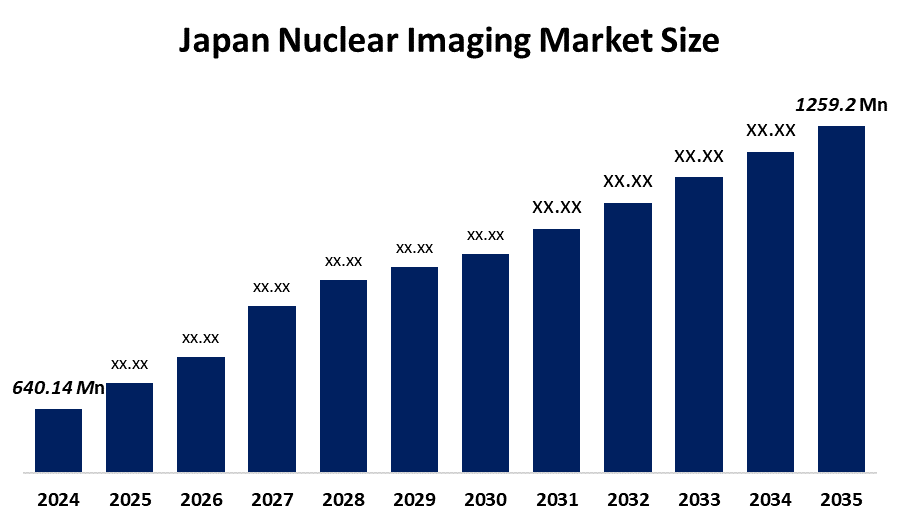

- Japan Nuclear Imaging Market Size 2024: USD 640.14 million

- Japan Nuclear Imaging Market Size 2035: USD 1259.2 million

- Japan Nuclear Imaging Market CAGR 2024: 6.34%

- Japan Nuclear Imaging Market Segments: Product and Application

Get more details on this report -

The Japan nuclear imaging market includes technologies that use radioactive tracers to produce detailed internal body images for medical diagnosis. Tools like PET and SPECT help doctors detect and monitor diseases such as cancer, heart conditions, and brain disorders by tracking tracer movement in organs. This market covers imaging equipment, radiotracers, and services used in hospitals and diagnostic centres. Furthermore, the Japan Nuclear Imaging Market is growing due to Japan’s rapidly ageing population and higher rates of chronic illnesses like cancer and cardiovascular diseases that require early diagnosis. Widespread adoption of advanced diagnostic tools, rising healthcare spending, and growing awareness of preventive health checks also boost.

Japan’s healthcare system ensures broad access to quality diagnostics, including nuclear imaging, through universal health insurance coverage. Regulatory bodies like the Ministry of Health, Labour and Welfare (MHLW) and the Pharmaceuticals and Medical Devices Agency (PMDA) enforce safety and quality standards for imaging devices and radioactive tracers. Government support for early disease detection, cancer screening, and medical technology adoption underlines national healthcare priorities.

Japan nuclear imaging market trends include the adoption of hybrid imaging systems (PET/CT, SPECT/CT), integration of AI and deep learning to enhance image interpretation and diagnostic accuracy, and emphasis on molecular imaging and personalised medicine. These advancements are improving early disease detection and workflow efficiency. Increased R&D investments and collaborations between healthcare institutions and technology providers are also shaping the market’s future.

Market Dynamics of the Japan Nuclear Imaging Market:

The Japan nuclear imaging market is driven by factors including the rising burden of cancer and heart disease, the growing elderly population, and higher healthcare spending on advanced diagnostics. Technological progress in imaging hardware and software enhances detection capabilities, while improved access to nuclear imaging services through Japan’s insurance system promotes usage. Focus on early diagnosis and tailored treatment planning also boosts demand for nuclear imaging

The Japan nuclear imaging market faces restraints from the high costs of nuclear imaging equipment and radiopharmaceuticals, which can be expensive to acquire and operate. Accessibility challenges may arise for smaller or rural healthcare facilities. The complexity of nuclear imaging procedures requires skilled specialists, and stringent regulatory approvals for new technologies or tracers can delay market entry and adoption.

Opportunities include the development of novel radiopharmaceuticals for targeted diagnostics and therapy, localized production of tracers, and advanced hybrid imaging solutions. The growth of personalized medicine and precision oncology is driving demand for targeted nuclear imaging applications. Additionally, the expansion of nuclear imaging services into smaller clinics, specialist training programs, and cross-border collaborations across the Asia-Pacific region present significant market growth potential.

Japan nuclear imaging market trends include the adoption of hybrid imaging systems (PET/CT, SPECT/CT), integration of AI and deep learning to enhance image interpretation and diagnostic accuracy, and emphasis on molecular imaging and personalised medicine. These advancements are improving early disease detection and workflow efficiency. Increased R&D investments and collaborations between healthcare institutions and technology providers are also shaping the market’s future.

Market Dynamics of the Japan Nuclear Imaging Market:

The Japan nuclear imaging market is driven by factors including the rising burden of cancer and heart disease, the growing elderly population, and higher healthcare spending on advanced diagnostics. Technological progress in imaging hardware and software enhances detection capabilities, while improved access to nuclear imaging services through Japan’s insurance system promotes usage. Focus on early diagnosis and tailored treatment planning also boosts demand for nuclear imaging

The Japan nuclear imaging market faces restraints from the high costs of nuclear imaging equipment and radiopharmaceuticals, which can be expensive to acquire and operate. Accessibility challenges may arise for smaller or rural healthcare facilities. The complexity of nuclear imaging procedures requires skilled specialists, and stringent regulatory approvals for new technologies or tracers can delay market entry and adoption.

Opportunities include the development of novel radiopharmaceuticals for targeted diagnostics and therapy, localized production of tracers, and advanced hybrid imaging solutions. The growth of personalized medicine and precision oncology is driving demand for targeted nuclear imaging applications. Furthermore, the expansion of nuclear imaging services into smaller clinics, specialist training programs, and cross-border collaborations across the Asia-Pacific region offer significant market growth potential.

Japan Nuclear Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 593 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.64% |

| 2035 Value Projection: | USD 1203 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 198 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Modality, By Application, and COVID-19 Impact Analysis |

| Companies covered:: | GE Healthcare; Siemens Healthineers; Canon Medical Systems Corporation; FUJIFILM Toyama Chemical Co., Ltd.; Bracco Imaging S.p.A.; Nihon Medi-Physics Co., Ltd.; IBA Radiopharma Solutions; Hitachi, Ltd. Healthcare Business Unit; Shimadzu Corporation; Philips Healthcare; and Other Companies. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Market Segmentation

The Japan nuclear imaging market share is classified into products and applications.

By Product:

The Japan nuclear imaging market is divided by product into equipment and radioisotopes. Among these, the n-butane segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The n-butane segment dominates due to it offers higher yield, lower production costs, and cleaner, environmentally safer processing compared to benzene, which faces stricter regulations and health concerns, making N-Butane the preferred choice in Japan’s maleic anhydride production.

By Application:

The Japan nuclear imaging market is divided by application into SPECT Applications and PET Applications. Among these, the unsaturated polyester resin segment dominated the share in 2024 and is anticipated to grow at a remarkable CAGR during the forecast period. The unsaturated polyester resin industry dominates due to it is widely used in construction, automotive, and industrial applications. Its demand for fibreglass-reinforced plastics, coatings, adhesives, and composites drives large-scale maleic anhydride consumption, ensuring a significant market share in Japan.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the Japan nuclear imaging market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

-

GE Healthcare

-

Siemens Healthineers

-

Canon Medical Systems Corporation

-

FUJIFILM Toyama Chemical Co., Ltd.

-

Bracco Imaging S.p.A.

-

Nihon Medi-Physics Co., Ltd.

-

IBA Radiopharma Solutions

-

Hitachi, Ltd. Healthcare Business Unit

-

Shimadzu Corporation

-

Philips Healthcare

-

Other Companies

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the Japan, regional, and country levels from 2020 to 2035. Spherical Insigts has segmented the Japan nuclear imaging market based on the below-mentioned segments:

Japan Nuclear Imaging Market, By Product.

- Equipment

- Radioisotope

Japan Nuclear Imaging Market, By Application

- SPECT Applications

- PET Applications

Frequently Asked Questions (FAQ)

-

Q 1: What is the Japan nuclear imaging market size? Japan nuclear imaging market is expected to grow from USD 640.14 million in 2024 to USD 1259.2 million by 2035, growing at a CAGR of 6.34 % during the forecast period 2025-2035.

-

Q 2: What are the key growth drivers of the Japan nuclear imaging market? The Japan nuclear imaging market includes growing cancer and cardiovascular disease prevalence, an ageing population, advanced hybrid imaging technologies, and increased healthcare spending.

-

Q 3: What factors restrain the Japan nuclear imaging market? The Japan nuclear imaging market is restrained by High costs of nuclear imaging equipment, limited availability of radiopharmaceuticals, complex regulatory approvals, a shortage of skilled professionals, and maintenance challenges.

-

Q 4: How is the Japan nuclear imaging market segmented by application? The Japan nuclear imaging market is segmented into SPECT applications, PET applications

-

Q 5: Who are the key players in the Japan nuclear imaging market? The Japan nuclear imaging market is led by companies such as GE Healthcare, Siemens Healthineers, Canon Medical Systems Corporation, FUJIFILM Toyama Chemical Co., Ltd., Bracco Imaging S.p.A., Nihon Medi‑Physics Co., Ltd., IBA Radiopharma Solutions, Hitachi, Ltd. Healthcare Business Unit, Shimadzu Corporation, Philips Healthcare, and other

Need help to buy this report?